Many brands struggle to measure and maximize the long-term value of their customers, often focusing on short-term gains instead of building lasting relationships.

In fact, as per studies from The Harvard Business Review, increasing customer retention by just 5% can boost profits by 25% to 95%. Yet, many companies fail to effectively track and nurture their most valuable customers.

Consider a coffee shop: a loyal customer spends $1,500 annually, while a one-time visitor spends $4. The difference is clear—investing in loyal customers drives long-term success.

This is where Customer Lifetime Value (CLV) becomes crucial.

Customer Lifetime Value, or CLV, is a way to estimate how much revenue a customer can bring to a business over their entire relationship with the brand. It’s not just about one purchase but understanding the complete journey a customer has with you.

This metric helps businesses figure out how much they should spend on acquiring, retaining, and delighting their customers. CLV gives you a clearer picture of how valuable your customers are in the long run.

Also Read – Metric of the Week: Social Media Engagement Rate

In this blog, we’ll explain CLV in simple terms, with examples to show how brands can use this metric for long-term growth.

Rather than trying to bring as many customers as possible on board, start with just a few perfect customers.

Steli Efti

Table of Contents

1. Why is CLV Important?

By understanding the true value of each customer, brands can optimize their marketing, improve customer retention, and predict future revenue.

Let’s understand how CLV can transform decision-making, using a few examples.

1.1. Optimizing Marketing Spend

When a brand spends money on acquiring customers, it’s essential to ensure that the investment is worthwhile. Without a clear understanding of Customer Lifetime Value (CLV), a brand might end up spending too much on attracting customers who won’t stick around.

For example, an online clothing brand might spend $30 on ads to acquire a new customer. If that customer only purchases a $25 t-shirt and never returns, the brand loses money.

However, by targeting customers who are more likely to make repeat purchases, such as seasonal shoppers who spend $500 a year, it becomes a more strategic and profitable investment.

CLV helps brands allocate their marketing dollars wisely, ensuring they’re spent on customers who will generate long-term value.

1.2. Segmenting Customers

Not all customers are the same. Some consistently bring in revenue and even refer others, while others make a single purchase and never return.

Read more – Scaling Up Retention Marketing with RFM: Your Key to Customer Retention Success

CLV helps brands identify their most valuable customers, allowing them to curate their approach accordingly.

For example, a luxury hotel chain might find that guests who book suites often spend more on additional services like spa treatments and dining than those who book standard rooms.

By recognizing these high-CLV customers, the brand can offer special perks such as free upgrades or personalized experiences. This not only makes the customers feel valued but also encourages them to return, strengthening long-term loyalty.

Read more – Points Vs. Cashback: What Drives Customer Loyalty?

1.3. Improving Retention Strategies

Keeping an existing customer is more cost-effective than acquiring a new one, yet many brands overlook this advantage. CLV highlights the importance of focusing on retention by revealing the value of nurturing current customers.

This approach not only sustains customer relationships but also maximizes their potential value over time.

For example, Netflix leverages CLV to analyze subscriber behavior. When data indicates that new users are likely to cancel within the first month, Netflix proactively sends personalized recommendations to keep them engaged.

These efforts extend the subscribers’ relationship with the platform, enhancing their lifetime value and boosting overall retention rates.

Read more – Is Retention Marketing The Key To Driving Higher Lifetime Value?

1.4. Forecasting Revenue

CLV serves as a predictive tool that helps brands make informed decisions. By understanding the lifetime value of their customers, brands can estimate future revenue and strategize effectively.

For example, a gym might determine that its members usually stay for two years, contributing an average of $1,200 each. By multiplying this figure by the total number of active members, the gym can forecast its revenue for the upcoming year.

This enables better planning for budgets, staffing, and marketing campaigns, ensuring resources are allocated for maximum impact.

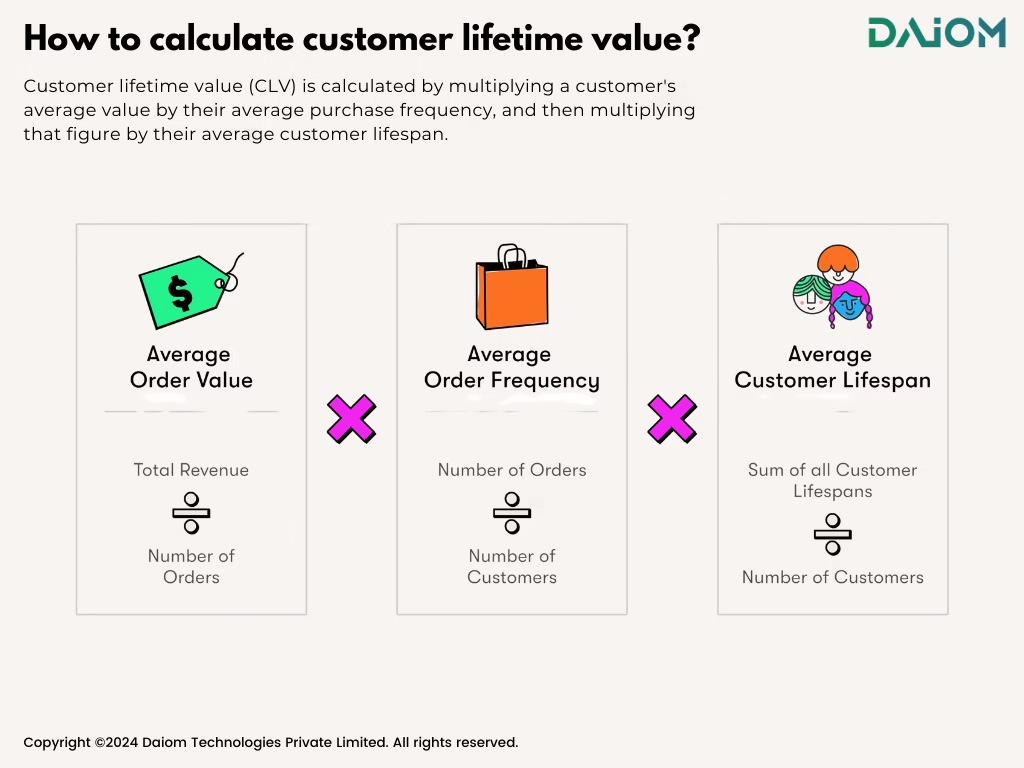

2. How to Calculate CLV?

Calculating Customer Lifetime Value (CLV) is not as complicated as it seems. Let’s break it down with a simple formula that helps you understand the true value of your customers.

CLV Formula:

CLV = (Average Purchase Value) × (Purchase Frequency) × (Customer Lifespan)

- Average Purchase Value: This is the total revenue divided by the number of purchases.

- Purchase Frequency: This measures how often a customer buys from you in a given period (like a month or year).

- Customer Lifespan: The average length of time a customer stays loyal to your brand and continues to make purchases.

Let’s say you own a pet supply store. Here’s how you’d calculate CLV:

- Average Purchase Value: $50

- Purchase Frequency: 4 times per year

- Customer Lifespan: 5 years

Now, let’s apply the formula:

CLV = 50 × 4 × 5 = $1,000

So, each customer is worth $1,000 over their lifetime with your store. This helps you make better decisions on how much to invest in retaining and acquiring customers.

3. Predictive Metric (CLV as a Forward-Looking Metric)

Customer Lifetime Value (CLV) is not just a retrospective measure but a powerful forward-looking metric that helps businesses anticipate customer behavior and revenue. By leveraging historical data and customer behavior insights, businesses can:

- Forecast Revenue: Predict how much revenue a customer or segment will generate in the future.

- Identify At-Risk Customers: Spot early warning signs of churn and take proactive measures, such as personalized offers or exclusive benefits, to retain them.

- Strategize Resource Allocation: Focus resources on high-potential customers with personalized marketing while adopting cost-effective strategies for low-potential segments.

- Enhance Engagement: Tailor offerings based on predictive trends, such as promoting content or products that align with customer preferences.

Predictive CLV aligns product development, marketing, and customer service strategies, enabling sustainable growth and staying ahead in competitive markets.

4. Understanding CLV Through Cohort Analysis

Cohort analysis involves grouping customers based on shared characteristics or behaviors during a specific time period to track their performance over time. It is a crucial tool for understanding CLV trends:

- Behavioral Insights: Helps identify how different cohorts perform (e.g., customers acquired during a festive sale might behave differently than regular buyers).

- Retention Analysis: Tracks customer retention rates and lifetime value for each cohort, revealing patterns in engagement and loyalty.

- Improving Strategies: For example, if a cohort shows lower CLV, businesses can refine acquisition campaigns or adjust retention strategies.

- Better Decision-Making: Enables businesses to make data-driven adjustments to marketing, product offerings, and engagement tactics based on cohort performance.

By analyzing cohorts, businesses can pinpoint strengths and weaknesses in customer engagement and optimize for long-term success.

Also Read – Cohort Vs. Segment: Are Brands Using These Terms Correctly?

5. Common Mistakes in Using CLV

While CLV is incredibly useful, brands often make mistakes when calculating or interpreting it. Let’s understand some common mistakes through relatable scenarios:

5.1. Relying on Static Calculations

One mistake brands often make with CLV is treating it as a fixed number. Customer behavior isn’t static—it evolves with trends, habits, and external factors.

If your CLV calculations don’t adapt, you could miss critical shifts in customer spending.

For example, a fast-food chain might calculate CLV based solely on in-store purchases. Initially, this approach makes sense as most customers dine in.

But with the rise of delivery apps, customer preferences shift, and online orders become the dominant revenue stream. These orders might have different patterns, like higher frequency but smaller average spends.

If the brand sticks to its old CLV formula, it risks underestimating the value of its delivery customers and making decisions that don’t align with current realities.

By regularly updating CLV calculations to reflect changing behaviors, brands can stay agile and make smarter strategic choices.

5.2. Ignoring Customer Acquisition Costs (CAC)

While Customer Lifetime Value (CLV) is a powerful metric, it doesn’t tell the complete story on its own. To make informed decisions, brands need to pair it with Customer Acquisition Cost (CAC).

Take a skincare brand as an example. Suppose the brand spends $50 to acquire each new customer. If the average CLV is only $40, the brand ends up losing $10 for every customer they bring in. This highlights a problem—acquisition efforts are costing more than they return.

However, the situation can shift with smart retention strategies. For instance, the brand might introduce discounts on repeat purchases or a loyalty program. If these efforts raise the CLV to $100, the $50 acquisition cost becomes not only justifiable but profitable.

By balancing CLV and CAC, brands can ensure their marketing and retention investments contribute to sustainable growth. This approach turns data into actionable insights, helping brands allocate resources effectively and drive long-term success.

5.3. Overlooking Indirect Value

Customers bring more to a brand than just revenue from their purchases. Advocacy, referrals, and glowing reviews create value that often flies under the radar but can significantly impact growth. These contributions might not directly appear in CLV calculations, but they are invaluable.

Let’s consider the example of Apple. Loyal fans don’t just buy iPhones—they actively recommend them to friends, family, and colleagues.

Each enthusiastic recommendation potentially converts a hesitant buyer into a lifelong customer.

While this ripple effect is harder to quantify, its influence on Apple’s dominance in the tech market is undeniable. This hidden value highlights the importance of fostering customer relationships.

Engaging with customers on a deeper level—beyond transactions—builds a community of advocates who drive organic growth and strengthen the brand’s reputation.

6. Conclusion

Customer Lifetime Value (CLV) shows how much each customer can bring to your brand over time. By focusing on loyal customers you can grow profits and create strong relationships.

When brands understand CLV, they can spend wisely, keep customers longer, and plan for the future.

Remember, it’s not just about making one sale—it’s about building a lasting connection.

If you’d like to discuss how we can help enhance your customer lifetime value and optimize your strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!