The home furnishing industry is evolving rapidly, shaped by larger macro trends. As urbanization grows and premiumization takes hold, consumers are no longer satisfied with just basic, functional products.

They now seek high-quality, stylish, and smart solutions that elevate both comfort and lifestyle. A clear example is the shift from simple cotton mattresses to orthopedic and premium designs, reflecting how demand is moving towards innovation and sophistication.

Moreover, the home furnishing sector is no longer limited to India 1 cities. It is rapidly expanding into India 2, where rising incomes and aspirations are driving demand for better quality and stylish products.

Read more: Understanding Indian Customer Segmentation: A Market Within a Market

A significant portion of the market—nearly 70%—remains unbranded, reflecting the dominance of local and unorganized players.

Regional brands account for a small share of around 3%, while PAN-India brands make up approximately 27% of the market.

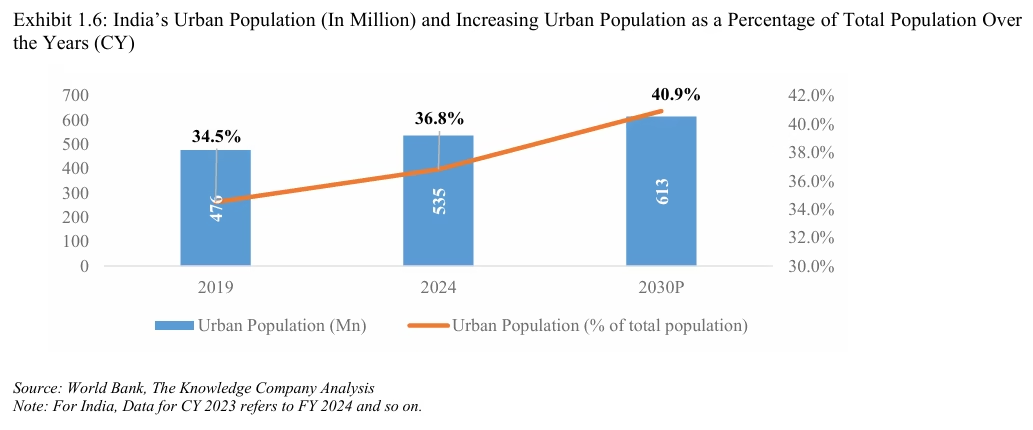

India’s cities are becoming major engines of growth. In 2024, around 535 million people (37% of the population) live in urban areas, contributing 63% of the country’s GDP. By 2030, cities are expected to house 41% of India’s population, about 11% of the world’s urban population.

At the same time, families are getting smaller. The average household size has dropped from 5.3 in 2001 to 4.38 in 2025, and could reach 3.9 by 2030. This means more demand for independent homes and consumer products.

In this blog, we explain omnichannel in plain words, map the customer journey step by step, and compare India’s well-known players such as Wakefit, Duroflex, and The Sleep Company (along with others).

We also look at how India’s rapid urbanisation and shift toward smaller, nuclear families are changing the way people shop and interact with brands.

These trends are shaping demand for independent homes, convenient products, and seamless omnichannel experiences that meet the needs of today’s modern consumer.

“The ‘omni’ approach prioritizes flexibility. You have to have flexibility in terms of your inventory and where you connect with your customers.”

— Anthony Sloan, Senior Vice President of Merchandising and Planning at Swarovski

Table of Contents

- What Comes Under Home Furnishing Category?

- Key Trends Shaping the Home Furnishing Industry

- Why Omnichannel Matters for the Home Furnishing Industry?

- Brand-by-Brand Omnichannel Comparison

- How Brands Drive Distribution in Home Furnishings?

- Common Complaints Customers Have in the Buying Journey

- Unique Features Driving Purchases in this Sector

- Interesting Growth Marketing Campaigns in Home Furnishings

- Conclusion

1. What Comes Under Home Furnishing Category?

Home furnishing is all about the products that bring comfort, style, and functionality to a home. It’s not limited to just one or two items but covers a wide range of essentials:

- Beds – The centerpiece of every bedroom, designed for rest and relaxation.

- Sofas – Create a cozy and welcoming space for family and guests.

- Mattresses – From basic cotton to orthopedic and premium, mattresses define sleep quality.

- Recliners – Add comfort and luxury, perfect for unwinding after a long day.

- Smart Beds – Tech-driven beds with features like posture control, sensors, and adjustable settings for modern living.

Together, these products make up the home furnishing category, blending functionality with lifestyle and evolving with consumer demand for better quality and smarter solutions.

2. Key Trends Shaping the Home Furnishing Industry

The Indian home and furnishing market is entering a high-growth phase, projected to reach a value of INR 5,147 billion by FY2030. This growth is fueled by a significant reduction in the replacement cycle—from 15 years down to 10 years—as consumers prioritize lifestyle trends and faster adoption of new technologies.

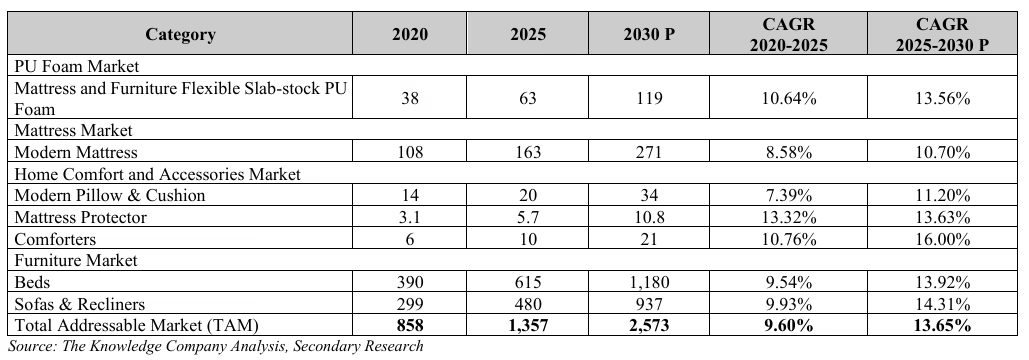

Furthermore, the market for “complete sleep systems” is expanding; the total addressable market for mattress players expanding into adjacent categories like sofas, beds, and home comfort was valued at INR 1,357 billion in FY2025.

Within the broader industry, the modern mattress market is a standout performer, expected to grow at a CAGR of 10.7% to reach INR 271 billion by FY2030. As of FY2025, branded players already control nearly 60% (INR 98 billion) of this segment, a share that is expected to rise to 65% by 2030. This shift highlights a growing trust in organized retail and branded quality over traditional, unbranded cotton mattresses.

A few other key trends that stand out are as follows:

- Product Innovation: Brands are moving beyond basic furniture and introducing smarter, health-focused solutions. For example, mattresses are no longer just about comfort—they now include orthopedic support, better designs, and features that improve sleep quality and overall health. Similarly, smart beds and recliners are gaining popularity for their convenience and advanced functions.

- Focus on Design and Lifestyle: Consumers today see furniture not just as a necessity but as a reflection of personal style. Modern designs, premium materials, and attention to aesthetics are becoming as important as durability. This shift is making people more open to investing in high-quality, stylish products.

- Real Estate and Home Ownership: With more people buying homes, especially in urban areas, the demand for home furnishings is rising. Owning a house naturally leads to higher spending on furniture, décor, and lifestyle products, making this sector a priority for many families.

- Global Players Driving Growth: The entry and expansion of global brands like IKEA in India have fueled competition and innovation. IKEA’s presence has not only expanded product variety but also raised consumer awareness about modern, affordable, and well-designed home furnishings.

Together, these trends show how the industry is heating up—driven by innovation, lifestyle aspirations, and a growing consumer base ready to spend on smarter and better-quality home solutions.

3. Why Omnichannel Matters for the Home Furnishing Industry?

The home furnishing industry is no longer just about selling products—it’s about creating a seamless experience for customers across every touchpoint. This is where Omnichannel plays a crucial role, built on three strong pillars: Sales, Marketing, and Service.

- Sales: Customers want flexibility in how they shop. Whether it’s through exclusive brand outlets (EBOs), company websites, mobile apps, or marketplaces like Amazon and Flipkart, omnichannel ensures that the buying journey feels consistent across all platforms. A customer browsing a mattress online can also test it in-store and complete the purchase wherever they feel most comfortable.

- Marketing: Omnichannel marketing goes beyond ads—it’s about creating visibility everywhere customers spend time. Brands in the home furnishing space actively use platforms like Facebook, Google Ads, and WhatsApp to stay connected. Many also leverage brand collaborations and celebrity endorsements to build trust. A great example is The Sleep Company, which collaborated with Anil Kapoor to highlight the value of comfort and premium quality in their products.

- Service: Post-purchase experience is just as important as the sale. From service centers to AI-powered chatbots and customer care teams, omnichannel service ensures that customers receive support whenever and wherever they need it. This builds long-term trust and loyalty, making customers more likely to return.

3.1 How Can Strategic Synergies Drive Cross-Selling?

A key pillar of the modern omnichannel play is the integration of core products with home comfort accessories. Branded players are increasingly using their mattress footprint to cross-sell:

Pillows & Cushions: A market projected to reach INR 72 billion by FY2030.

Mattress Protectors: Growing at a robust 13.6% CAGR, driven by a focus on hygiene and mattress longevity.

Furniture Adjacencies: Leading players are leveraging furniture distribution networks to showcase “complete home solutions,” allowing consumers to buy bed frames and mattresses as a cohesive unit.

4. Brand-by-Brand Omnichannel Comparison

When we look at the home furnishing landscape, brands can broadly be divided into two types based on how they’ve approached omnichannel:

- Traditional Companies Going Omnichannel: These are veteran players who built their reputation in the offline market and are now expanding into digital channels. Brands like Sleepwell and Duroflex are good examples. They already have strong offline distribution networks, and their focus is on adapting to online platforms while maintaining their established customer trust.

- Digital-First (D2C) Companies Expanding Offline: On the other side are modern, digital-first brands such as Urban Ladder, Wooden Street, and Pepperfry. These companies started online, scaled rapidly through e-commerce, and later moved into offline formats like experience centers and stores to strengthen their presence and build consumer trust.

Together, these two groups show how omnichannel is reshaping the industry. Traditional brands are learning digital-first strategies, while D2C brands are investing in offline channels. This convergence highlights that the future of home furnishing lies in a unified approach—blending both online and offline seamlessly.

4.1 Traditional Companies Going Omnichannel

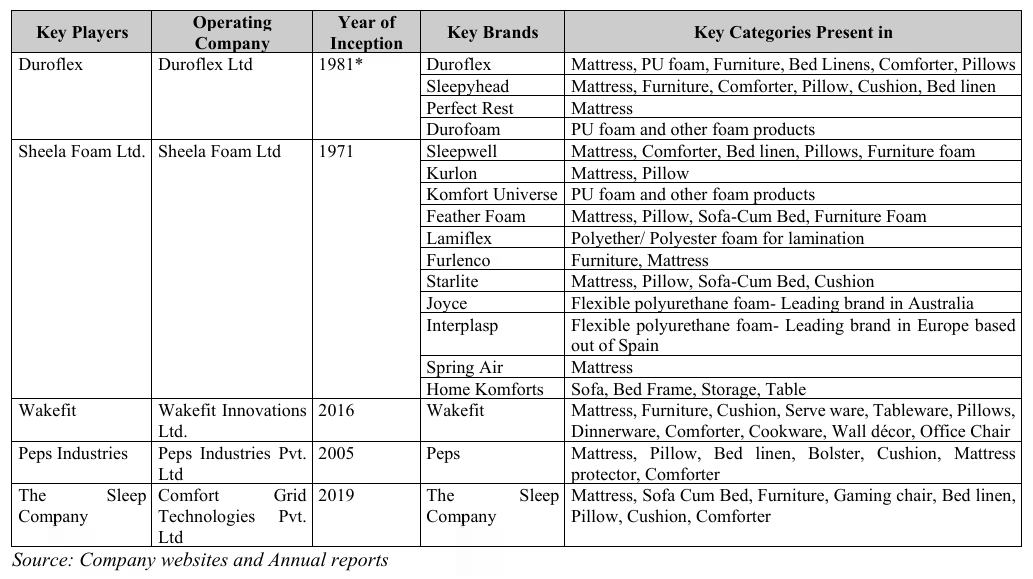

The home furnishing and sleep solutions market in India is a dynamic landscape defined by a mix of heritage giants and agile, digital-first innovators.

As shown in the industry overview, the sector is anchored by long-standing players like Sheela Foam Ltd. (est. 1971) and Duroflex (est. 1981), who have built massive portfolios through household names like Sleepwell and Kurlon, spanning everything from mattresses to specialized industrial foams.

However, the last decade has seen a significant shift with the entry of “new-age” brands like Wakefit and The Sleep Company. These younger players, founded in 2016 and 2019 respectively, have rapidly diversified beyond traditional bedding into broader lifestyle categories, including ergonomic office chairs, home décor, and tech-driven furniture.

This evolution reflects a broader consumer trend where the line between “utility bedding” and “comprehensive home comfort” is increasingly blurred, driven by a competitive mix of multi-brand conglomerates and specialized startups.

Here are some brands are strengthening their long-standing retail presence with digital channels to stay relevant in a changing market.

Duroflex

Duroflex, a well-established sleep solutions brand, has been steadily modernizing its omnichannel strategy across India. Today, it boasts a network of approximately 77 exclusive retail locations—including the Sleepyhead sub-brand stores—and plans to add another 23 by the end of the current fiscal year, highlighting a deliberate “city saturation” expansion strategy focused on strengthening presence in major urban centers.

Complementing its offline footprint, Duroflex has also partnered with Pando to overhaul its logistics and supply chain with digital tools, enabling seamless fulfillment across retail stores, e-commerce platforms, and B2B channels.

Duroflex reflects how a legacy brand can modernize operations and meet omnichannel expectations while protecting trust.

Home Centre by Lifestyle

Home Centre, part of the Landmark Group (Lifestyle), has long been a dominant offline-first retailer in the home furnishing and décor category. With large-format stores in malls and high streets, it offers customers a wide range of furniture, décor, and home accessories under one roof.

In recent years, Home Centre has expanded its digital presence, integrating e-commerce and app-based shopping with its offline stores. Its strength lies in affordability and variety, appealing to middle-class and upper-middle-class consumers who want stylish yet accessible home solutions.

The brand’s omnichannel model is built on scale, convenience, and value pricing, making it one of the strongest competitors in the offline-to-online transition.

Sleepwell

Sleepwell, one of India’s oldest and most trusted mattress brands, represents the traditional companies going omnichannel. For decades, it built a strong presence through general trade networks and offline dealers, making it a household name across India.

In recent years, Sleepwell has invested in building its online presence, offering mattresses and bedding solutions through its website and marketplaces. To connect with younger audiences, it has also experimented with growth marketing campaigns such as mattress exchange offers and bundled deals.

Sleepwell’s strength lies in brand trust and wide offline distribution, while its ongoing challenge is to scale effectively in the digital-first space. Its omnichannel approach is steadily evolving, blending decades of offline dominance with new-age online strategies.

Digital-First (D2C) Companies Expanding Offline

These brands are opening experience centers and retail outlets to build trust and give customers a chance to touch and feel products.

Wakefit

Wakefit, one of India’s fastest-growing sleep and home solutions brands, has quickly expanded its reach through a strong omnichannel strategy. Starting as a digital-first company, it has steadily built an offline presence with more than 50 exclusive stores across key cities.

The brand integrates its online platform with physical experience centers, allowing customers to browse, try products in person, and order seamlessly. This combination of online convenience and offline touchpoints has helped Wakefit strengthen trust and scale rapidly across India.

Recently, Wakefit filed its Draft Red Herring Prospectus (DRHP) as it prepares for an IPO.

This document has opened up valuable information about both the company and the wider home furnishing industry.

What we present here is our interpretation of these insights, based on public information such as Wakefit’s DRHP and industry research reports.

A key part of understanding Wakefit’s strategy lies in its Growth Flywheel—a self-reinforcing cycle that drives both scale and profitability in this sector.

Also Read: The Growth Flywheel: How Leading Brands Create Self-Sustaining Success?

- Category Expansion: Wakefit started with mattresses but quickly expanded into furniture, home décor, and allied categories. This expansion increases customer spending (share of wallet) and brings more opportunities for repeat purchases.

- Customer Acquisition and Retention: By offering value-driven products and aggressively marketing online, Wakefit has been able to acquire new customers at scale. Its focus on quality, affordability, and strong service ensures retention, turning first-time buyers into loyal customers.

- Full Stack Model: Wakefit controls its R&D, supply chain, and distribution channels, allowing it to maintain quality while offering competitive pricing. This model also enables faster feedback loops for product improvements and new launches.

- Brand Building and Scaling: Over time, Wakefit has built strong brand equity through digital-first campaigns, word-of-mouth, and customer trust. This brand equity makes entering new categories smoother and accelerates growth.

The cycle repeats: brand strength enables new category launches, which improve customer lifetime value (CLV); efficient processes help manage customer acquisition costs (CAC); and reinvestment in innovation fuels further expansion.

Read more – Customer Lifetime Value (CLV)

With its IPO on the horizon, Wakefit’s journey reflects not just its own growth but also the future playbook for the home furnishing industry.

Sources: Wakefit DRHP, Redseer Research & Analysis, public filings

The Sleep Company

The Sleep Company has emerged as a disruptive player in India’s mattress and comfort solutions market with its unique SmartGRID technology.

While it began as a digital-first brand, it has quickly built an omnichannel presence with over 70 exclusive brand outlets across the country.

Its strategy combines a strong e-commerce platform with offline experience centers, giving customers the flexibility to explore, test, and purchase seamlessly across touchpoints. This hybrid approach has fueled its rapid growth and positioned it as a modern leader in the sleep solutions space.

Omnichannel approach

- Strong online education on product tech and benefits.

- Rapidly built experience centers to let people try products.

- Uses performance marketing, influencers, and brand campaigns to drive discovery, then converts across both online and offline.

What they do well

- Clear differentiation through product technology and storytelling.

- Aggressive and high-energy go-to-market with focus on awareness and trials.

Common gaps in the category to watch

- As physical networks grow, ensuring consistent demos and experience quality across all locations.

- Balancing premium stories with competitive offers without confusing customers.

The Sleep Company shows how strong product differentiation plus fast retail rollout can create a powerful omnichannel engine.

Pepperfry

Pepperfry is one of India’s leading furniture and home décor marketplaces, known for its strong digital-first approach. Over the years, it has expanded into an omnichannel model with more than 200 studios across 100+ cities.

These studios act as experience centers where customers can touch, feel, and customize products before buying, while still enjoying the convenience of Pepperfry’s vast online catalog. This blend of online scale and offline presence has made Pepperfry a trusted name for modern Indian homes.

To address customer hesitation in buying bulky products online, Pepperfry pioneered the concept of ‘Studios’ (experience centers) where buyers can explore designs before ordering online. Today, Pepperfry operates 150+ studios across India, making it one of the largest omnichannel networks in the sector.

Pepperfry’s growth strategy has been powered by marketplace scale, strong logistics, and omnichannel expansion. By combining seller diversity with physical studios, it bridges the gap between online discovery and offline trust.

Urban Ladder

Urban Ladder started as a digital-first furniture and home décor brand and has steadily grown into an omnichannel presence across India. Today, it operates through its online platform along with more than 50 stores in key cities.

The brand emphasizes design-led furniture and premium positioning, attracting urban, aspirational consumers. With Tata Group’s investment, Urban Ladder gained scale and credibility, leveraging Tata’s offline reach while continuing to strengthen its digital presence.

Urban Ladder’s growth strategy relies on trust and lifestyle appeal—its designs are marketed not just as furniture but as part of creating a modern home. By combining strong brand storytelling, curated designs, and omnichannel distribution, Urban Ladder has carved out a niche in the premium segment.

Wooden Street

Wooden Street started as a customized furniture brand, offering buyers the ability to tweak fabrics, finishes, and designs. This customization model set it apart early on in a crowded market.

The brand expanded quickly from being an online-first player to establishing over 90 experience stores across India. Its offline presence is designed to build trust, as furniture is a high-touch product that customers prefer to see and feel before purchase.

Wooden Street’s growth strategy hinges on three levers: customization, affordability, and omnichannel reach. By blending online convenience with offline trust, it has managed to scale in Tier 1 and Tier 2 markets, tapping into both India 1 and India 2 consumers.

5. How Brands Drive Distribution in the Home Furnishing Industry?

In the home furnishing industry, distribution plays a big role in reaching customers effectively. Traditionally, most brands relied on general trade channels—retail shops and dealer networks—to get their products into the market. But as customer expectations have evolved, so have the distribution models.

Today, many brands are also opening their own experience centers. These stores allow customers to see, touch, and try products like sofas, beds, and mattresses before buying. Experience centers build trust and give buyers confidence, especially for high-value purchases.

Data shows that while Multi-Brand Outlets (MBOs) still lead the market, the distribution mix is diversifying rapidly:

E-commerce: Projected to grow at a 16.6% CAGR, reaching a 13% market share (INR 35 billion) by FY2030.

Company-Owned Company-Operated (COCO) Stores: Expected to grow at 15.7% CAGR, as brands focus on experience-led retail.

Institutional Sales: Segments like hospitality and healthcare currently account for 10% of the market (INR 16 billion) and are vital for volume-driven growth.

Another important shift is customization. Customers now want furniture and furnishings that reflect their personal style. Many brands offer options like choosing fabrics, finishes, or even design tweaks. This not only enhances customer satisfaction but also increases loyalty, as buyers feel more connected to products tailored for them.

Together, general trade, experience centers, and customization are shaping how brands expand their reach and build deeper relationships with customers.

6. Common Complaints Customers Have in the Buying Journey

Buying home furnishing products is not always smooth for customers, and a few common complaints stand out. Addressing these pain points is key to improving the overall customer journey in this sector.

- Bulky Products: Furniture and mattresses are large, heavy products. Customers often feel the need to see, touch, and try them before buying. This is why experience centers play such a critical role—they solve the “trust gap” by allowing people to physically interact with products.

- Delayed Deliveries: Unlike smaller consumer goods, furniture delivery often takes weeks due to manufacturing, customization, or logistics challenges. Long waiting times frustrate customers, especially when compared to the instant delivery culture of e-commerce.

7. Unique Features Driving Purchases in this Sector

Home furnishing purchases are not always impulse-driven; they’re often tied to life milestones. These unique triggers show that the home furnishing market is closely connected to life events and lifestyle shifts, making timing and personalization crucial in marketing and sales strategies:

- Marriages – Families tend to invest in new furniture and furnishings as part of setting up a new household.

- New Homes – When people buy or move into a new house, furnishing becomes a top priority.

- Lifestyle Upgrades – Rising incomes and premium aspirations also push customers to replace old products with smarter, more stylish ones.

8. Interesting Growth Marketing Campaigns in Home Furnishings

To stand out in a competitive market, home furnishing brands have been running creative campaigns that focus on both customer acquisition and retention.

Also read: The Smartest Growth Marketing Strategy Brands Need Today!

Some notable examples include:

Sleepwell

Known for running mattress exchange offers, where customers can trade in old mattresses for discounts on new ones.

Wakefit

Launched the famous “Sleep Internship” campaign, paying people to sleep as a way to promote healthy sleep habits and their brand.

They also offer a 100-day mattress trial, giving customers confidence before committing.

The Sleep Company

Frequently runs pillow exchanges and festive gifting offers, highlighting comfort and affordability.

Duroflex

Promotes neck pillow offers and seasonal deals to capture demand during lifestyle-driven purchases.

These campaigns are designed not only to attract first-time buyers but also to create buzz, drive repeat purchases, and build stronger brand recall in a cluttered market.

“The future of retail is not about online versus offline—it’s about creating seamless omnichannel journeys where customers can move effortlessly between touchpoints.”

9. Conclusion

The next big growth in the home furnishing industry will come from brands that truly master omnichannel. This doesn’t just mean being online and offline. It means giving customers one smooth brand experience across discovery, trust, and personal engagement.

To do this, retailers need to:

- Tell stories that connect with people in different regions.

- Use digital tools and innovation to make shopping exciting.

- Make sure every product is easy to find and every design has a story.

- Build strong, flexible supply chains that match the tastes of India’s growing middle class.

With the right omnichannel strategy, brands can cut through the clutter and win in one of India’s most emotional but less valued categories—home furnishings.

If you’d like to discuss how we can help enhance and optimize your Omnichannel and growth marketing strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!