India’s consumer market is evolving rapidly. Many brands struggle to keep up, treating the country as a single market while spending patterns differ across regions and income groups.

Over the next decade, millions of new consumers will enter the economy, income levels will change, and spending behavior will evolve across regions and income groups.

In October 2025, Fireside Ventures released a landmark report titled “The Indian Consumer at 2030,” projecting a seismic change in how the world’s most populous nation shops, eats, and lives. This report is a roadmap for the next 100 iconic brands.

The report predicts India will become a $1 trillion retail economy driven by a structural shift toward branded, “phygital” consumption across 1.1 billion internet users.

Without a clear understanding of these changes, brands risk misreading demand, mistargeting customers, and missing long-term growth opportunities.

Earlier, we had explored the “Three India Framework,” which highlighted how consumption patterns vary widely across metro, urban, and rural India.

Now, this blog breaks down the 13 transformative shifts that are steering India’s consumption future.

Table of Contents

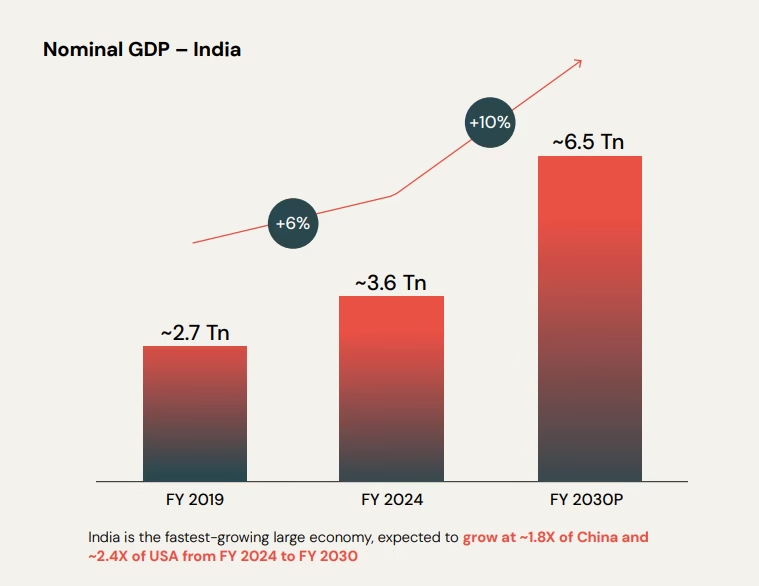

1. How Fast Is India’s Economy Really Growing?

In 2025, India has become the fourth-largest economy in the world. Over the next five years, it is expected to grow faster than most other countries and move to the third position, after the US and China.

This growth will mainly come from people spending more, as savings continue to fall each year. Together, this will add nearly $300 billion to the economy every year.

This growth means more consumers, higher spending power, and hundreds of billions of dollars in new consumption added every year.

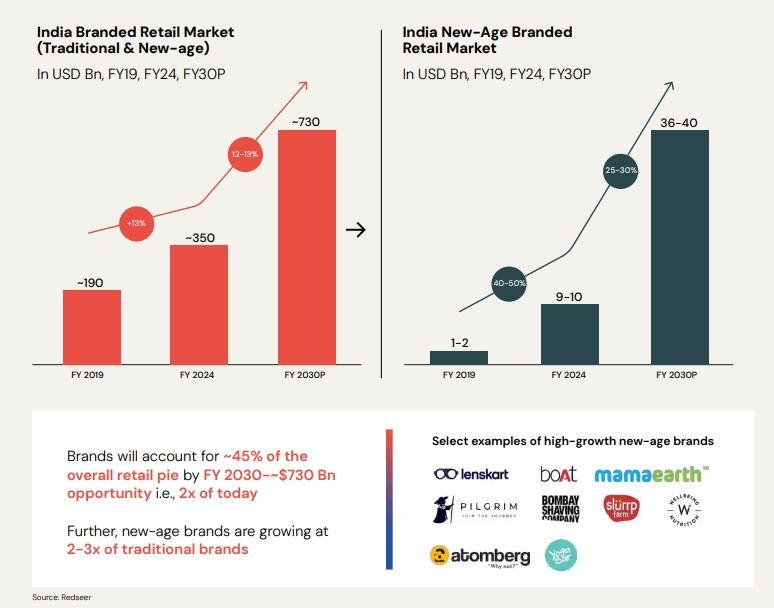

2. How New-Age Brands Are Rewriting India’s Brand Playbook?

India was earlier seen as a market with very few strong brands. But that is changing fast. As people earn more and feel confident spending, they are looking for new and local brands that fit their needs better.

Hundreds of new-age brands are doing this well by focusing on customer experience in ways older brands never did. Today’s Indian consumers are more unique, and their choices depend on much more than just age, income, or where they live.

This chart below shows how India’s branded retail market is expanding and how new-age brands are growing much faster within it.

The overall branded retail market (traditional + new-age brands) has grown from about $190 billion in FY 2019 to nearly $350 billion in FY 2024, and is expected to reach around $730 billion by FY 2030.

This means branded products will make up almost 45% of all retail spending by 2030, nearly 2x of today’s share.

Within this growth, new-age brands like Lenskart, boAt, Mamaearth, Pilgrim, Bombay Shaving Company, Slurrp Farm, Wellbeing Nutrition, Atomberg, & Yoga Bar are the real growth engines.

Their market size has increased from just $1–2 billion in FY 2019 to around $9–10 billion in FY 2024, and is projected to reach $36–40 billion by FY 2030.

These brands are growing 2–3 times faster than traditional brands, driven by digital-first models, D2C channels, and sharper consumer understanding.

3. The Evolution of Retail Infrastructure

Indian commerce is changing because people have more money and use digital technology everywhere. New online-first brands are also shaping what and how people buy. Here are the key drivers of change:

- Omnichannel Expansion: The internet has dismantled traditional barriers, providing consumers with an unprecedented variety of shopping channels.

- Beyond Urban Centers: While Urban India remains a primary engine of growth, India II and III are rapidly narrowing the gap, signaling a nationwide shift in consumption patterns.

- Information Symmetry: Social media has democratized brand awareness. Today, a consumer in a Tier-3 town is as informed as one in a metro city, forcing retail infrastructure to evolve rapidly to meet this distributed demand.

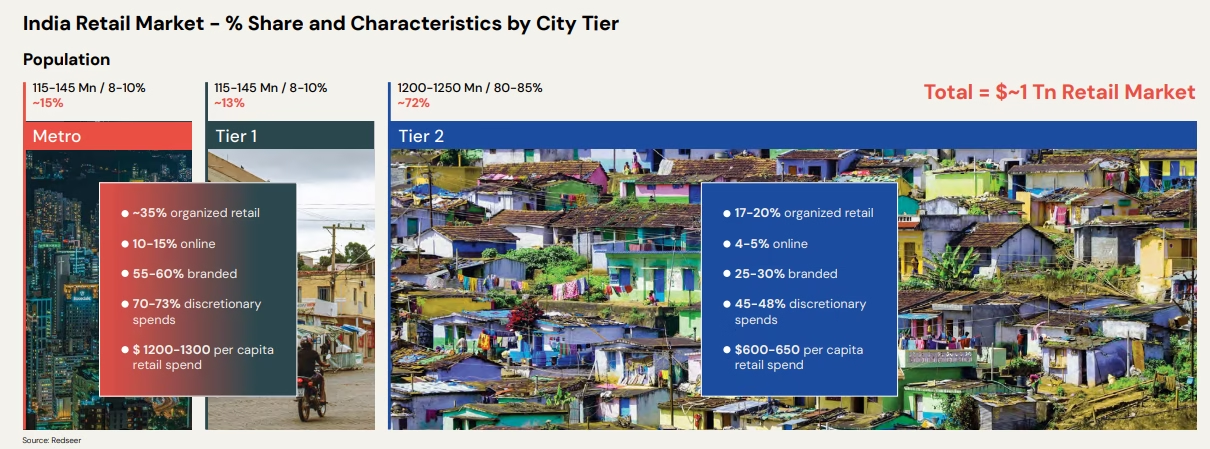

4. Analyzing India's Retail Landscape by City Tier

The market is divided into three primary categories:

4.1. Metro Cities (The High Spenders)

While only 8–10% of the population (115–145 million people) lives in Metros, they account for ~15% of the total retail market.

- High Individual Spending: Per capita retail spend is the highest here at $1,200–$1,300.

- Modern Shopping: About 35% of retail is “organized” (malls/chains), and 10–15% of shopping happens online.

- Lifestyle Choices: Residents favor brands (55–60% branded) and spend heavily on “wants” rather than just “needs,” with 70–73% going toward discretionary items.

4.2. Tier 1 Cities (The Middle Ground)

Similar to Metros, Tier 1 cities house 8–10% of the population (115–145 million people).

- Market Share: These cities represent ~13% of the total retail market.

- Growth: They serve as the bridge between the highly modernized Metros and the vast rural/semi-urban landscape of Tier 2.

4.3. Tier 2 Cities & Beyond (The Mass Market)

This category represents the “real” India in terms of scale, containing the vast majority—80–85%—of the population (1.2 — 1.25 billion people).

- Dominant Market Share: Because of the sheer number of people, they make up ~72% of the total retail market.

- Traditional Habits: Spending is more conservative, with a per capita spend of $600–$650.

- Untapped Potential: Retail is less modernized here; only 17–20% is organized, and just 4–5% of shopping is done online.

- Focus on Essentials: Spending is more balanced between needs and wants, with discretionary spending at 45–48%.

5. The 13 Big Shifts Rewriting the Brand Playbook

The “The Indian Consumer at 2030,” report identifies 13 fundamental shifts that are fundamentally altering the DNA of Indian consumption:

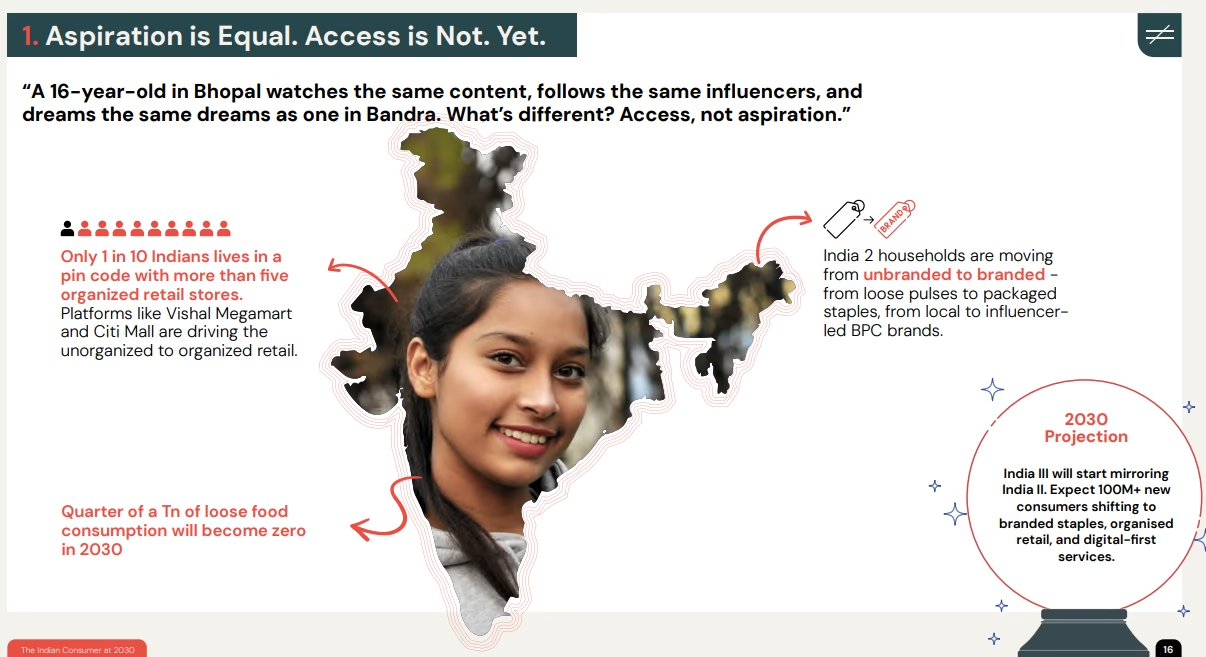

5.1. Aspiration is Equal; Access is Not

Social media has made people across India equally aware of brands and trends. But physical access still lags, only 1 in 10 Indians lives in an area with more than five organized retail stores. Awareness is widespread, but access is limited.

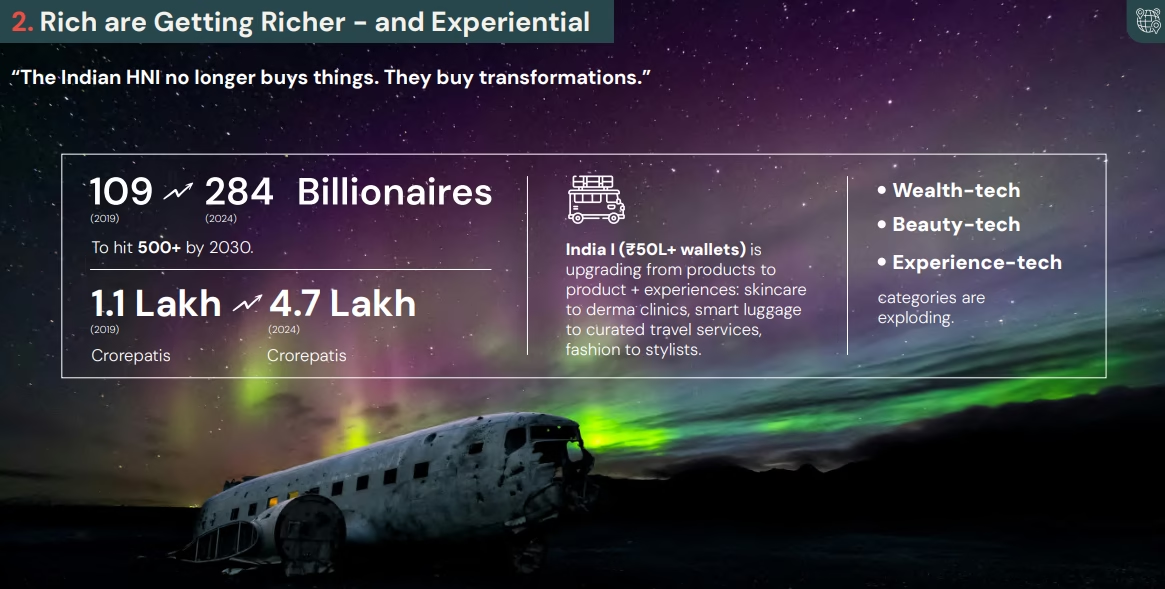

5.2. Rich Are Getting Richer and Experiential

High-net-worth individuals (HNIs) are spending less on things and more on experiences. They value transformation and unique memories over material possessions, making experiences the new symbol of wealth. Curated travel, wellness programs, and biohacking are replacing traditional luxury purchases.

5.3. The Woman Is the Market

As more women join the workforce, they are making major household decisions in food, health, and tech.

Brands that save time and simplify life appeal most to this audience, and their choices are shaping markets, pushing brands to focus on convenience, efficiency, and meaningful solutions.

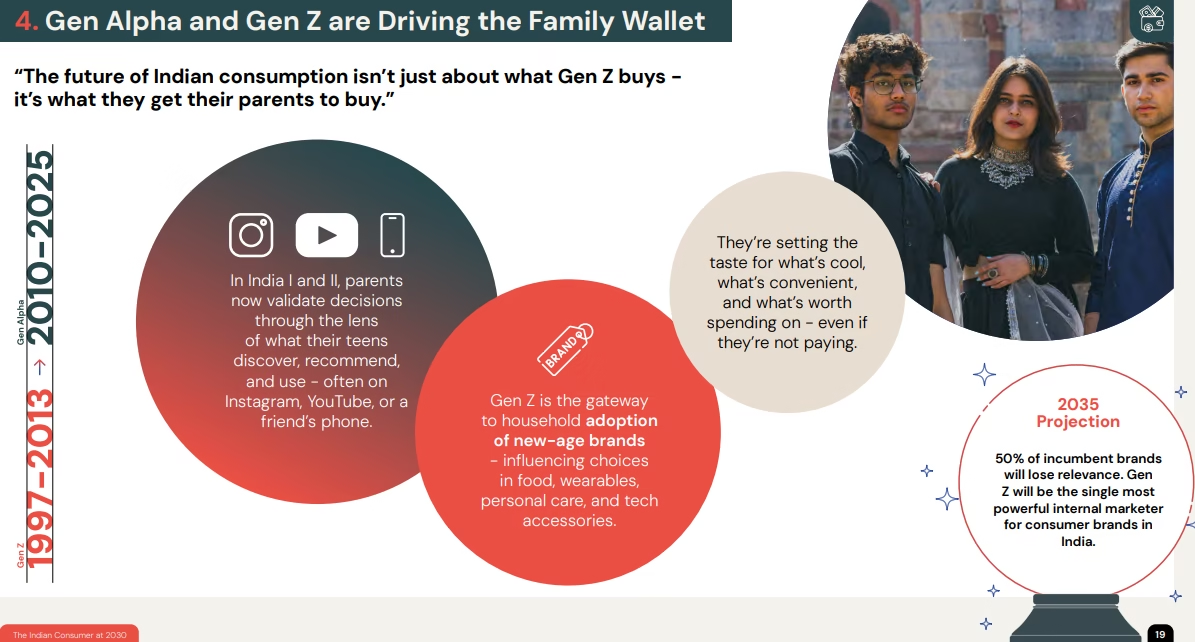

5.4. Gen Alpha/Z Drive the Family Wallet

Children and teenagers—especially Gen Alpha and Z—are increasingly influencing family purchases in areas like EVs, skincare, and food.

Their opinions, trends they follow, and brand preferences often guide what parents choose, making young consumers a powerful force in household spending decisions.

5.5 Shopping is No Longer Gendered

Self-expression and wellness are bringing men and women to similar products.

Men’s personal care alone is growing at an 11% CAGR, showing that traditional gender lines in shopping are blurring.

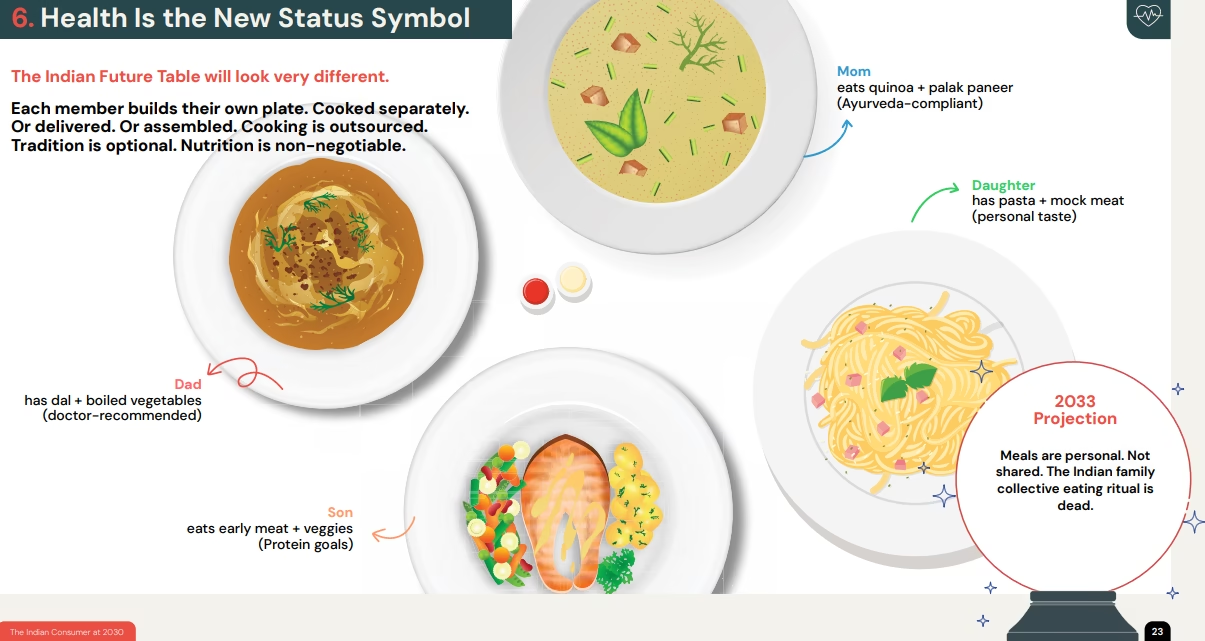

5.6 Health as the New Status Symbol

Wellness has become a key part of everyday life. Families are not just eating healthier, they track protein and nutrient intake, follow personalized nutrition and fitness plans, and embrace ‘biohacking’ techniques like sleep optimization, stress management, and supplements.

Health is now a status symbol, with consumers actively investing in practices, tools, and experiences that enhance longevity, energy, and overall well-being.

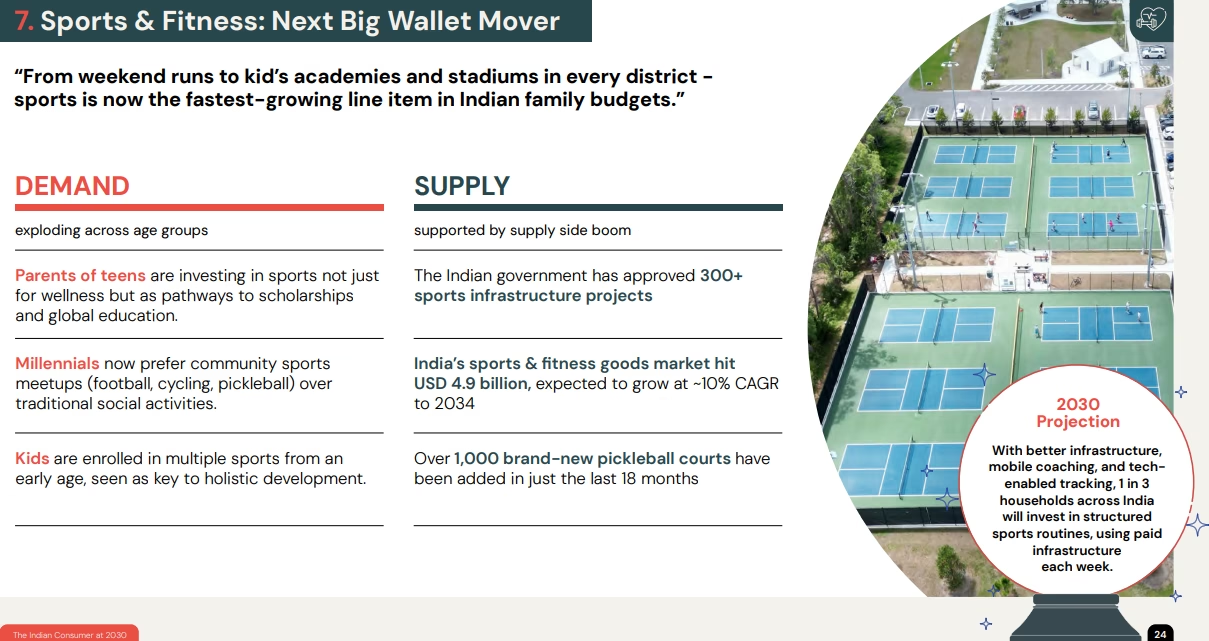

5.7. Sports & Fitness Is A Wallet Mover

Sports and fitness are becoming major family priorities.

By 2030, 1 in 3 households is expected to spend on structured sports routines, making sports a key budget category.

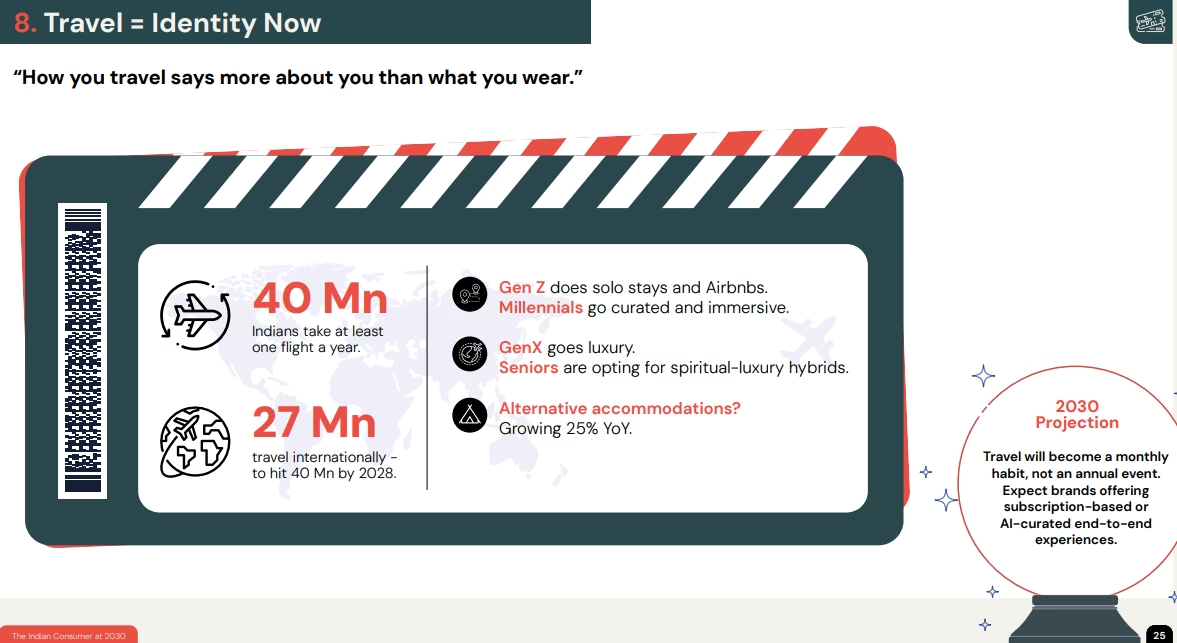

5.8 Travel Equals Identity

How you travel today says more about you than what you wear. It is no longer just an annual trip, it’s becoming a regular habit.

Consumers now seek unique experiences, such as spiritual-luxury hybrids or AI-personalized trips.

5.9 Kids Are the Wallet

Parents invest heavily in their children, aiming to build their “portfolio of potential.” Urban families are expected to spend ₹1–1.2 lakh per child annually by 2030.

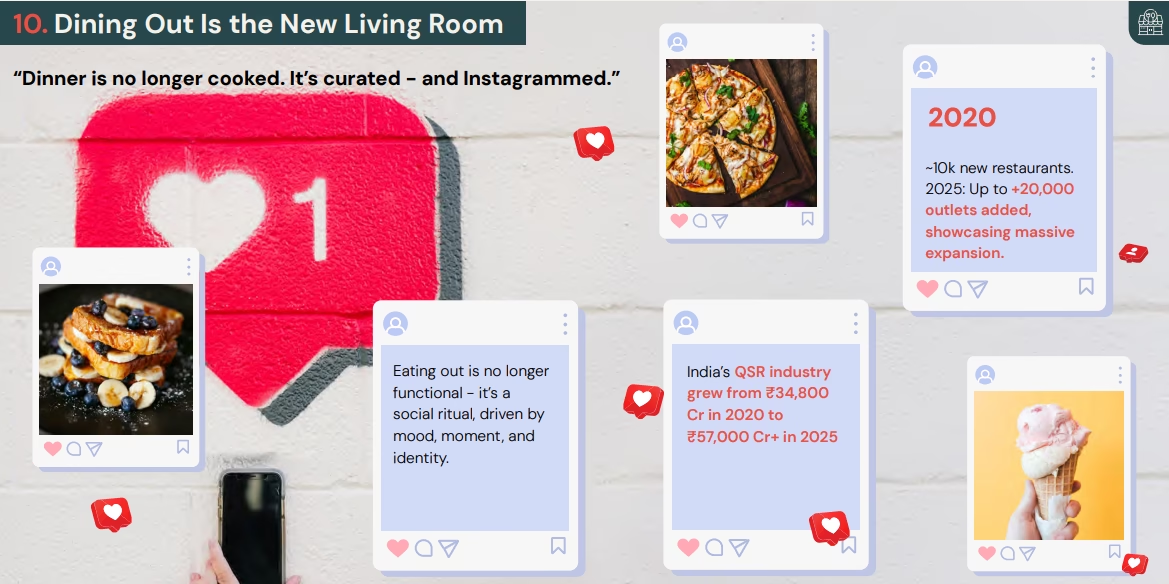

5.10 Dining Out as the New Living Room

Eating out has become a social experience rather than just a functional meal. Consumers seek “Instagrammable” moments that express identity and lifestyle.

5.11 Education is Global and Always-On

Learning now goes beyond degrees. Exposure matters to a great extent when it comes to education today.

Parents prioritize exposure and skills like coding and STEM from an early age, integrating alternate learning into childhood education.

5.12 Experience Trumps Product

India’s experience economy is growing fast.

People are spending more on experiences, like travel, events, and unique activities, rather than just buying things, and this market is expected to exceed $300 billion by 2030.

5.13 AI is Rewiring Everything

Artificial intelligence is changing the way people shop. Consumers are no longer just buyers, they can now use AI tools, like skincare analysis or sports performance trackers, to personalize products and experiences to their needs.

6. About Fireside Ventures

Fireside Ventures has established itself as a premier venture capital firm in India by specializing exclusively in the “next-generation” consumer brand ecosystem, managing an impressive AUM of approximately ₹5,300 crore as of early 2026.

The firm is widely recognized for its “omnichannel-first” investment thesis, moving beyond pure-play digital brands to support companies that bridge the gap between online discovery and offline experience.

A prime example is The Sleep Company, which Fireside backed during its early stages; the brand has since evolved from a digital startup into a massive comfort-tech leader with over 150 physical stores nationwide.

Similarly, Fireside’s portfolio includes high-growth omnichannel players like BlueStone (as part of their broader focus on lifestyle and premiumization) and boAt, proving their ability to scale brands across diverse retail touchpoints.

By providing not just capital but also a dedicated “operating model” that includes mentorship in supply chain and brand storytelling, Fireside remains the go-to partner for founders aiming to build iconic, long-lasting Indian brands.

7. Conclusion

Based on the 13 seismic shifts identified by Fireside Ventures, the overarching conclusion is that the 2030 Indian consumer will no longer be a monolith, but a “mosaic of identities” defined by “symmetry in awareness” but vast differences in access and choice.

For brands, this era signals the end of mass-market dominance and the rise of a $1 trillion retail landscape where success belongs to those who leverage AI to offer hyper-personalization and deep innovation for a population that increasingly values “transformational experiences” over material products.

Disclaimer: This report was originally published by Fireside Ventures. The insights shared here reflect our key learnings and interpretations based on that report.

If you’d like to discuss how we can help enhance and optimize your Omnichannel and growth marketing strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!