India’s retail landscape has always intrigued me. It’s like stepping into two worlds at the same time.

On one side, I grew up visiting local markets, where countless small shops sold everything from clothes to spices. Most of them weren’t big brands, just local sellers with loyal customers.

A few steps away, you’d suddenly find yourself in a mall, surrounded by shiny storefronts of national and global brands.

Today, the gap between these worlds is closing fast, thanks to omnichannel retail. It’s no longer just about shopping online or offline; smart retailers are blending both to let shoppers explore products whenever and wherever they want.

People aren’t just buying things, they’re seeking experiences. That’s why exclusive brand stores, whether in malls or on busy streets, are growing popular.

That mix—of the unbranded and the branded, the small shop and the organized chain—is what makes India’s retail story so unique. And it’s only getting more exciting.

According to a Redseer report, the market is set to cross $1.6 trillion by 2030, driven not just by large brands, but by lakhs of small businesses and now, new-age D2C players that are reshaping how we shop.

In this blog, we are going to explore this amazing change in retail, looking at its special challenges and the huge chances it offers as India moves from many small parts to a more connected system.

Retail is no longer about just selling products; it's about creating experiences.

Paco Underhill

Table of Contents:

1. Why India Runs on Small Sellers, Not Big Distributors?

India’s shopping journey is very different from other countries. In many developed markets, a few big brands dominate. But in India, most products still come from many small businesses.

Things are changing fast with faster deliveries, smarter supply chains, and more organized retail are on the rise. At the same time, traditional markets are still strong, creating a mix of the old and the new.

What makes this journey special is the diversity. With so many new D2C (online-first) brands emerging, small sellers are even more visible. It highlights just how unique and varied Indian customers really are.

2. India’s Retail Market: How big can it really get?

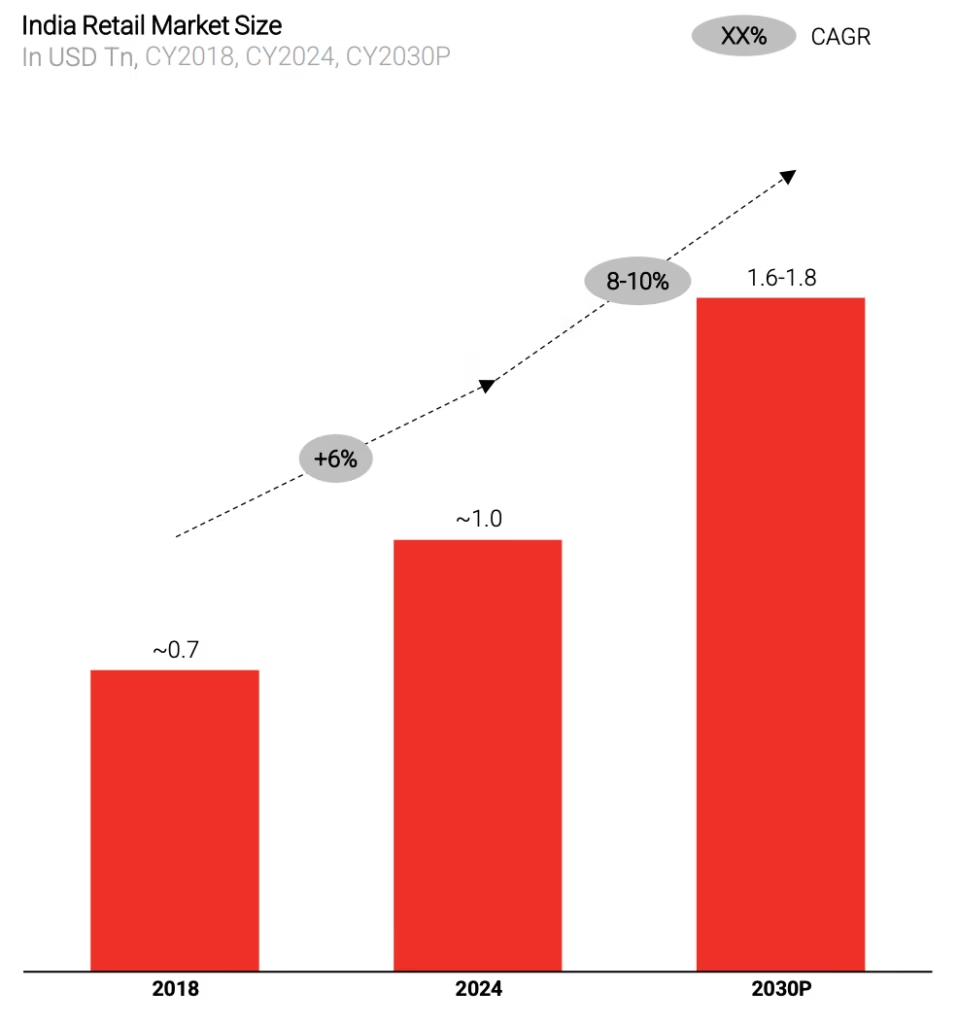

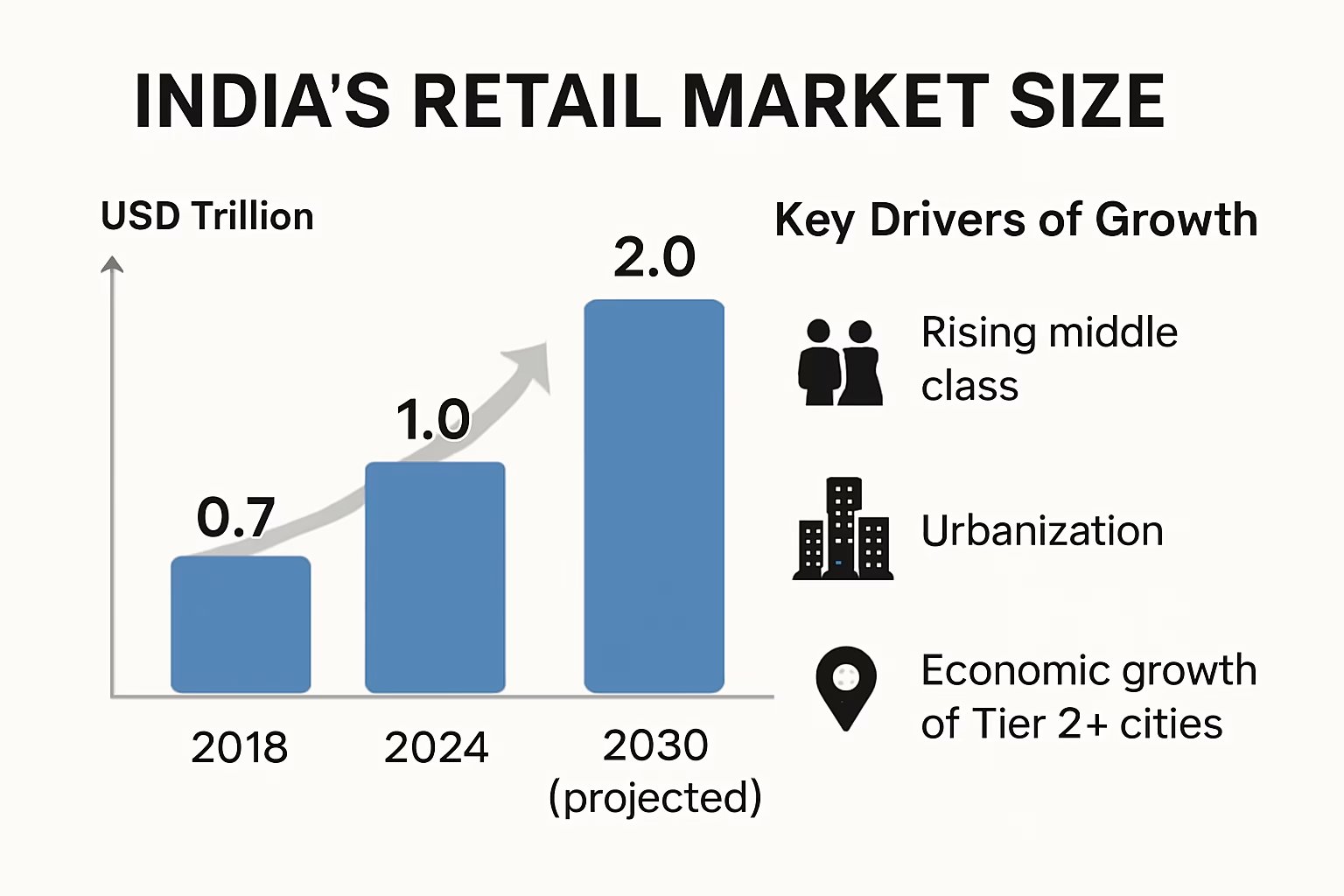

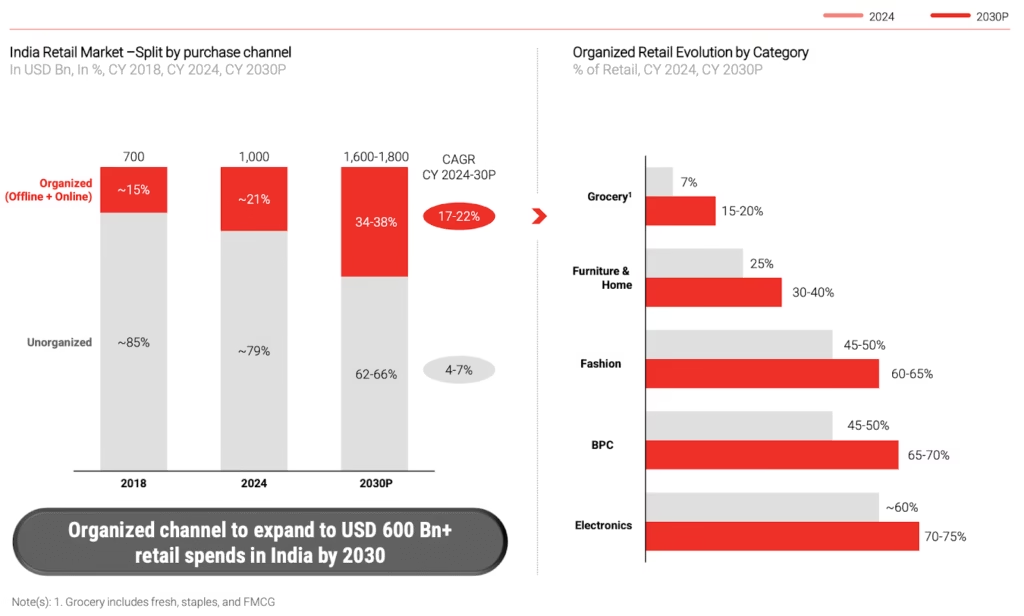

Get ready to be amazed by how much India’s retail market is set to grow! In 2018, it was worth about 0.7 trillion US dollars. By 2024, it grew to an estimated 1.0 trillion US dollars, and it’s not stopping there. Experts believe it will jump to a massive 1.6 to 1.8 trillion US dollars by 2030.

This isn’t just growth, it’s a huge wave of new opportunities, making India one of the most exciting places for shopping in the world.

2.1 What’s Making the Market Grow?

What’s behind this amazing growth? It’s a mix of strong economic changes and more people with money to spend:

- More Middle-Class Families: India’s middle class is getting bigger and bigger. These families are looking for good quality products and better shopping experiences.

- Cities Are Growing Fast: More and more people are moving to cities. When they live in cities, their shopping habits change.

- Growth in Smaller Cities: It’s not just the big cities that are growing. Smaller cities and towns are also becoming important places for spending money, adding a lot to the total retail market.

- More Women Working: More women are joining the workforce. This means families have more income, and they spend money on a wider range of things.

- Organized Shopping is Rising: As we talked about, organized retail is stepping up. They are meeting what customers want by offering better prices, more choices, and easier ways to shop.

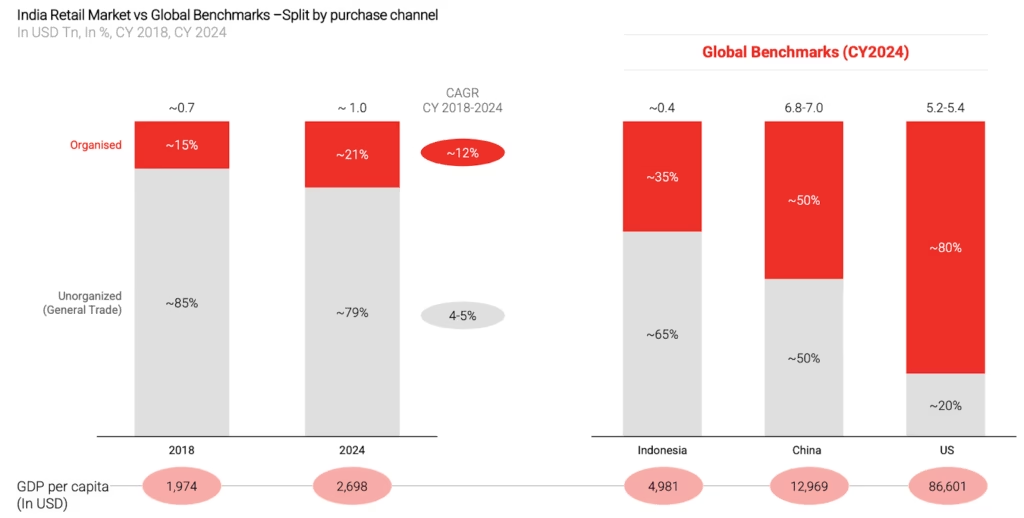

In India, the average income per person annually is currently around $2,000. But it’s expected to reach about $5,000 by 2030. This might seem small compared to richer countries, but it’s a very important point. In the past, when countries crossed the $2,000 mark in average income, they often saw a huge jump in how much people spent, just like China did after 2006.

This shows there’s a lot of room for India’s retail market to keep growing, meaning its shopping journey is just getting started.

3. Small and Local Brands: Why do they still matter?

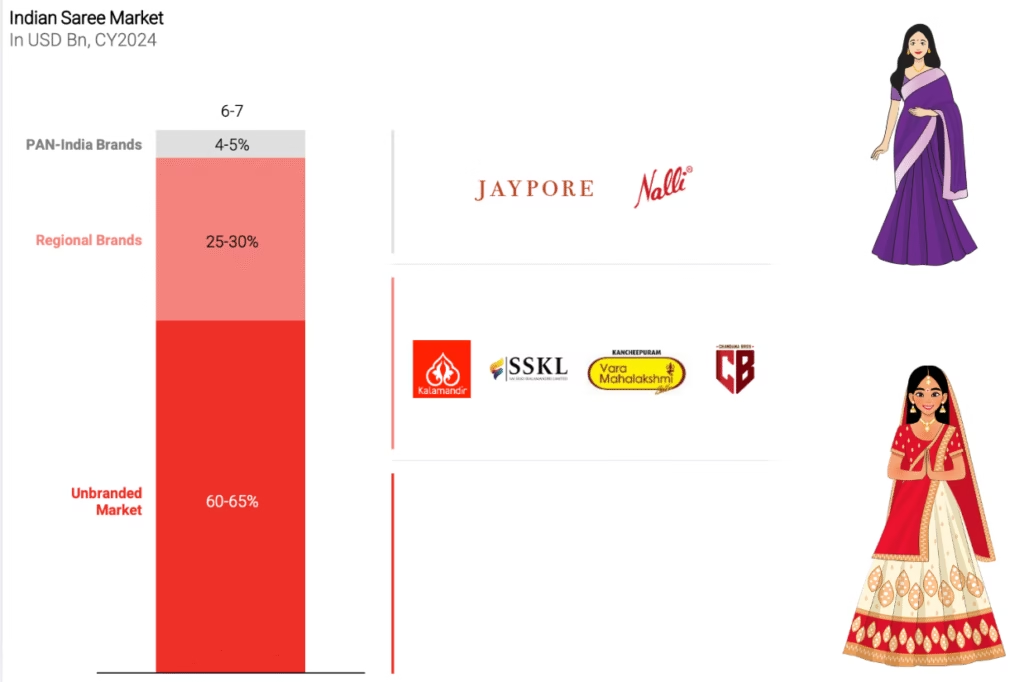

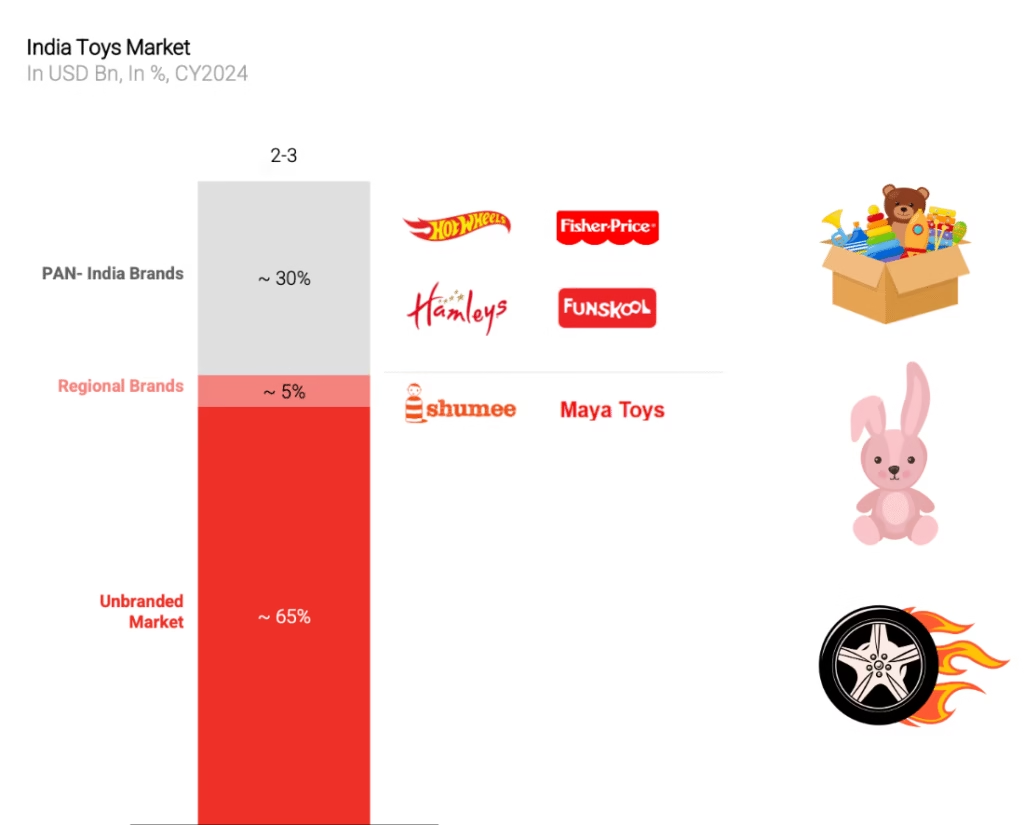

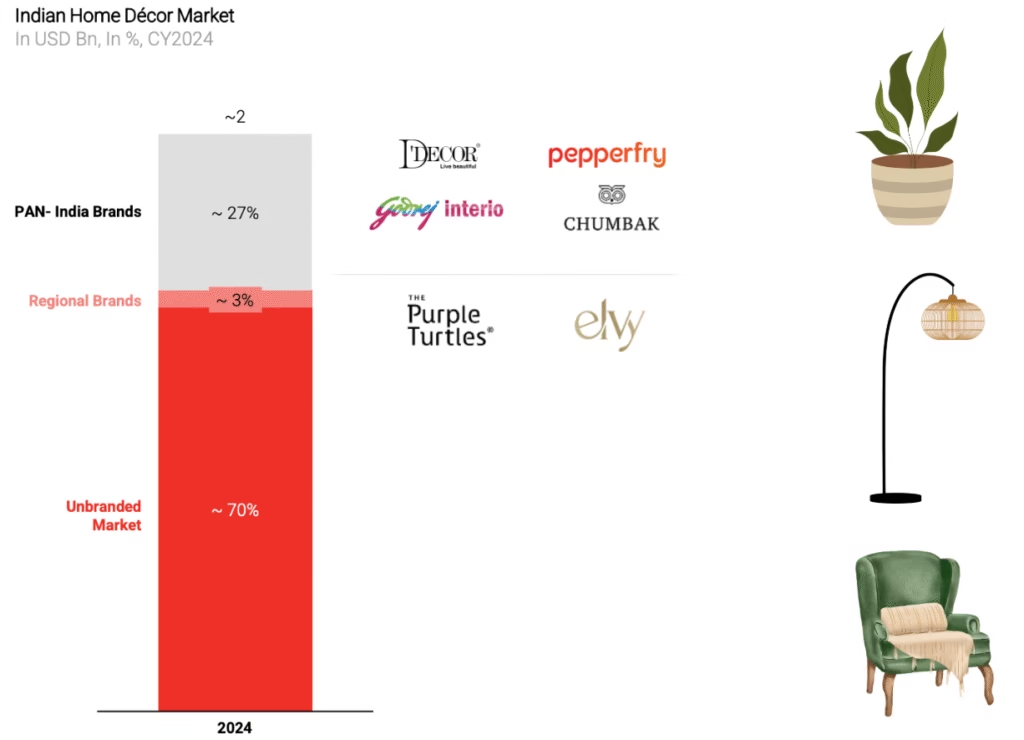

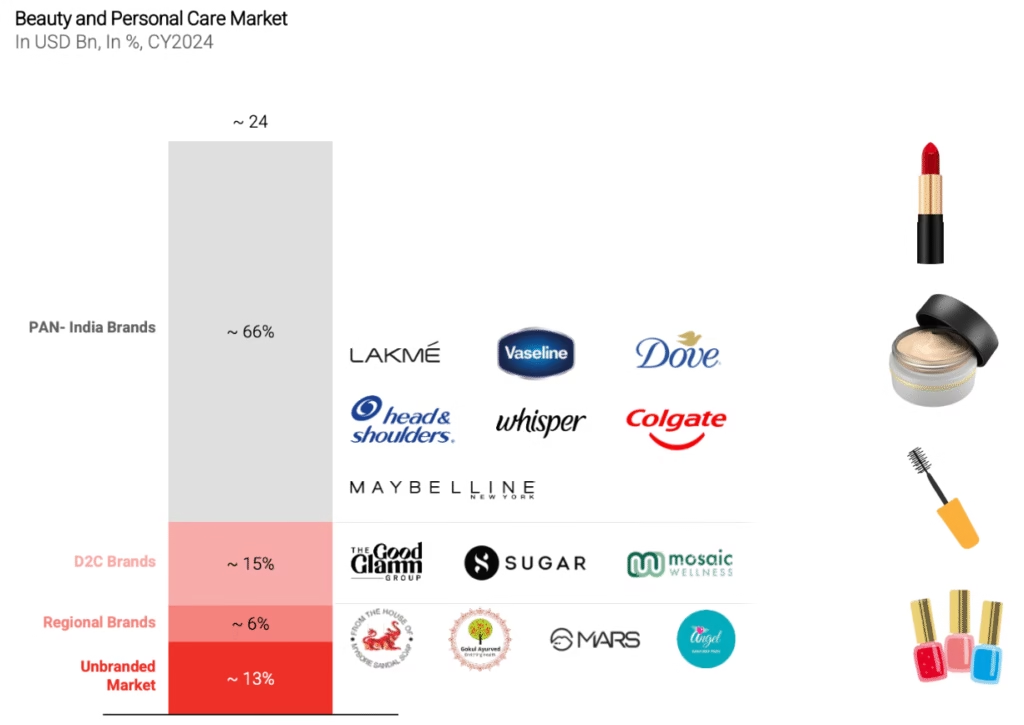

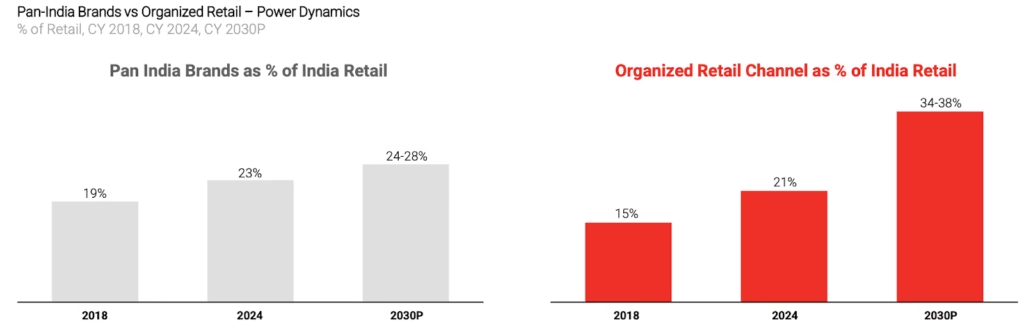

Even with the fast growth of organized retail, a big part of India’s shopping world is still made up of products without big brand names and goods from local sellers. This doesn’t mean the market is behind; it just shows how unique India is, with its many different cultures and customer tastes. In 2024, products without big brands made up a huge 62% of all retail, and local brands added another 14%.

While these numbers might go down a little by 2030, they will still account for over 1 trillion US dollars in sales. This lasting strength shows a key truth about Indian shoppers: they like things that are easy to get, affordable, and made to fit their local needs and tastes.

3.1 Why Big National Brands Have a Hard Time?

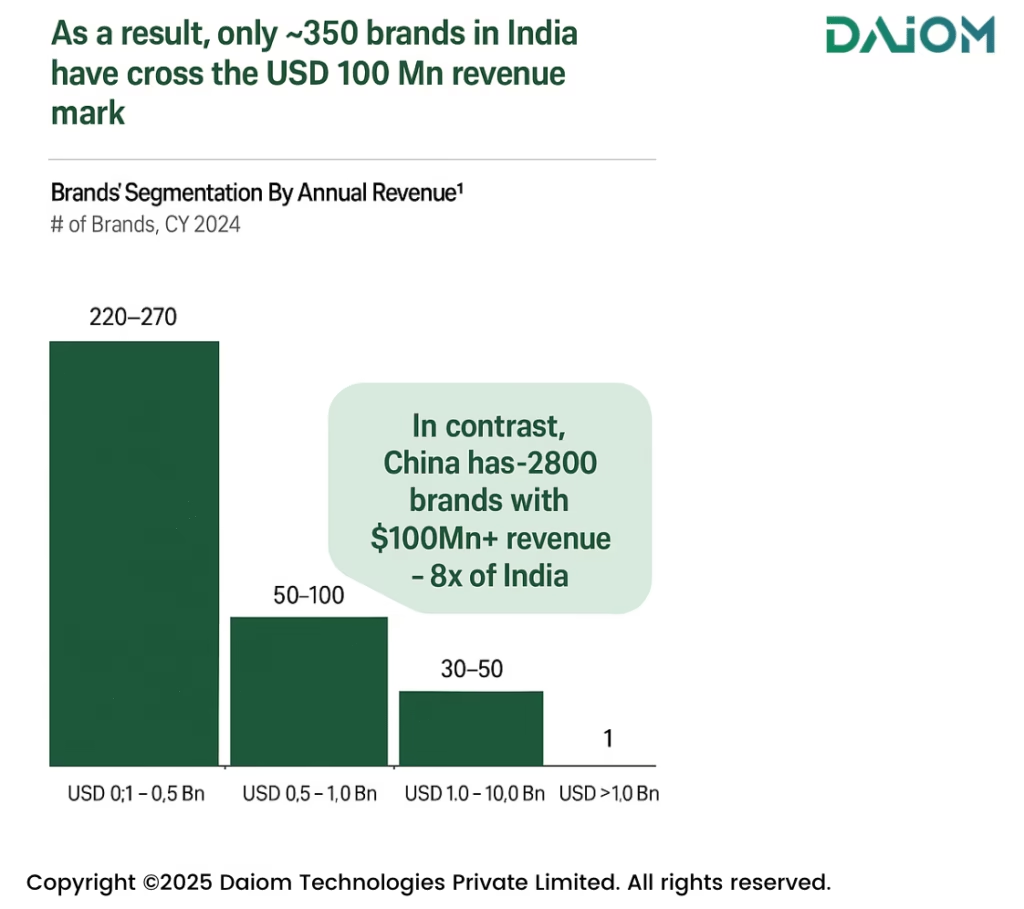

Building a brand that’s loved across India isn’t easy. Unlike more uniform markets, India is a patchwork of cultures, languages, and spending power. What clicks in one state may flop in another, and getting products across such a vast country adds another layer of complexity.

No surprise then, as India has only around 350 brands making $100M+, compared to China’s 2800. And this gap isn’t just temporary; it’s baked into how the market works.

3.2 How Product Variety Drives the Market among Many Choices

One of the most interesting things about India’s many small sellers is the huge number of different products (SKUs) available. This isn’t just about having a lot of options; it’s about meeting very specific local demands and detailed customer choices. Look at these examples:

- Sarees: The top 400,000 different saree designs make up about half of all saree sales. This shows an amazing range of styles, materials, and regional designs.

Toys: There are a huge 1.2 million different toys available, showing many different tastes and prices.

Home Decor: This area has an astonishing 10-12 million different items, from traditional crafts to modern furniture, fitting every style and budget.

Makeup and Skincare: Even in personal care, there are 10-12 thousand different products, showing a very specific market with many different needs.

Source: Redseer

This huge variety of products, while making things harder for big companies to standardize, also shows the strong spirit of local business owners and how quickly they respond to what customers want. It also means that for organized retail to truly do well, it must find ways to accept and work with this variety, instead of trying to make everything the same.

4. Organized Retail: How is it changing the way we shop?

The way retail is shaping up in India right now is a mix of excitement and big changes. Everyone talks about online shopping being the future, but the reality is that 80–90% of retail still happens offline, in malls, supermarkets, and local stores—because people love the experience of touching, trying, and being part of the shopping vibe.

What we’re really seeing is a shift towards omnichannel retail, where brands don’t treat online and offline as separate but blend them to give shoppers the best of both worlds.

4.1 Omnichannel in Action

Today, customers might browse on a website, head to a store to try out the fit or feel, and then have the product delivered home. Or, they may just order straight through an app when they already know what they want. This flexibility is what smart retailers are betting on, and according to Redseer, this mix will be the driving force behind India’s $600+ billion organized retail market by 2030.

D2C Categories Leading the Way:

- Fashion: Brands like Snitch, Zudio, and Newme are redefining affordable fashion with strong online play while also opening offline stores to strengthen customer connections. Omnichannel here means customers can shop a new drop online but also walk into a store to pick the exact color or size.

- Beauty & Personal Care: Nykaa has built its reputation online but now has physical stores in malls across India. This helps them offer both personalized recommendations online and real-life trials offline, making it easy for customers to discover and trust products.

- Electronics & Gadgets: Players like Croma and Reliance Digital do omnichannel well by letting shoppers explore options online, check stock at their nearest store, and even schedule in-store demos before buying.

5. Smart Ways to Win: Different Plans for Different Shoppers

India’s retail world is too big and varied for just one way of doing business. For organized retail to succeed, it needs to use many different plans, each made for specific customer likes, groups of people, and situations.

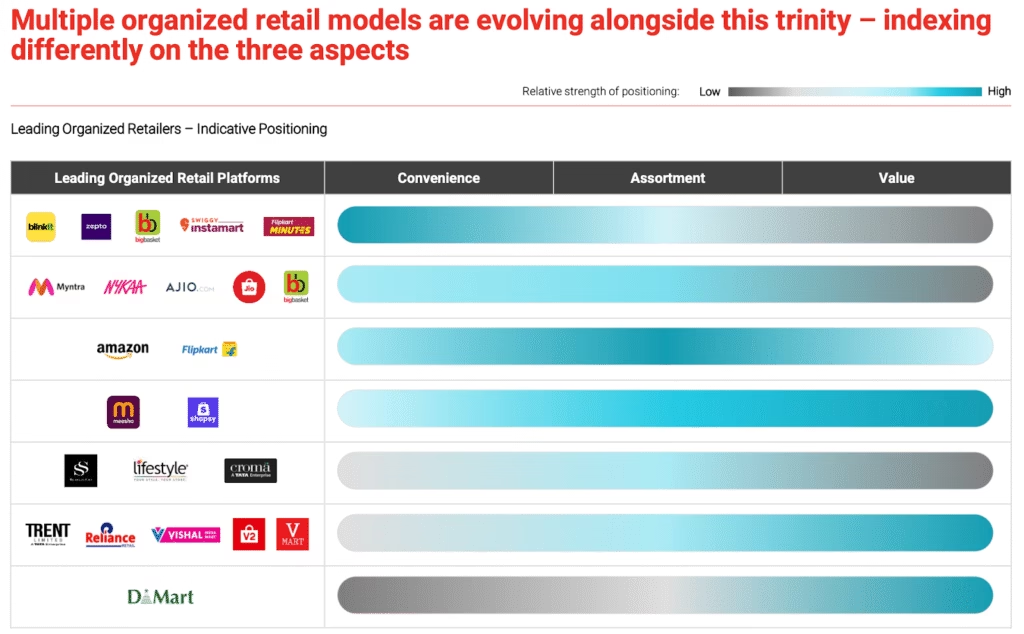

The RedSeer report says that the best organized retail plans are built around three main ideas: variety, good value, and convenience.

- Variety: Since India has so many different kinds of products, successful businesses offer a wide and useful range of goods. This means understanding local tastes, special regional items, and the small details of what customers want.

- Good Value: How much something costs is still very important for Indian shoppers. Businesses that win are those that can offer great value. This could be through fair prices, special loyalty programs, or smart ways of getting products that keep costs down.

- Convenience: In today’s fast world, being easy to use is key. This includes everything: how easy it is to get to a shop (both real and online), quick delivery options (especially for daily needs), simple ways to pay, and a smooth shopping experience.

This ability to change has led to many successful ways of selling, such as:

- Big Stores: Large supermarkets and hypermarkets still attract customers who want many choices and good prices all in one place.

- Specialty Stores: These shops focus on specific things like electronics, fashion, or home decor. They offer special collections and expert advice.

- Online Shopping Sites: Websites like Amazon and Flipkart allow businesses to reach many people and offer a huge variety of products, connecting buyers and sellers across the country.

- Direct-to-Consumer (D2C) Brands: These brands use online ways to talk directly to customers. They offer unique products and personal shopping experiences, often at good prices because they don’t use middlemen.

- Quick Delivery Services: These focus on delivering groceries and other daily items very quickly. They are changing how people shop every day in cities.

The good news is that there’s plenty of room for these different ways of selling to grow and stay strong in India’s busy retail market. The main thing is to understand what different groups of customers need and to keep finding new and better ways to do things. This way, they can succeed alongside the many traditional local shops, rather than trying to replace them completely.

Retail is an act of trust. Every interaction is a chance to build a bridge.

Shep Gordon

6. Conclusion

India’s retail story is a mix of local traditions and modern retail powered by tech. The market will jump from $0.7 trillion market to $1.6 trillion+ by 2030 (Redseer).

From working with D2C brands in the omnichannel space, I’ve seen how success comes from balancing the strength of local players with the scale of organized retail. The revolution is already here, this is the time to adapt and innovate.

If you’d like to discuss how we can help optimize your Omnichannel Marketing strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in.

For more informative content and blog, follow and stay tuned to DAiOM!

Subscribe to our NEWSLETTER!