India is often described as a “country within a country,” with a vast and diverse population of 140 crore people. The Indus Valley Annual Report 2025 by Blume Ventures provides valuable insights into India’s evolving consumer landscape and the distinct market segments shaping it.

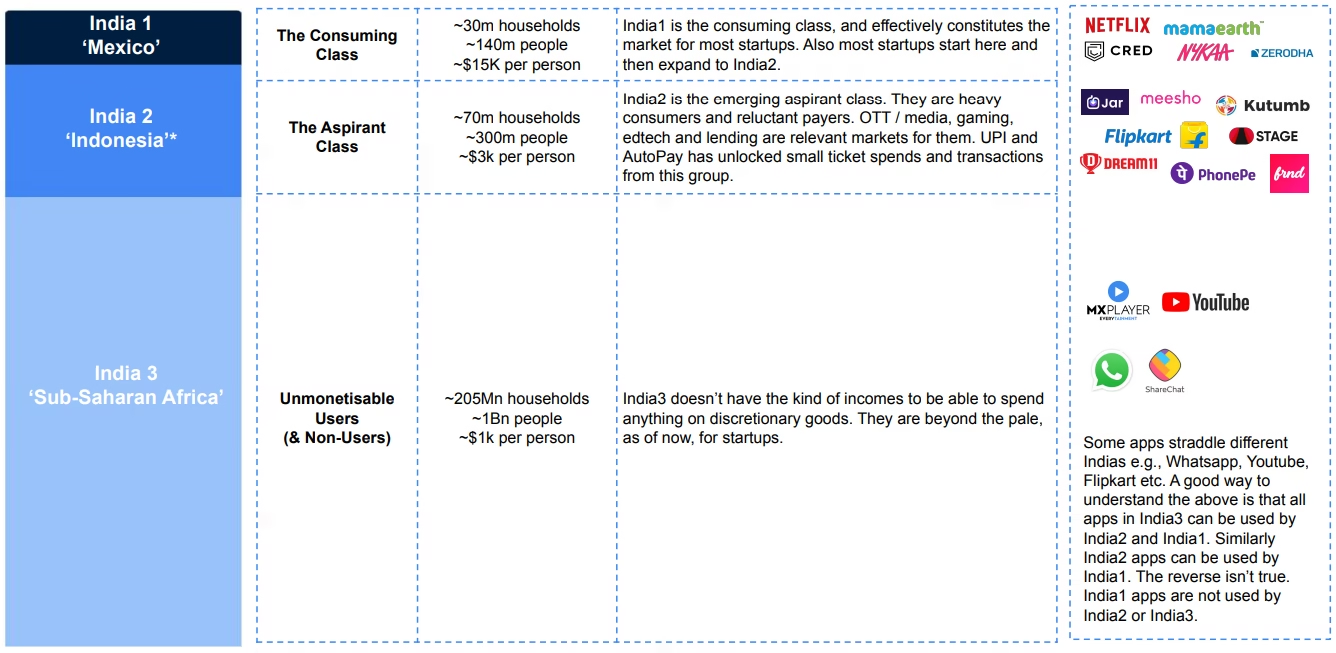

When it comes to consumer behavior, the Indian market isn’t one unified entity—it can be broken down into three distinct segments: India1, India2, and India3.

Each of these segments represents a different consumer class with unique purchasing power, preferences, and accessibility to goods and services.

This blog explores these three segments and how brands can strategize to tap into India’s diverse consumer landscape.

Table of Contents

1. Understanding India’s Consumption Growth and Market Segments

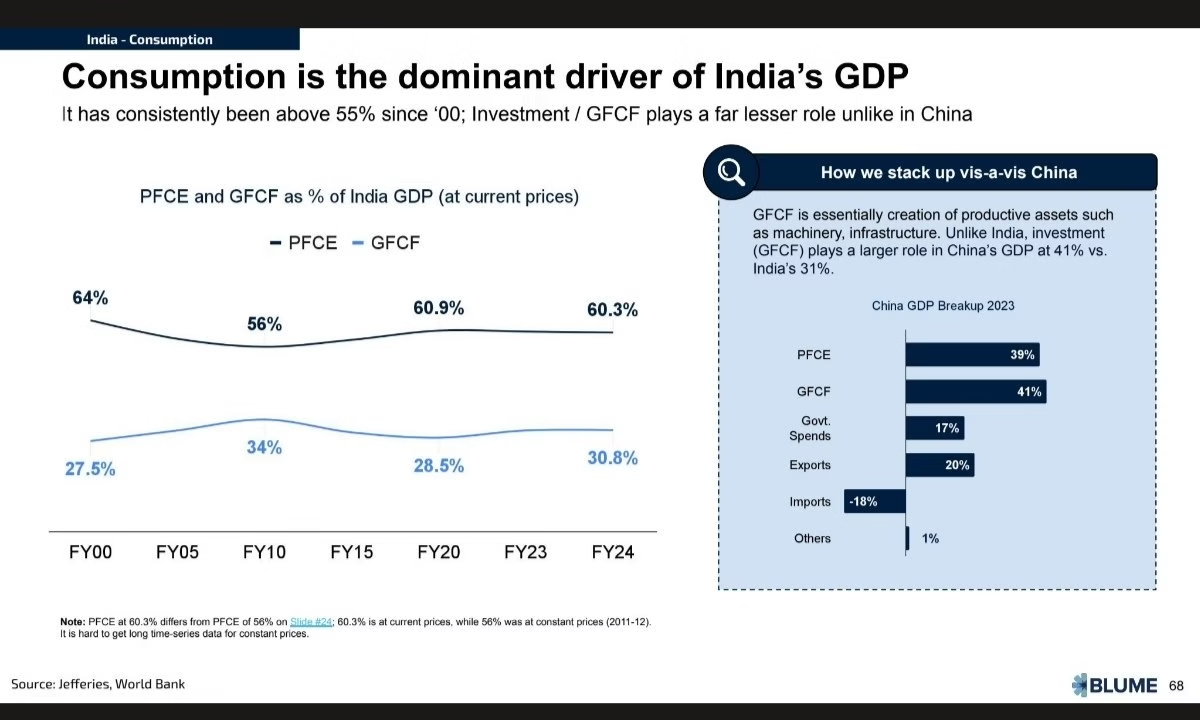

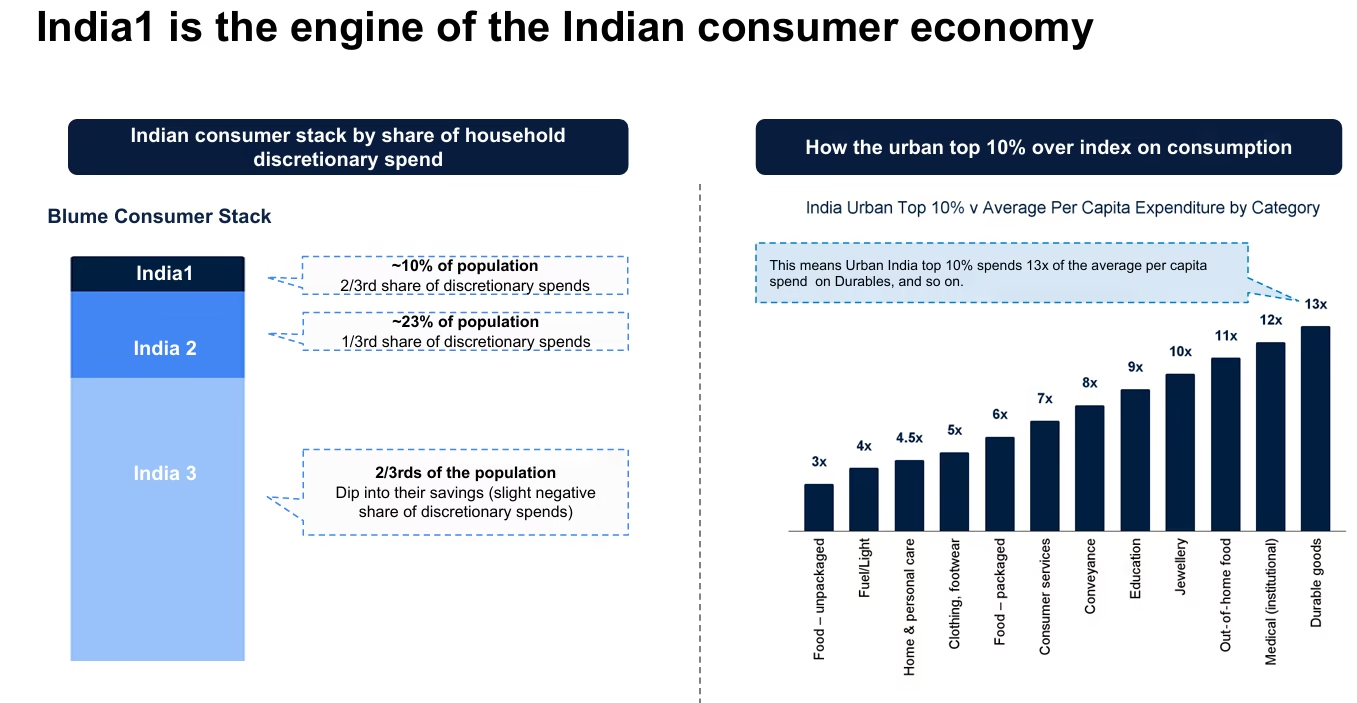

India’s consumption-driven economy has been a steady force, with private consumption accounting for around 60% of the GDP. This has remained consistent over the years, making India the fifth-largest consumer market globally.

A deeper breakdown of India’s $2.1 trillion consumption economy shows:

- Retail and Services are the two dominant sectors, each contributing roughly $1 trillion.

- Within retail, categories such as grocery and FMCG make up nearly 50% of total spending.

- Online retail penetration remains relatively low at 7%, equating to a $70 billion e-commerce market.

- Branded consumption has grown to 37%, indicating a shift toward organized retail.

One of the most interesting takeaways from this data is the projected growth trajectory. If India continues its 7% annual growth, total retail consumption could double to $4.2 trillion in the next 10 years. This could potentially position India as the third-largest consumer market globally, behind the US and China.

However, sustaining this growth depends on several factors—including income distribution, savings rates, and structural reforms—which are crucial to ensuring that discretionary spending expands across income groups.

2. Understanding India’s Consumer Segments: India 1, India 2, and India 3

India’s consumer market is not a single entity—it is a complex mix of different income groups, preferences, and behaviors. To make sense of this, the Indus Valley Report breaks it down into three segments:

- India 1: The affluent, high-spending class.

- India 2: The emerging, aspirational middle class.

- India 3: The lower-income, mass-market segment.

Each segment has unique income levels, consumption patterns, and preferred shopping channels, influencing how businesses should position themselves. Let’s explore each in depth.

3. India 1: The affluent, high-spending class

India 1 comprises 50-75 million people, making up approximately 5-7% of the country’s population. This segment is primarily concentrated in metros and Tier 1 cities like Delhi, Mumbai, and Bangalore, where economic opportunities are abundant.

Highly educated and financially secure, these consumers are also digitally native, seamlessly integrating technology into their daily lives. They typically work in high-paying jobs, including roles in corporate leadership, startups, global enterprises, professional services, and investment sectors, making them a key driver of premium consumption in India.

The India 1 consumer set is the top ~120 million consumers in India. They have the majority of disposable income, behave like Western audiences, and are almost English native.

Blume

3.1 Income & Size

- Household income: ₹30 lakh+ per year.

- This segment is not growing in size (not widening), but it is spending more per capita (deepening).

- Luxury, convenience, and premiumization is driving spending.

3.2 Consumption Behavior

- Prioritizes quality, exclusivity, and experience over price.

- Engages in global travel, high-end fitness, and personalized financial services.

- Uses subscription models (Netflix Premium, Amex Platinum, CRED, Apple One).

- Brand loyalty is high, but expectations are high as well—poor service can lead to quick churn.

3.3 Shopping Channels

- Luxury e-commerce & premium retail stores: Nykaa Luxe, Tata Cliq Luxury, Ajio Luxe.

- Exclusive D2C brands: Tesla, BOAT, Le Creuset.

- High-end memberships: American Express Platinum, CRED, Taj InnerCircle.

- Premium services: Concierge apps, private banking, premium OTT.

3.4 Brands Targeting India 1

- Apple: Sells premium devices with strong brand loyalty.

- Amex & CRED: Elite financial services targeting HNIs (High Net-Worth Individuals).

- Tesla & BMW: High-end automobiles positioned as status symbols.

India 1 is not widening in size, but it is deepening in spending. With higher disposable incomes, people in this segment are spending more on luxury, convenience, and premium experiences.

This trend has led to growing demand for exclusive products, personalized services, and loyalty programs. Brands catering to India 1 focus on premiumization, offering tailored experiences that match their sophisticated preferences.

Whether in fashion, hospitality, or financial services, businesses must emphasize quality, exclusivity, and seamless service to succeed in this deepening market.

4. India 2: The emerging, aspirational middle class

India 2 represents the fastest–growing consumer segment, comprising 200-300 million people (around 20-25% of India’s population).

This group is primarily found in Tier 1, Tier 2, and rapidly developing Tier 3 cities like Lucknow, Jaipur, Indore, and Surat.

They consist largely of first-generation professionals, salaried employees, and small business owners, all driven by ambition and aspirational goals.

With a strong desire for upward mobility, they are constantly seeking opportunities to improve their financial and social status, making them a key target audience for brands offering affordable, high-value products and services.

India 2 is an emerging consumer cohort with significantly lower per capita income. Beyond income, they are 'regional language first,' thinking in a local language, creating cultural differentiation that shows up in their consumption.

Blume

4.1 Income & Size

- Household income: ₹5-30 lakh per year.

- The segment is expanding rapidly (widening), bringing new consumers into formal and digital economies.

- Financial inclusion is accelerating adoption of digital services (UPI, credit cards, EMIs).

4.2 Consumption Behavior

- Looks for value-for-money products that balance quality and affordability.

- Increasing adoption of healthtech, fintech, and edtech services.

- Prefers Buy Now Pay Later (BNPL), No-Cost EMI, and cashback offers to access premium products.

- Influenced by social media, influencer marketing, and vernacular content.

- Biggest driver of e-commerce growth (Flipkart, Amazon, Meesho, Myntra).

4.3 Shopping Channels

- Affordable e-commerce platforms: Flipkart, Amazon, Nykaa.

- Social commerce & influencer-led buying: Meesho, Instagram Shops, WhatsApp commerce.

- Mobile-first payment platforms: UPI, PhonePe, Paytm.

- Fast fashion & aspirational brands: Zara, H&M, Boat, Realme.

4.4 Brands Targeting India 2

- Jio: Expanded affordable data, bringing millions online.

- PhysicsWallah: Affordable online education for aspirational learners.

- Realme & Xiaomi: Budget-friendly smartphones with premium features.

- Zomato & Swiggy: Expanding into Tier 2 & 3 cities with affordable pricing.

5. India 3: The lower-income, mass-market segment

India 3 represents the largest segment, comprising 800+ million people (around 65% of India’s population). This group primarily resides in rural areas and Tier 3 & 4 towns across states like Bihar, Uttar Pradesh, Odisha, Jharkhand, and Madhya Pradesh.

Their livelihoods are mainly dependent on agriculture, daily-wage labor, informal sector jobs, and small businesses.

While financial constraints limit their purchasing power, digital adoption is steadily increasing, driven by affordable smartphones, UPI-based transactions, and government-led financial inclusion initiatives. Brands targeting this segment often focus on affordability, accessibility, and trust-building to drive engagement.

5.1 Income & Size

- Household income: Below ₹5 lakh per year.

- The segment is growing in size (widening) as more people enter the formal economy through government-backed financial inclusion programs (Jan Dhan Yojana, UPI, Rupay cards, microfinance loans).

5.2 Consumption Behavior

- Highly price-sensitive, prioritizes savings and discounts.

- Prefers local, unbranded, and kirana-store purchases over national brands.

- Trusts word-of-mouth recommendations and local retailers over digital ads.

- Government subsidies and financial schemes drive spending.

5.3 Shopping Channels

- Local kirana stores (90% of shopping still happens here).

- Mass-market e-commerce (Flipkart Wholesale, Amazon Bazaar).

- WhatsApp commerce & vernacular apps (JioMart, PhonePe, ShareChat).

- Direct-to-rural distribution (ITC, HUL, Dabur’s rural expansion).

5.4 Brands Targeting India 3

- Patanjali & Dabur: Affordable FMCG and healthcare products.

- PhonePe & GPay: Simple digital payment solutions for rural consumers.

- Airtel & Vi: Low-cost telecom plans for smaller towns and villages.

- SBI & Paytm: Driving financial inclusion through microfinance and UPI.

India 2 and 3, on the other hand, are expanding as millions of people enter the formal economy and embrace digital commerce. Financial inclusion—through UPI, microfinance, and Buy Now Pay Later (BNPL) options—is making it easier for them to spend.

Affordable, mobile-first platforms like Meesho, Jio, Paytm, and regional e-commerce apps are enabling mass adoption. As this segment grows, brands must focus on accessibility, affordability, and ease of use to reach these new consumers.

6. Key Considerations for Future Growth

As India’s economy evolves, several factors will shape its consumption trajectory in the coming years:

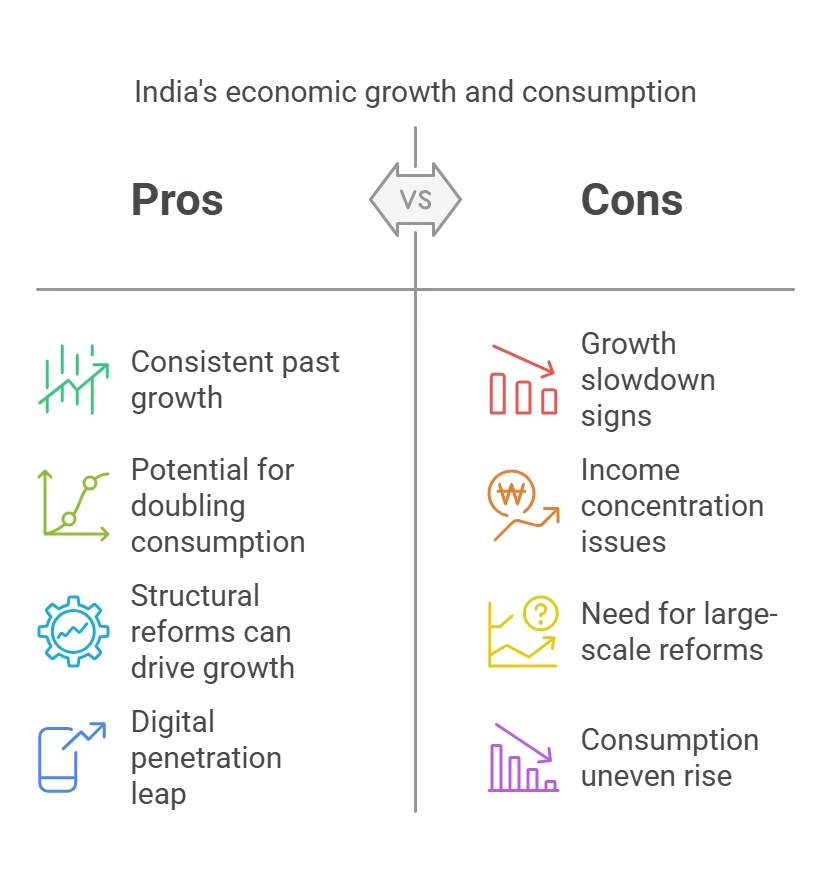

- Growth Trajectory & Potential Slowdown: While the past decade saw consistent 7% growth, there are signs of a slight slowdown. Even if growth dips by 1-2%, we might still see India’s consumption doubling, albeit in 12 years instead of 10 (following the Rule of 72). The Rule of 72 is a simple formula used to estimate how long it takes for an investment (or an economy) to double, given a fixed annual growth rate.

- Income Growth & Savings: Consumption is ultimately driven by disposable income and savings. For strong discretionary spending (which goes beyond essential needs), income levels must rise across a wider population. If income growth remains concentrated in a smaller group, overall per capita consumption won’t rise as evenly.

- Structural Reforms & Positive Shocks: India often grows in step functions—big jumps followed by a plateau. For instance, Jio’s expansion pushed digital penetration forward by five years. The next wave of growth will likely require similar large-scale structural changes or policy shifts to sustain momentum.

7. Final Thoughts

To succeed in India, brands need to focus on the right customer group.

- India 1 prefers premium products and top experiences, making it a market for brands like Tesla, Amex, Apple, and Taj Hotels.

- India 2 looks for affordable but aspirational brands, with companies like Realme, Jio, Zomato, and Flipkart meeting their needs.

- India 3 relies on budget-friendly products and financial access, served by brands like Patanjali, ITC, and PhonePe.

It’s important to understand how these groups are changing—India 1 is growing in depth, while India 2 and 3 are expanding in size—to build a successful business. You can explore the full Indus Valley Annual Report 2025 here.