In today’s informed market, customers face an abundance of choices, leading to increased switchability. To stand out, businesses offer incentives, either through quality or cost, birthing loyalty programs like rewards points and cashback.

The loyalty program industry, valued at $11 billion as of 2023, processes over $200 billion in transactions, with India seeing a 22% rise in new cashback websites.

Loyalty programs are crucial across retail, airlines, and credit cards, with points and cash-back driving varied consumer behaviour. While cashback offers immediate rewards, points build long-term benefits, creating a fierce debate on which is better for brands and customers.

In this following blog, let us discuss the different offerings of the loyalty programs, their benefits and how they are measured by the businesses to gain insights about customer retention and the effectiveness of these programs.

Do what you do so well that they will want to see it again and bring their friends

Walt Disney

Table of Contents

2. Customer Loyalty Programs

CashBack Programs:

Cashback is straightforward—users receive a percentage of their spend back in cash. For example, if you spend $100 on a credit card offering 2% cashback, you get $2 back. This immediate reward is appealing for its simplicity and instant gratification.

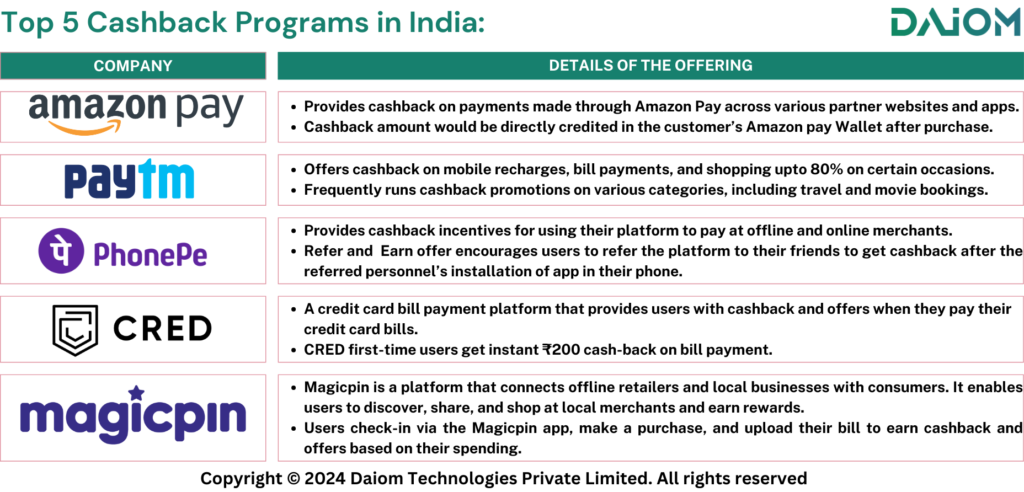

Let us look at some of the popular cashback programs which are prevalent in India.

Reward Points Program:

In contrast, points programs involve accumulating points based on spending, which can later be redeemed for various rewards such as flights, hotel stays, merchandise, or discounts. This system requires patience and a strategic approach to maximise benefits. There are different types of point programs offered by different industries such as:

- Airlines

- Credit Cards

- Hotels

Airlines : Some of the commonly offered points incentives by airlines are:

- Frequent Flyer Miles (FFM): Points earned based on the distance flown or the amount spent on airline tickets. Example: American Airlines, Delta SkyMiles

- Tier Points/Status Credits: Points earned based on the class of service, ticket fare, and distance flown, used to determine elite status levels. Example: British Airways Tier points.

Credit Cards: Some of the commonly offered points incentives by credit cards are:

- Reward Points: Points earned on purchases that can be redeemed for travel, merchandise, gift cards, or other rewards. Example: American Express Membership Rewards, Chase Ultimate Rewards.

- Travel Points: Points specifically designed for travel redemptions, such as flights, hotels, and car rentals. Example: Citi ThankYou Points

Hotels: Some of the commonly offered points incentives by hotels are:

- Hotel Loyalty Points: Points earned for staying at hotel properties within a hotel chain or group, redeemable for free nights, room upgrades, and other perks. Example: Marriott Bonvoy Points, World of Hyatt Points.

- Status Points: Points accumulated to achieve higher membership tiers within a hotel loyalty program, providing benefits such as late check-out, free breakfast, and room upgrades. Example: Hilton Honors Status Points, Marriott Bonvoy Elite Night Credits

There are also other programs such as Retail Loyalty Points, Dining Points, Fuel Points.

Points Redemption:

Points in any rewards program are based on the amount you spend using their services. For instance, HDFC credits around 1 reward point for every ₹150 spent. These points can be converted into some form of monetary value within the provider’s ecosystem to avail benefits. However, the value of points earned through spending may not always be equal to their redeeming value and can vary from one service provider to another.

Also Read – How Are Loyalty Programs Evolving?

Step-Up Benefits

Apart from the normal reward points that the businesses such as credit card provide on your amount spend to equivalent points, there are also Step-Up benefits included in them which are additional benefits apart from the already receivable reward points. Let us consider the following examples:

American Express:

If a person were to have a American Express® Platinum Travel Credit Card, he earns 1 Membership Rewards Point for every Rs. 50 spent on the Card and if he were to spend Rs. 1.90 Lacs in a year, he would earn 15,000 Membership Rewards points additionally redeemable for Flipkart voucher and for spend of Rs. 4 Lacs in a year, a Taj Stay voucher worth Rs. 10,000 from Taj, SeleQtions and Vivanta Hotels.

Club Vistara:

It is a frequent flyer membership program of Vistara Airlines and the passengers are placed in different tiers such as (i.e Basic, Silver, Gold, Platinum). If a person earns enough points by flying in Vistara airlines frequently in a year, he can be subjected to tier upgrade for free and this upgrade comes with One-Class Upgrade vouchers, Priority Waitlist Clearance, Rescheduling Fee Waiver etc.. for no additional cost.

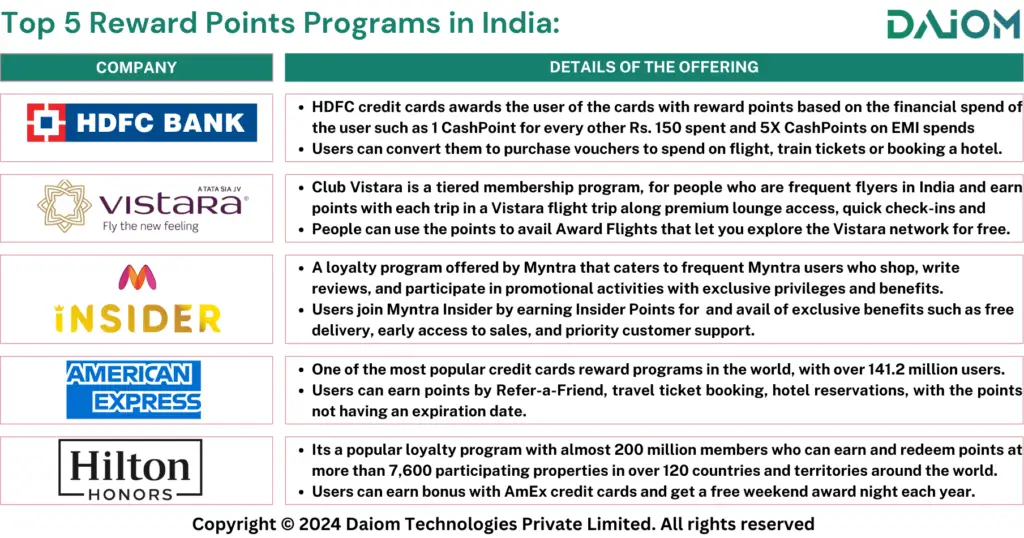

Let us look at some of the reward points programs which are popular among the Indian Market.

Special Value-Based Subscription Programs:

Beside the traditional cashback and points programs, there has been a rise in the new kind of programs with subscriptions. These Value-based subscription services offer points or other loyalty benefits designed to provide additional perks to customers, enhancing their overall experience and encouraging repeat business. There are both types of subscriptions which are paid subscriptions and the free ones.

The free value-based subscription services that offer a range of benefits to their members without charging a subscription fee. These programs typically aim to build customer loyalty and encourage repeat business by providing exclusive perks, discounts, and rewards.

Examples:

Paid Subscription: Lenskart Gold, Zomato Gold, Amazon Prime, PayTM first

Free Subscription: Sephora Beauty Insider, H&M Membership, Starbucks Rewards

3. Customer Loyalty Program Analysis: Overview

To get an overview of the different loyalty programs and make an comparative view of various offerings of the program, an info-graphic below is put together.

Advantages and Disadvantages:

Cashback

Advantages:

- Immediate Reward: Cashback provides instant gratification, making it highly attractive for consumers seeking quick returns on their spending.

- Simplicity: The straightforward nature of cashback is easy for consumers to understand and manage.

- Short-Term Acquisition: Effective in attracting new customers quickly, as the immediate benefit is a strong motivator.

Disadvantages:

- Limited Long-Term Engagement: Once the initial attraction fades, there may be fewer incentives for long-term loyalty.

- Lower Extrinsic Rewards: While immediate, the rewards may not feel as substantial over time compared to large-scale redemptions in points programs.

Points

Advantages:

- High Perceived Value: Accumulating points can lead to significant rewards, such as free flights or luxury goods, which provide a high sense of achievement.

- Long-Term Loyalty: Points systems encourage customers to stay engaged over longer periods to redeem larger rewards.

- Strategic Engagement: Customers often feel more invested in maximizing their points, leading to a deeper connection with the brand.

Disadvantages:

- Complexity: Points programs can be complicated, sometimes leading to confusion or frustration among users.

- Delayed Gratification: The need to accumulate points over time requires patience, which may not appeal to everyone.

4. Coalition Loyalty Program

A coalition loyalty program is a multi-brand loyalty initiative where multiple businesses partner to offer a shared rewards system. Customers earn and redeem points across a network of participating companies, which can include retailers, airlines, hotels, banks, and more. This type of program provides customers with more opportunities to earn and spend points, increasing the overall value and attractiveness of the loyalty scheme

Top Coalition Loyalty Programs in India:

- Tata Neu:

Tata Neu is one of the biggest loyalty coalition programs of India with comprehensive rewards & points integrating across various Tata Group brands under one umbrella. Members earn NeuCoins on purchases across Tata brands such as Tata Cliq, BigBasket, Croma, and IHCL (Taj Hotels). These NeuCoins can be redeemed across the ecosystem, providing a seamless and rewarding shopping experience. The platform aims to leverage the diverse offerings of Tata Group to create a robust and attractive loyalty program for customers.

- Earning Rate: 5% of the purchase price as Neu Coins

- Redemption Rate: 1 Neu Coin is INR 1. (Validity 365 days from the date of accrual)

2. Times Prime:

Times Prime is also one of the popular coalition loyalty programs in the Indian Market. It offers it’s offers members a suite of premium benefits across various partner brands. The Subscribers can enjoy exclusive deals and discounts on services such as dining, entertainment, shopping, travel, fitness and more. Some of the key partners include brands like JioSaavn, Google One, Zomato Pro, NetMeds, Yatra, Cult Fit and Uber. The membership fee, starting as low as INR 959, provides access to these perks, aiming to enhance the overall value proposition for consumers by consolidating multiple services into one unified subscription.

3. Reliance One:

Reliance One is the loyalty program of Reliance Retail with no boarding charges, designed to reward customers for shopping across Reliance brands. Members earn points on purchases from Reliance Fresh, Reliance Trends, Reliance Digital, and other participating stores. These points can be redeemed for discounts or special offers, enhancing the shopping experience and encouraging repeat purchases. Reliance One aims to build customer loyalty by providing consistent value and benefits across its wide retail network.

- Earning Rate: 1 ROne Loyalty Point for every INR 300 spent.

- Redemption Rate: 1 ROne Loyalty Point shall be seventy (0.70) paisa

4. Landmark Rewards:

Landmark Rewards coalition loyalty program is a multi-brand initiative by Landmark Group, one of the largest retail conglomerates in the Middle East and India. The program allows customers to earn and redeem points across various Landmark Group brands, including Lifestyle, Home Centre, Max, Krispy Kreme, Fun City and Spar in their omni-channel ecosystem. Members earn points on purchases which can then be used for discounts on future purchases within the network of participating brands.

- Earning Rate: 2 points for Gold Tier (upto 65K annual spend), 4 points for Platinum Tier (above 65K annual spend) for every INR 400 spent.

- Redemption Rate: The unit value of a point is 60 paisa. (Valid for 12 months from date of accrual)

5. InterMiles:

InterMiles is a comprehensive coalition loyalty program that started as Jet Airways’ frequent flyer program and has since evolved into a multi-brand initiative. Members earn and redeem InterMiles points across a diverse range of partners, including airlines, hotels, retail stores, dining establishments, and financial services. The program aims to enhance the customer experience by providing versatile redemption options and seamless integration across various sectors. This flexibility ensures that customers can maximize their rewards in multiple areas of their daily lives, fostering long-term loyalty and engagement with the InterMiles ecosystem.

- Earning Rate: Varies across different spends with different services.

- Redemption Rate: Varies with each point is valued around INR 0.20 to 0.60 with various credit cards.

Special Tools for D2C Coalition Loyalty Program

Nectar.io:

Nectar.io is a customer loyalty platform designed to help businesses enhance customer retention through personalized loyalty programs. It allows businesses to create and manage rewards and engagement strategies, providing tools for tracking customer behavior and preferences. Nectar.io focuses on delivering customized loyalty solutions that align with a company’s brand and objectives, ultimately aiming to increase customer lifetime value and satisfaction.

Rivio.io:

Rivo.io offers a suite of tools for e-commerce stores to boost customer engagement and sales. Their platform includes features for creating loyalty programs, managing reviews, and generating referrals. By integrating with popular e-commerce platforms, Rivo.io helps businesses automate customer interactions, enhance shopping experiences, and drive repeat purchases. Their tools are designed to be user-friendly and scalable, suitable for businesses of all sizes.

5. The Psychology Behind Loyalty: The Marshmallow Theory

The debate between points and cashback can be understood through the lens of the Marshmallow Theory of delayed gratification. This psychological concept originated from a study conducted in the late 1960s and early 1970s by psychologist Walter Mischel at Stanford University. In the study, children were given a choice between one small but immediate reward (a marshmallow) or two small rewards if they waited for a period of time. The study concluded that children who were able to wait tended to have better life outcomes in various aspects, suggesting that the ability to delay gratification can lead to greater rewards.

Cashback aligns with immediate gratification—like choosing to eat one marshmallow now. It’s attractive for those seeking quick, tangible benefits.

Points, however, are about delaying gratification for a larger reward in the future—choosing to wait for two marshmallows later. This appeals to consumers who are willing to be patient for potentially greater extrinsic rewards.

How Points Systems Came About

Points systems have a rich history, originating in the mid-20th century, with frequent flyer programs being among the first to popularise the concept. American Airlines introduced the first frequent flyer program in 1981, which rewarded loyal customers with points that could be redeemed for future flights. It helped to increase the customer retention by 15% and sales by 10% over the years. The success of this model quickly spread to other industries, including retail and hospitality, as businesses recognized the potential of points programs to foster long-term customer loyalty and increase repeat business.

6. KPIs used to measure Customer Loyalty

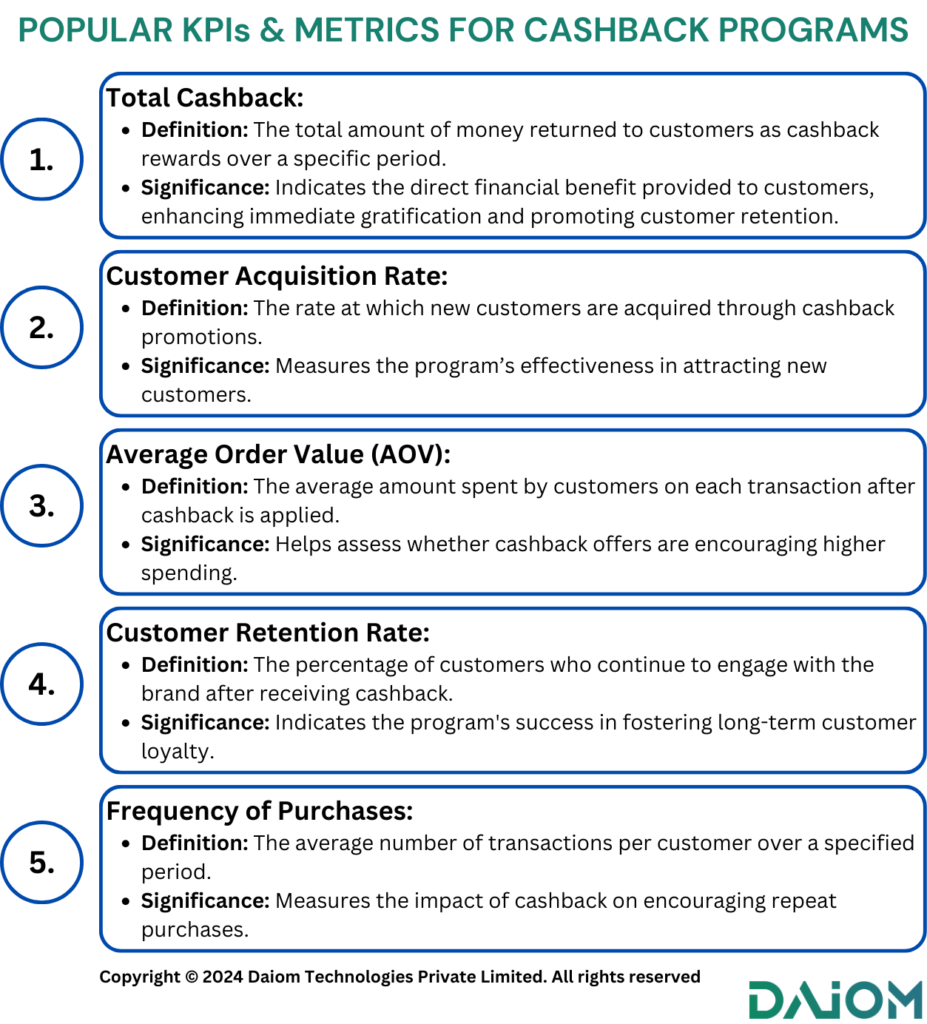

Cashback:

KPIs are crucial for measuring the effectiveness of customer loyalty in cashback programs. They provide insights into how well these programs are performing. These metrics help businesses understand customer engagement, identify areas for improvement, and optimize strategies to enhance customer satisfaction and loyalty. By monitoring these KPIs, companies can ensure their cashback programs are driving desired outcomes and delivering value to both customers and the business.

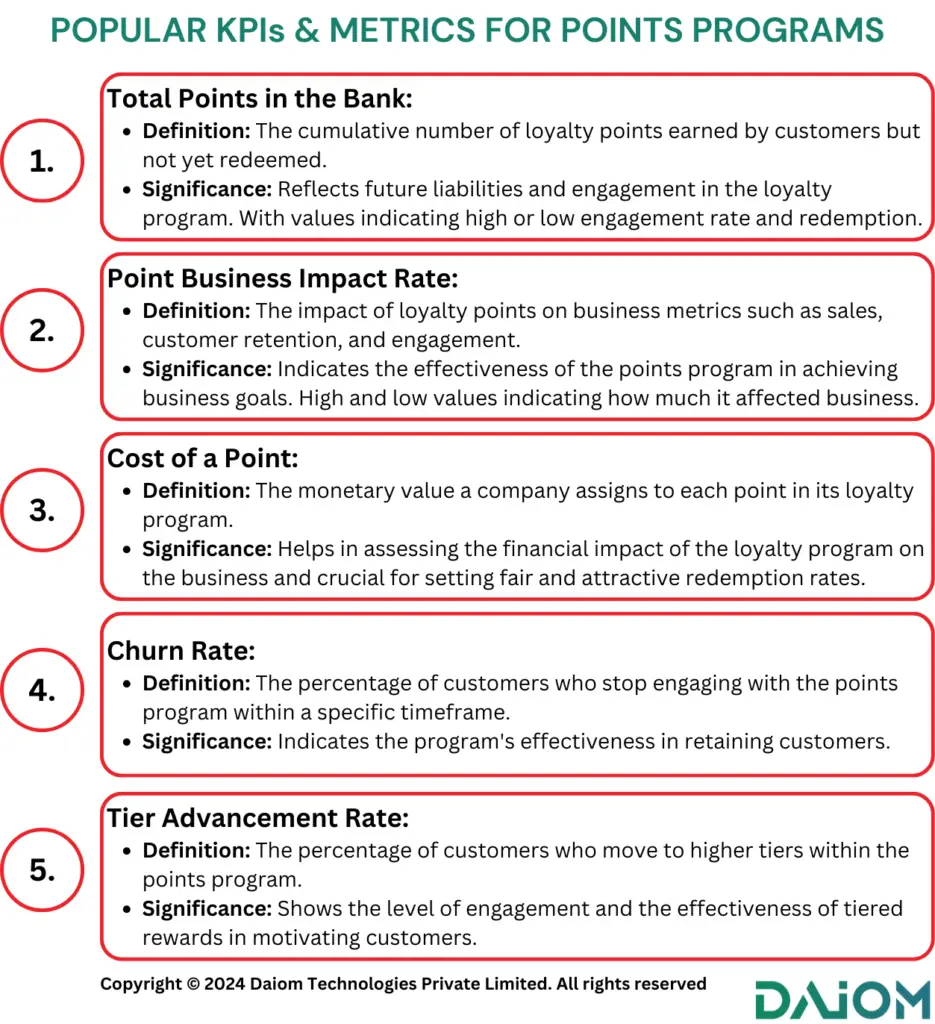

Rewards Points:

Even in case of reward points programs, KPIs are similarly essential for evaluating the success of customer loyalty. These metrics help businesses identify trends, optimize reward structures, and enhance overall customer satisfaction and loyalty. By closely monitoring these KPIs, companies can ensure their reward points programs drive meaningful customer interactions and long-term loyalty, ultimately boosting revenue and brand loyalty.

7. The Role of Customer Behavior Data and Analytics

To make any points or cashback program successful, leveraging customer behaviour data and robust analytics is crucial. Understanding how customers interact with a loyalty program allows businesses to tailor offerings to better meet customer needs and preferences, thereby enhancing the program’s effectiveness.

However, this data-driven approach comes with significant costs and potential liabilities. Investing in advanced analytics and data management systems can be expensive.

Moreover, handling large volumes of customer data responsibly is a critical concern, given the increasing emphasis on data privacy and security regulations. The potential liabilities associated with data breaches or misuse of information can also weigh heavily on a company’s balance sheet.

8. Deciding Between Points and Cashback: A Framework

When choosing between points and cashback for a loyalty program, brands should consider the following factors:

- Customer Demographics:

- Younger consumers or those with lower incomes may prefer the immediacy of cashback.

- Older or more affluent customers might appreciate the long-term benefits of a points system.

- Purchase Frequency and Value:

- For frequent, lower-value transactions, cashback might be more appealing as the rewards are immediately tangible.

- For infrequent, high-value purchases, points can offer more significant rewards that feel more satisfying over time.

- Brand Goals:

- If the goal is rapid customer acquisition and short-term sales boosts, cashback programs can be very effective.

- For fostering long-term loyalty and deeper customer engagement, points programs are typically more successful.

- Program Complexity and Flexibility:

- Simplicity is key for broad appeal; if a brand wants a straightforward, easy-to-understand program, cashback is ideal.

- Points programs, while potentially more complex, can be tailored to offer tiered rewards and exclusive benefits, enhancing their appeal to highly engaged customers.

- Cost and Liability:

- Consider the financial investment and potential risks associated with managing customer data and analytics.

- Ensure the program’s benefits justify the costs involved, and have robust measures in place to protect customer data and comply with privacy regulations.

9. Future Trends in Customer Loyalty

The below points discuss about some of the popular trends in which are upcoming or in the rise in the customer loyalty programs.

- Personalization and AI-Driven Rewards: Companies are increasingly using AI and ML to analyze customer data and behavior, enabling them to offer personalized rewards and recommendations. AI-driven systems can adjust rewards in real-time, offering customers incentives that are most likely to encourage immediate action. For instance, a customer browsing electronics might receive an instant discount or a loyalty point bonus for making a purchase within a certain timeframe.

- Omnichannel Loyalty Programs: As customers increasingly engage with brands across multiple channels (online, mobile, in-store), loyalty programs are evolving to provide a seamless experience across all touchpoints. This means customers can earn and redeem points regardless of how they interact with the brand.

- Gamification: Customers may be presented with challenges or missions that, when completed, earn them additional rewards. For instance, a coffee shop might challenge customers to try a new drink each week for a month in exchange for a free beverage.

- Social and Environmental Responsibility: Consumers are becoming more socially and environmentally conscious, and brands are responding by incorporating sustainability into their loyalty programs. For example, customers might earn points for recycling products, using eco-friendly packaging, or making donations to charitable causes.

10. Conclusion

Both points and cash back have their place in driving customer loyalty. The choice between them depends on the brand’s goals, the behaviours they wish to encourage, and the resources available for managing the program.

Cashback is excellent for immediate engagement and customer acquisition, while points are more suited for fostering long-term loyalty and deeper customer relationships.

By understanding the unique advantages and psychological underpinnings of each, and leveraging customer behaviour data effectively, businesses can design more effective loyalty programs that cater to their target audience’s preferences and behaviours.

Hope this blog helped to provide you with some insights and choosing in-between on the cashback and points programs.

If you’d like to discuss how we can help enhance and optimize your Omnichannel strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!