Summary:

In this episode of Dilse Omni Podcast, Saurabh and Abhijeet unpack when brands should actually invest in a mobile app, and why it’s not the right move for every category on day one. They dig into the key KPIs that define app success—like app share of D2C revenue, conversion rate and AOV uplift vs web, LTV, and retention—and how to read these numbers in context.

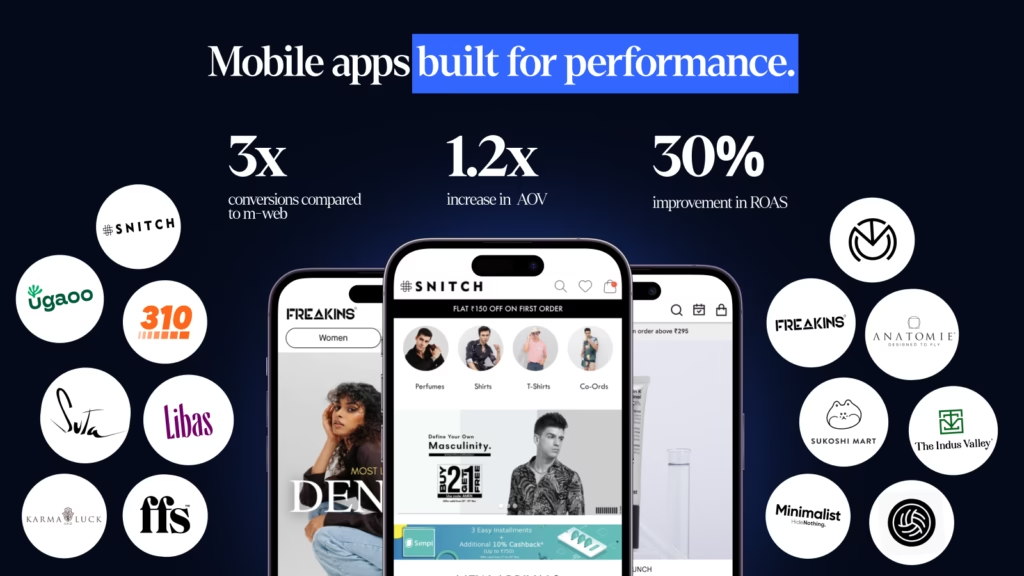

The conversation also covers how apps fit alongside websites and marketplaces in an omnichannel journey, and why native apps often become the most efficient channel once repeat purchase kicks in. Drawing on Appbrew’s work with brands like Snitch and leading skincare players, they break down what goes into building app experiences that don’t just get installs, but actually retain users and drive repeat purchases at scale.

When brands should launch an app?

Most brands don’t need an app on day one, but once there’s repeat purchase behavior and a meaningful D2C base, a well-built app can become the most profitable, high-intent channel in the entire stack. The episode makes it very clear that the question is not “app or no app?” but “when, why, and how do you build an app that actually moves revenue, retention, and brand love?”

The podcast frames apps as a channel you graduate into, not a starting point. Early-stage brands should first validate the product–market fit and build a stable D2C flow via website and marketplaces before thinking of an app. Once repeat purchase kicks in and a brand wants deeper relationships, owning an app becomes a 10x lever instead of a vanity project.

Abhijeet calls out categories where apps almost become non‑negotiable:

- Fashion: Apps often become the main channel within 1–2 months because of high browsing frequency and impulse behavior.

- Personal care/beauty: Routine‑driven, high‑repeat categories (like minimalist‑style skincare) see strong adoption once the app experience is done right.

- Large catalogs (FMCG, marketplaces, etc.): The more SKU depth and repeat buying, the more an app pays off through better discovery, retention, and data.

For ultra‑niche or very low‑repeat categories, the bar is higher: an app only makes sense if the marketing team believes in it, is ready to push it, and can curate it as a real channel, not a parked asset.

Apps vs websites in omnichannel journeys

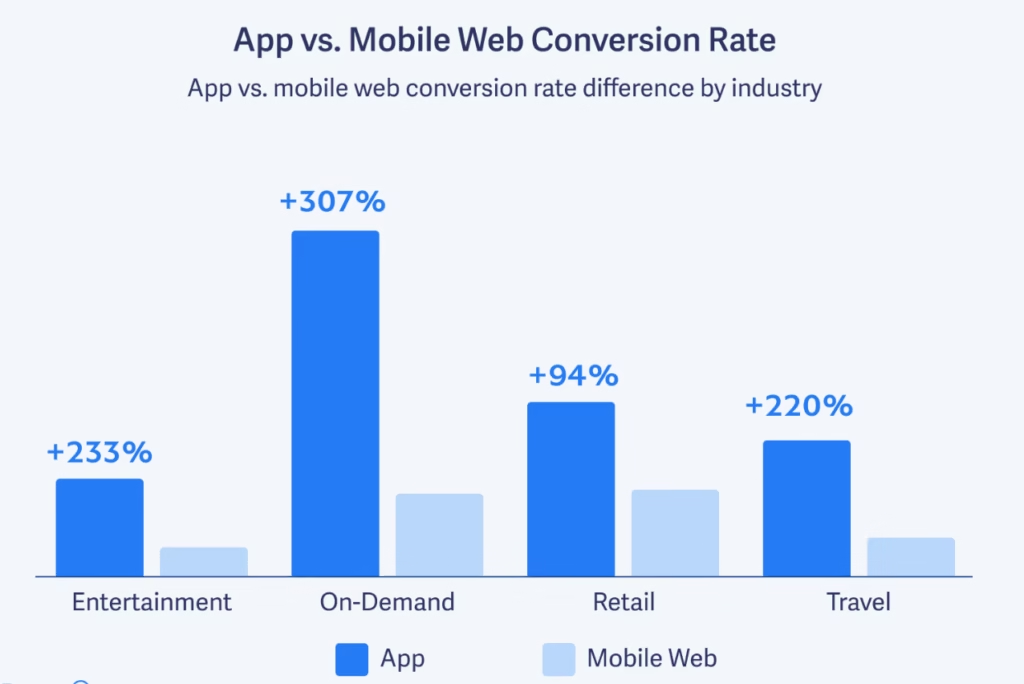

Abhijeet draws a simple contrast: 90% of e‑commerce happens on mobile devices, but the quality of that experience is radically different on native app vs mobile web. Median app conversion rates are around 3x of web, and AOV on app is typically 25%+ higher, largely because app flows are faster, more personalized, and designed for repeat users rather than one‑time visitors.

He also explains the “identified user” advantage:

- On web, a small fraction of visitors log in; many check out as guests, making it hard to track and retarget beyond paid media.

- On apps, around 30% of users log in, and an active app user can pass 150+ behavioral events per month vs 15–20 on web, giving brands rich, user‑level data to drive journeys, cohorts, and campaigns.

This is why a good app feels like an exclusive brand outlet in the customer’s pocket: it’s always present, not subject to Meta/Google “tax” every time you want to talk to your own customer, and it compounds value as more behavior data flows in.

KPIs that define app success

The podcast is very clear that installs are a vanity metric; real success is measured on business outcomes. Abhijeet and Saurabh anchor on a handful of core KPIs:

- App share of D2C sales

- As an organic baseline, 20–25% of D2C revenue from the app is healthy; with conscious pushing, they’ve seen brands reach 50–60% of D2C sales via app.

- Conversion rate delta (app vs web)

- The app should outperform web on session‑to‑purchase; median 3x uplift is cited as a realistic benchmark when the app is done well.

- Average Order Value (AOV) uplift

- Apps should deliver higher AOV through better merchandising, personalized bundles, and cross‑sell; 1.2–1.3x AOV vs web is common in case studies.

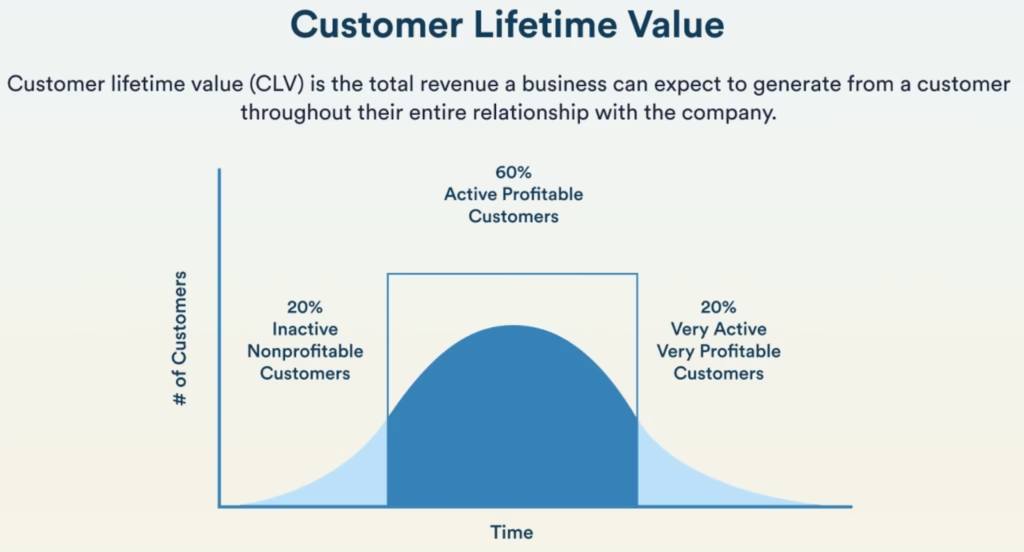

- Lifetime value (LTV) and retention

- In the episode they talk about app customers showing much higher LTV—often several times web customers—because frequency and ticket size both improve.

- Day‑30 retention of app users can be 10–20x that of web visitors; one example mentioned is web at about 0.3% vs app at ~7% on day 30.

- Ad efficiency / CAC

- As app contribution grows, brands reduce reliance on paid retargeting because push, in‑app journeys, and CRM handle a lot of repeat activations.

Saurabh also adds two important input metrics people ignore: app‑store listing conversion (view‑to‑install) and push notification reachability, both of which have massive downstream impact on ROI but are entirely in the brand’s control.

Appbrew’s work with leading D2C brands

A big chunk of the conversation is anchored in Appbrew’s actual builds for high‑growth D2C brands. Snitch is the flagship story: they already had an app from another provider, but after an Appbrew‑led audit and rebuild, app contribution doubled within about 15 days and conversion rates jumped roughly a third on top of already strong app numbers. Within a month of the relaunch, around 60% of their D2C business was coming from the mobile app, with 2.5x conversion vs earlier baselines and about 1.3x AOV uplift.

Similar patterns show up in other categories:

- Skincare brands using Appbrew report ~3x higher app conversion vs web, ~40% D2C contribution from the app, and ~20–25% higher AOV from better personalization and routines.

- Appbrew’s stack typically includes native analytics, CRM and Meta/Google integrations, loyalty, social login, and campaign‑specific landing pages so marketing teams can ship concepts fast without dev bottlenecks.

Under the hood, Abhijeet talks about two layers: an infra layer (fast, reliable commerce plumbing) and an intelligence layer (events, segmentation, AI, and recommendations) that turns the app into a performance engine, not just a catalog.

Building apps that retain (not just acquire) users

Both speakers agree: “having an app” does nothing on its own; retention comes from what you do with the channel. Abhijeet mentions that an active app user sends 150+ events per month, and retention leaders are the ones who turn that data into journeys, nudges, and experiences instead of just broadcasting discount pushes.

Some of the retention levers they highlight:

- Strong “showroom” on the app stores

- Improve listing conversion (views → installs) with sharp copy, high‑quality imagery, social proof, and proactive review management; lifts of 15–20 percentage points in view‑to‑install are achievable with focused ASO experiments.

- Push notification strategy and reachability

- Since platforms default opt‑in to “off,” brands need to sell the value of notifications in‑app—early access, drops, order updates, rewards—to raise push opt‑in towards the 60%+ tier.

- Retention marketing and journeys

- Combining rich event data with tools like CleverTap or CRM, brands can orchestrate lifecycle flows: replenishment nudges, win‑back campaigns, milestone rewards, and content‑led journeys that make the app a habit, not a one‑time download.

The podcast keeps circling back to one idea: a bad, low‑effort app is worse than no app, but a focused, data‑driven app can quickly become the highest‑ROI channel in an omnichannel brand’s toolkit.

Check out our website: https://dilseomni.talk/