We recently published a blog on Indian consumers—exploring how India 1, India 2, and India 3 differ in their needs and spending styles—which resonated deeply with readers.

Thanks to that enthusiasm, we’re presenting a follow-up focused entirely on what India 1, India 2, and India 3 are, simplifying and defining these segments in a clear way.

Read here – Understanding Indian Customer Segmentation: A Market Within a Market

So, India is a country of contrasts.

With over 1.4 billion people, it’s impossible to understand it as a single, uniform market or society. Economically, socially, and geographically, there are deep divides that make the Indian population highly diverse.

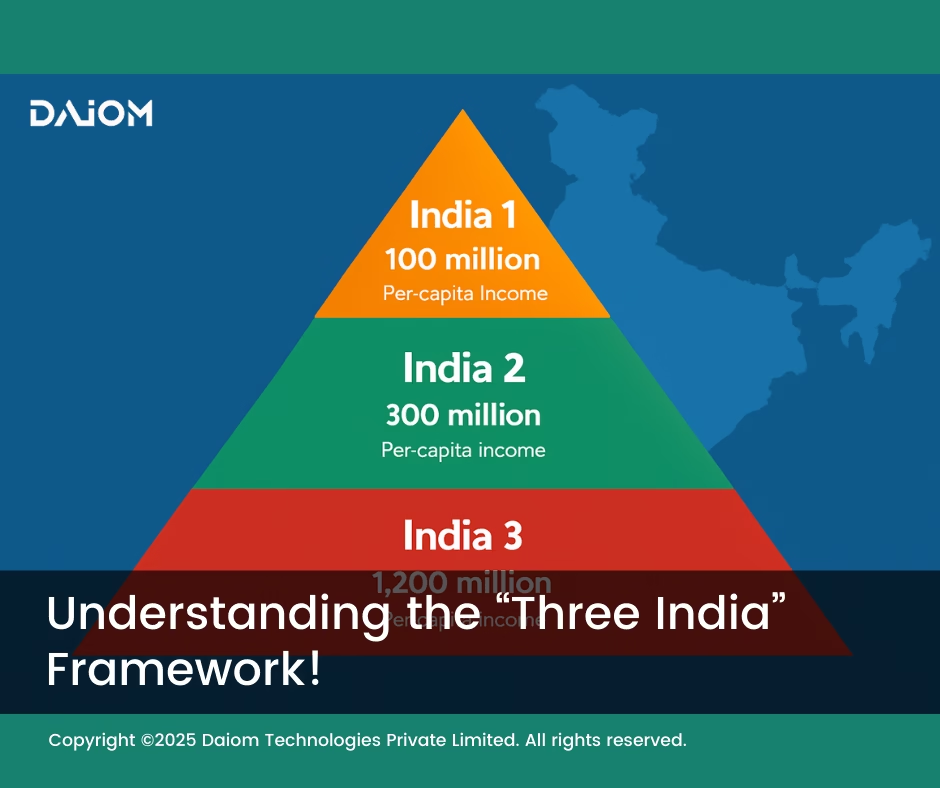

To make sense of this complexity, a simple framework was developed by Blume IVC report 2023: India 1, India 2, and India 3.

These aren’t official zones or political regions, but socio-economic layers that help explain how India lives, earns, and grows.

In this blog, we will break down what each of these Indias means.

"India is not one market. It is a collection of many small markets, each with its own rules, behaviors, and levels of access. Understanding this is the first step to building anything meaningful here."

— Sajith Pai, Blume Ventures

Table of Contents

1. What Are India 1, India 2, and India 3?

India isn’t one big, uniform market. It’s made up of many different Indias—each with its own pace of growth, access to products, and way of living.

To understand this diversity, experts often divide the country into three segments: India 1, India 2, and India 3.

These aren’t regions on a map. Instead, they’re socio-economic layers—ways to group people based on things like income levels, internet access, spending habits, and exposure to modern brands or services.

Why does this matter?

Because a strategy that works in India 1 might completely fail in India 3. Knowing these differences helps businesses, policymakers, and marketers target the right people with the right message.

In the next sections, we’ll break down what each of these segments looks like, how they behave, and why they matter.

2. India 1 – The Top Economic Layer

India 1 sits at the top of the socio-economic pyramid. These are the most affluent, connected, and digitally savvy consumers in the country.

They typically live in urban metro cities, have stable incomes, and enjoy access to everything—from global brands to fast internet and world-class infrastructure.

Key Traits:

- Small in size, big in impact: India 1 makes up less than 10% of the population, but contributes a disproportionate share of consumption and economic activity.

- High purchasing power: They have more disposable income (what’s left after paying for essentials), so they spend more—on travel, food delivery, tech gadgets, personal care, and experiences.

- Digitally active: This group is always online. They shop, pay, learn, and interact digitally. It’s no surprise that most UPI transactions, online shopping, and app-based services come from India 1.

- Regular transactors: They frequently use credit cards, digital wallets, and apps like CRED, Ola, Swiggy, and Zomato—not just occasionally, but as part of their daily lives.

- Privileged access: Many in this group come from families with early access to education, jobs, and globalization. They’ve benefited from India’s economic growth over the past few decades.

Startups and new-age brands often start with India 1—because they’re easier to reach, more likely to adopt new services, and generate more revenue per user. Think of them as the first 100k customers who will try your product, give feedback, and pay for convenience.

Startups like CRED, Dunzo, Ola, and Zomato start with India 1 because it includes users who are digitally savvy, spend frequently, and are willing to pay for convenience. This group has high purchasing power and is quick to adopt new tech, making them the most reliable and monetizable customer base for early-stage growth.

3. India 2 – The Aspiring Class

India 2 represents the “in-between” layer—people who are not at the bottom, but not quite at the top either.

They’re aspirational, ambitious, and on the rise. Many come from Tier 2 and Tier 3 cities, suburbs, or semi-urban areas. They’re exposed to new ideas, brands, and lifestyles—but don’t always have the consistent access or income to fully participate.

Key Traits:

- Growing and dynamic: India 2 makes up about 8–10% of the population, and that number is steadily rising with improvements in internet access, education, and economic mobility.

- Lives in smaller towns and transitional spaces: These are your residents of Indore, Lucknow, Kochi, Nagpur, and others like them—not mega metros, but rapidly developing hubs with emerging infrastructure.

- Partial access to services: They might have smartphones but not the latest models, or internet access but not high-speed. Healthcare, education, and financial systems are within reach, but not always reliable or affordable.

- Blends formal and informal work: Many people here juggle between traditional jobs, gig work, and small businesses. Some are salaried, others are hustling their way up—often self-employed or running family-owned shops.

- Aspirational mindset: India 2 wants more. They follow trends, consume content, dream of better jobs, homes, and lives. Their consumption is often value-conscious—not cheap, but worth it.

India 2 is where the next wave of growth is coming from.

They’re brand-aware, digitally learning, and ready to spend—cautiously but consistently. They may not be your highest-spending customers today, but they’re becoming more active every year.

4. India 3 – The Foundational Majority

India 3 makes up the majority of the country—over 75% of the population. Most people in this group live in villages, remote towns, or underserved regions where access to healthcare, education, internet, and stable jobs is limited.

Key Traits:

- Rural and under-connected: India 3 is primarily found in non-urban and remote areas, where basic infrastructure is still catching up.

- Part of the informal economy: Many here work as farmers, daily wage earners, or run micro-businesses. Formal employment or regular salaries are rare.

- Limited access to digital tools: Internet and smartphone use is growing, but connectivity, affordability, and digital literacy are still major barriers.

- Low and uncertain income: Most households have low disposable income and often prioritize essentials over aspirational or digital services.

India 3 shows the real scale of India, and while they may not be the target customers for most startups today, they represent future potential. Barriers like geography, lack of infrastructure, and deep-rooted inequality have held this segment back—but with the right interventions, India 3 can be a key part of India’s long-term growth story.

"If you’re building for Bharat, you’re building for the next 500 million internet users."

— Sajith Pai, Blume Ventures

4. Conclusion

India is not just one fast-moving train—it’s three, all moving at different speeds. India 1 is already on the express lane, India 2 is boarding, and India 3 is still connecting to the journey.

Understanding these segments helps us see the country not as a blur, but as a set of overlapping, real experiences. Whether you’re writing policy, designing services, or just trying to understand India better—knowing which India you’re talking about is the first step.

It’s important to understand how these groups are changing—India 1 is growing in depth, while India 2 and 3 are expanding in size—to build a successful business. You can explore the full Indus Valley Annual Report 2025 here.

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!