Today, loyalty programs play a big role in helping brands retain customers and drive repeat purchases in omnichannel marketing. But these programs aren’t universal anymore—they’re evolving.

From simple point-based systems to tiered rewards, cashback offers, and even exclusive experiences, brands now have many ways to build omnichannel loyalty.

Read more on – How Are Loyalty Programs Evolving?

The real question is – how quickly are you adopting and optimizing your loyalty program?

In a competitive market, the faster you build meaningful connections, the stronger your customer base becomes.

In fact, 50–70% of people who join loyalty programs don’t use them again. Many brands think that getting sign-ups means the program is working, but that’s not true.

A good loyalty program in omnichannel should bring customers back and make them buy more. If it doesn’t do that, it’s just a formality.

After talking to teams from different industries and doing my own research, I found that there are five key things you should track to know if your loyalty program is truly working.

- Member Acquisition Rate

- Repeat Rate

- Renewal Rate

- Redemption Rate

- Purchase Frequency

In this blog, we will discuss what it is, why it matters, how to track it—and how it drives ROI.

“A loyalty program KPI shows whether your members are engaged...if they aren’t, it’s time to re-evaluate.”

— Ebbo

Table of Contents

1. Member Base

Member base helps you look at the total number of your customers and how fast are you acquiring them. A growing member base means more people see value in your program.

For example, if you had 100 new customers this month and 30 of them joined your loyalty program, your membership rate is 30%. This helps you understand how well you’re converting regular customers into loyal members.

Also keep an eye on your total subscriber count—people who have signed up for emails or SMS—and see how many of them are active loyalty members.

You can also compare your total number of customers with your loyalty members to see your member acquisition rate. Member Acquisition Rate in omnichannel measures how quickly new customers are joining your loyalty program. It shows how effective your efforts are in converting regular shoppers into loyalty members over time.

1.1 How to Track It?

- Keep a regular count of loyalty program sign-ups through your website, app, POS, or CRM.

- Segment these sign-ups by source—did they join via your website, in-store, through a campaign, or via your mobile app?

- Watch for patterns in growth by tracking sign-ups month over month or quarter over quarter.

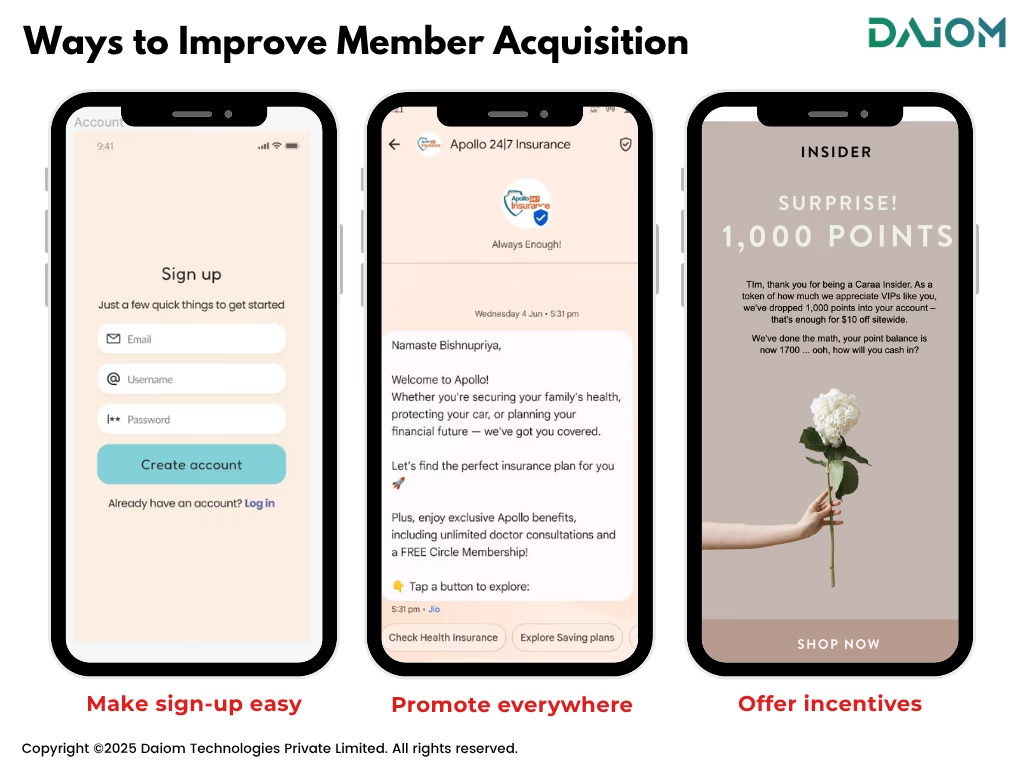

1.2 Ways to Improve Member Acquisition

- Make sign-up easy: Allow customers to join quickly, especially at checkout. Auto-enroll them when they share contact details or make a purchase.

- Promote everywhere: Add loyalty sign-up CTAs on email receipts, product packaging, social media, and even in-store displays.

- Offer incentives: Give customers a reason to join—like a welcome discount, bonus points, or a free gift for signing up or referring a friend.

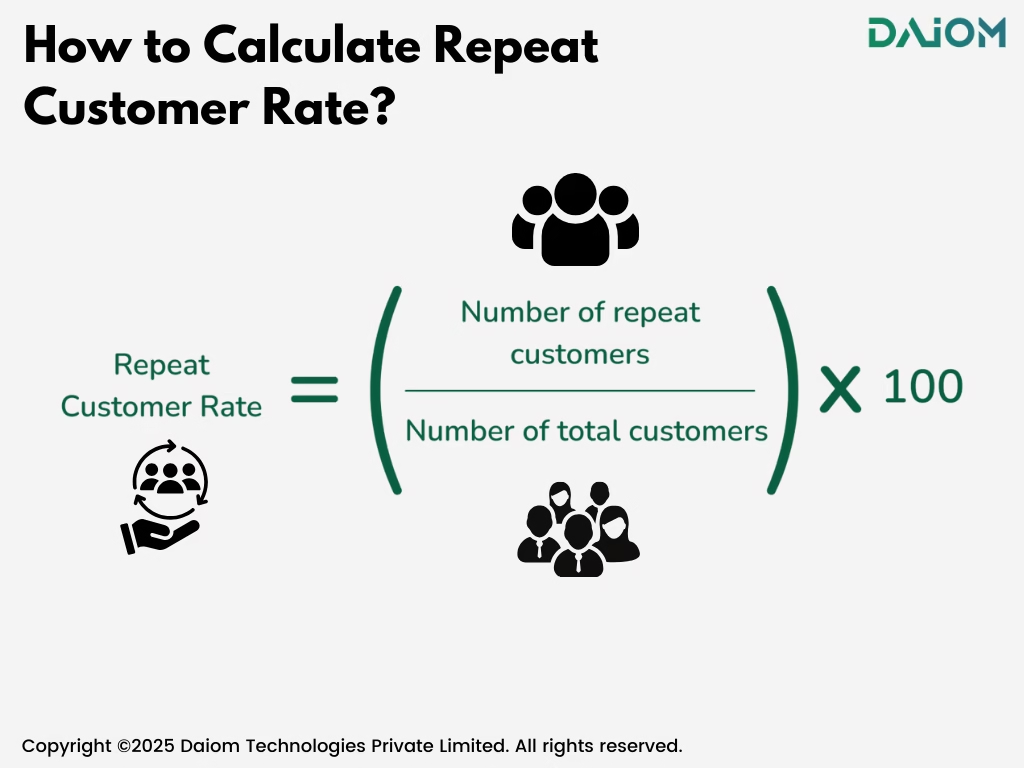

2. Repeat Rate

The primary goal of any loyalty program in Omnichannel is to increase repeat purchases—but are you seeing that happen?

Repeat rate says how often members come back to purchase again. It shows how engaged your loyalty members really are.

Read more – Everything You Need to Know About Repeat Customer Rate

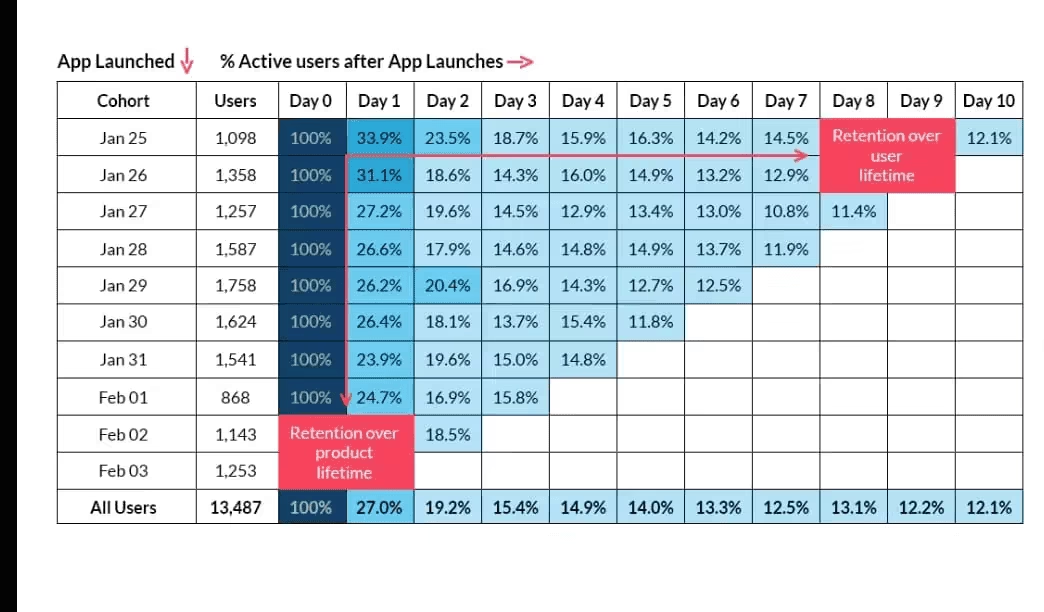

2.1 Tracking Repeat Rate in Cohorts

Don’t just track repeat rate—look at it through a cohort view to truly understand how loyalty is impacting behavior over time.

Tracking Repeat Rate in cohorts provides deeper insights into customer retention trends. Instead of looking at an overall repeat rate, businesses should analyze RCR based on customer acquisition cohorts.

Example: If a brand acquires 1,000 customers in January and 300 of them make a second purchase by March, the 3-month repeat rate for the January cohort is 30%.

Cohort-based analysis helps businesses understand:

- How different customer segments behave over time.

- Whether first-time buyers are turning into loyal customers.

- The impact of specific marketing campaigns on repeat purchases.

By analyzing RCR at a cohort level, brands can refine their customer retention strategies and optimize engagement based on actual buying patterns.

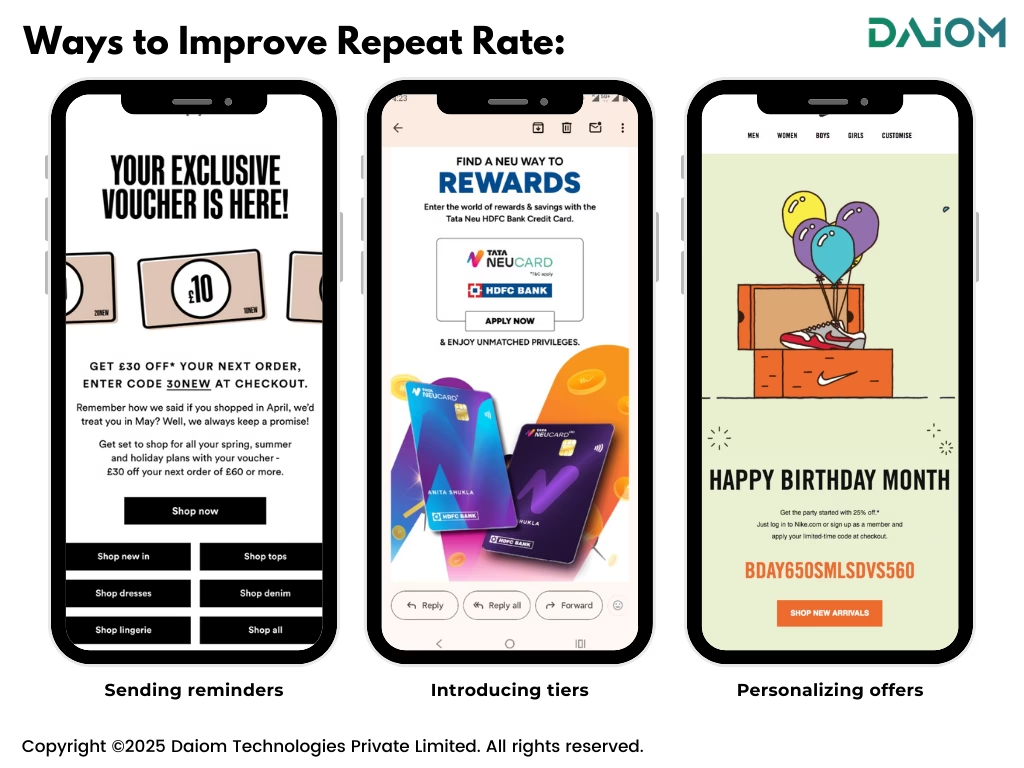

2.2 Ways to Improve Repeat Rate

To keep members coming back, make your omnichannel loyalty program helpful, fun, and personal. Then continue with:

- Sending reminders: Nudges like “You’ve earned points!” or “Don’t miss your next reward” help re-engage members.

- Introducing tiers: Reward loyal members with exclusive benefits, early access, or milestone bonuses.

- Personalizing offers: Use past purchase behavior or preferences to tailor discounts and messages that feel relevant.

3. Renewal Rate

Renewal Rate applies mainly to paid loyalty programs—it shows how many members are choosing to renew after their subscription ends.

It helps you understand if customers see enough value to keep paying, either through auto-renewals or manual sign-ups.

3.1 How to Track It?

- Monitor retention of members nearing the end of their subscription period—check how many renew, cancel, or go inactive.

- Segment by acquisition source, membership tier, or first-year activity to see which groups are more likely to renew.

- Track auto-renewals vs. manual renewals to understand user intent and satisfaction.

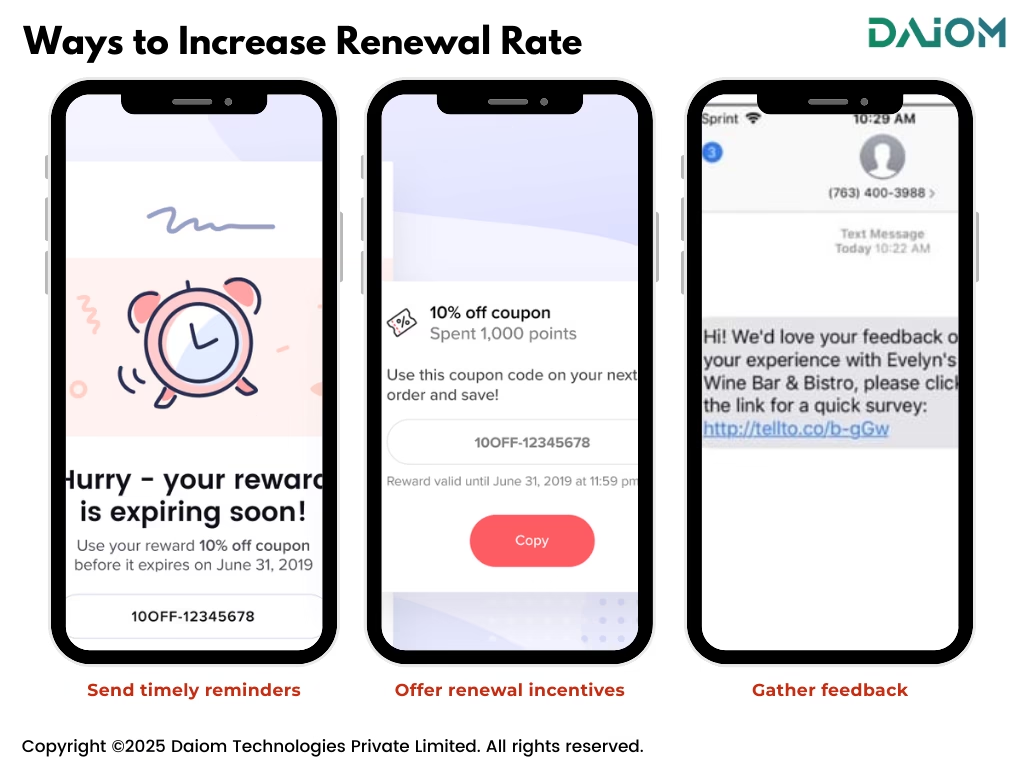

3.2 Ways to Increase Renewal Rate

To boost renewals in omnichannel, focus on reminding members of value and reducing friction in the renewal process:

- Send timely reminders: Notify users before their plan expires, especially if auto-renewal is off.

- Offer renewal incentives: Provide limited-time bonuses, extra points, or early access to new features for renewing members.

- Gather feedback: Use quick surveys to understand why members don’t renew—and fix what’s missing.

4. Redemption Rate

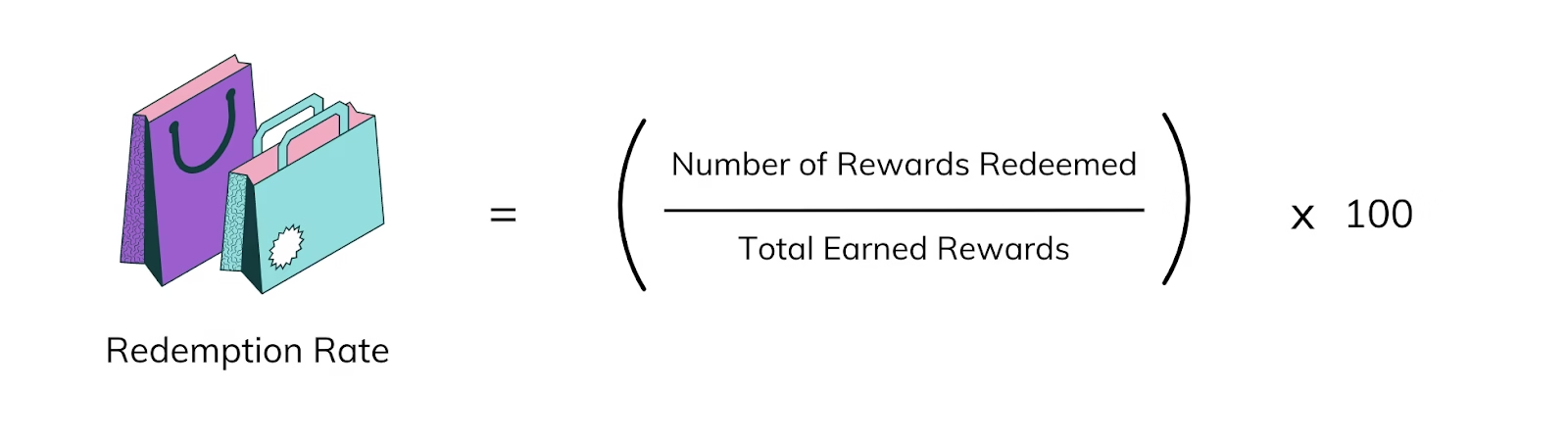

Redemption Rate in omnichannel shows how many loyalty points earned by members are actually being used. If members earn 1,000 points and redeem 400, your redemption rate is 40%. It reflects how valuable and usable your rewards feel to your customers.

A related long-term view is the Ultimate Redemption Rate (URR)—measured after 1–2 years of running the program—to see how much of the total issued value was eventually redeemed. The Ultimate Redemption Rate helps you assess the long-term strength and sustainability of your loyalty program.

4.1 How to Track It?

- Track redemption monthly, quarterly, and annually to spot trends.

- Compare rates across member tiers, channels, or campaign types.

- After 2+ years, calculate your URR for a full view of reward utilization.

4.2 Ways to Increase Redemption Rate

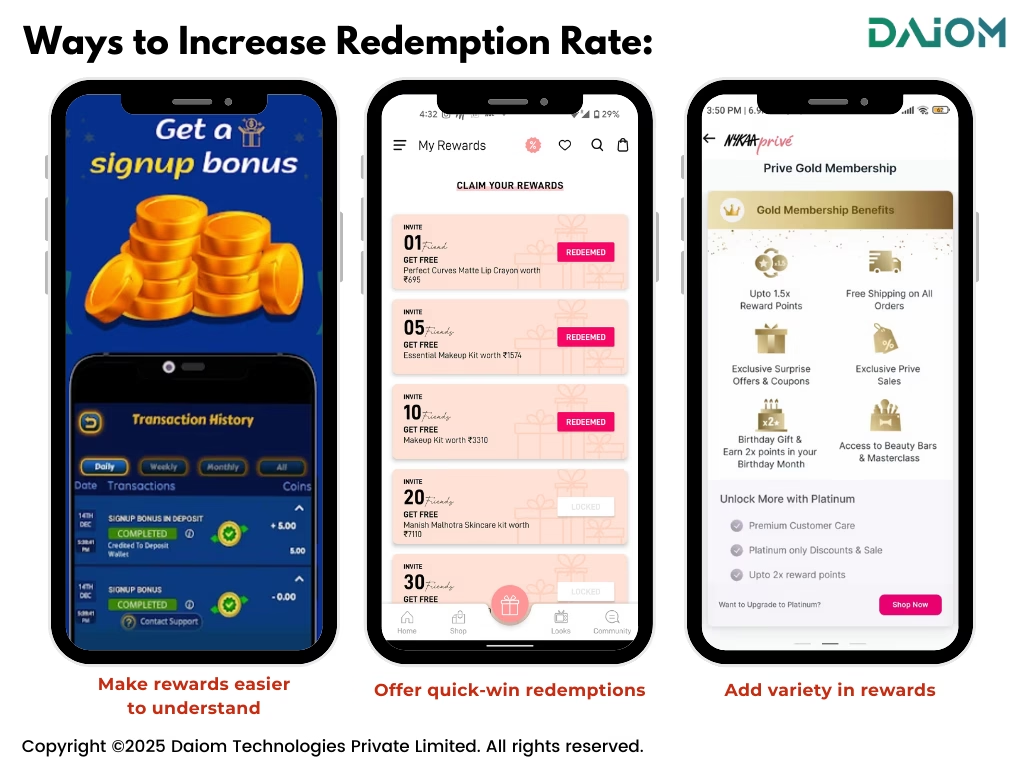

- Make rewards easier to understand: Keep the structure simple and show users how close they are to redeeming something.

- Offer low-value, quick-win redemptions: Let members redeem small points often, instead of saving for big milestones.

- Add variety in rewards: Mix product discounts, experiences, or partner offers.

5. Purchase Frequency

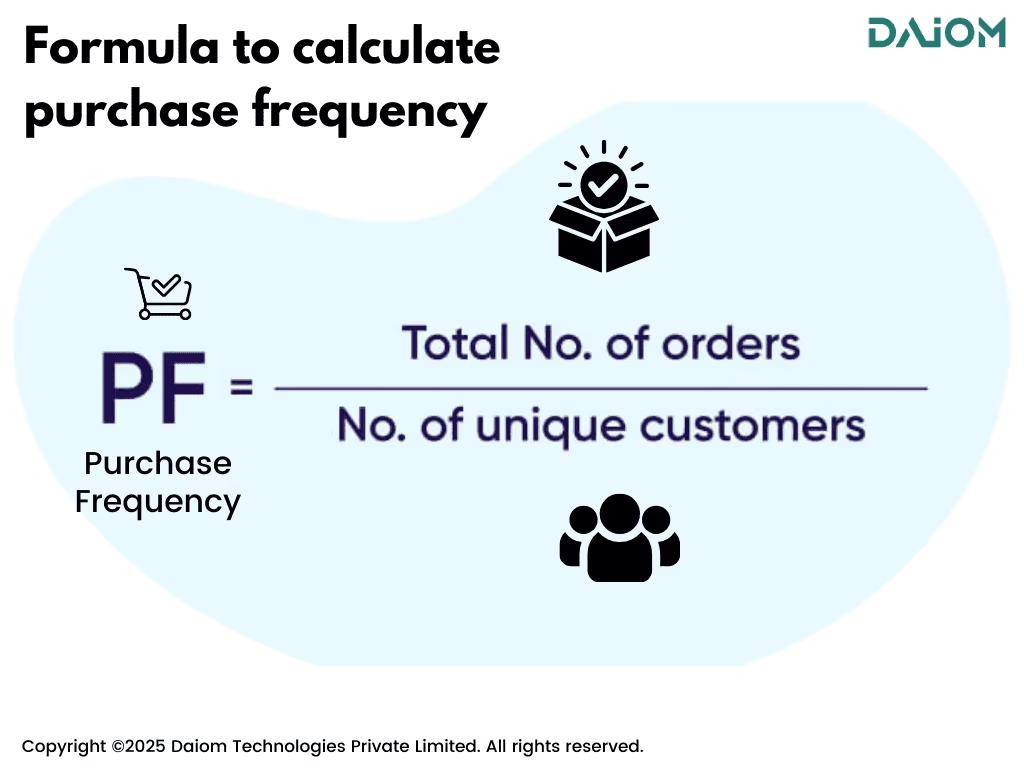

One of the clearest signs of an engaged loyalty member is how often they return to buy again. Purchase frequency measures the average number of transactions a loyalty member makes over a set period—monthly, quarterly, or yearly.

Read more – Metric of the Week – Purchase Frequency

5.1 How to Track It?

- Compare how often loyalty members purchase vs. non-members.

- Track metrics like average visits or orders per member per month or quarter.

- Segment by campaign, acquisition source, or tenure to see where lift is strongest.

5.2 Ways to Increase Purchase Frequency:

To keep members coming back, give them these reasons to re-engage more often.

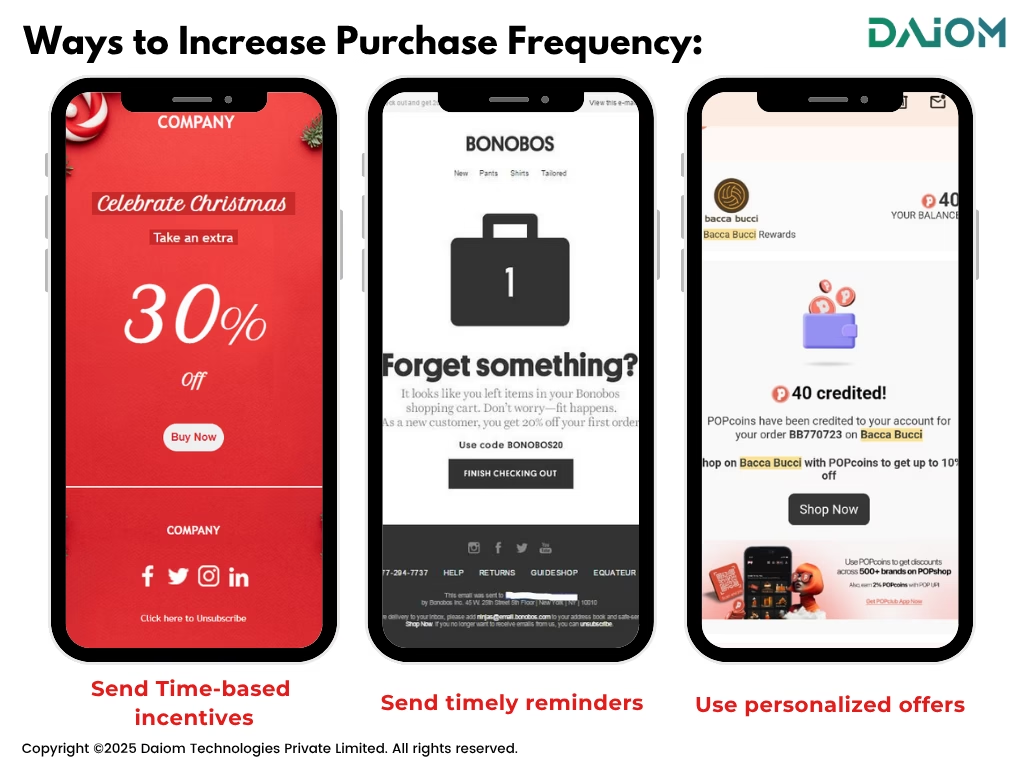

- Time-based incentives: Offer double points during festivals, limited-time deals, or seasonal sales.

- Send timely reminders: Recover abandoned carts or nudge inactive users with personalized prompts.

- Use personalized offers: Suggest products based on past purchases or preferences.

All these KPIs—repeat rate, member base, redemption rate, renewal rate—work together to build stronger customer relationships. When tracked and optimized, they directly contribute to higher Customer Lifetime Value (CLV) by increasing engagement, retention, and revenue over time.

Read more – Metric of the Week: Customer Lifetime Value (CLV)

6. Why Tracking These 5 KPIs Are Essential?

These five KPIs are inherently inter-linked. Member acquisition builds the base, repeat keeps them coming back, renewal highlights engagement, redemption shows value, and purchase frequency proves ROI.

If you only look at one, you might miss important problems. For example: If many people join your program, but no one uses the rewards, it means they don’t find it useful. When these five are tracked together:

- You know you’re growing properly

- You understand if people actually care

- You catch when programs plateau

- You connect decisions to measurable return

7. Conclusion

Loyalty isn’t just about programs or reward points—it’s about building a strong connection with your customers. These five KPIs—acquisition, retention, churn, redemption, and purchase frequency—act like a guide.

Also Read: How Are Loyalty Programs Evolving?

They help you know when to make changes, solve problems, or grow faster. By checking these numbers regularly, brands can turn loyalty into real results for their business.

Want help setting a loyalty program? Feel free to reach out to us at saurabh@daiom.in. We’d be happy to set up a consultation call.

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!