In this customer-centric landscape, prioritising and measuring Customer Experience (CX) is no longer optional – it’s vital for building brand loyalty and business growth.

While every brand obsesses over CX, effective measurement is supercritical and the first step towards driving meaningful improvement. We will be sharing our thoughts and learnings about different aspects of this topic in our blog series.

Accurately capturing customer experience can be challenging at times. Tools like Net Promoter Score (NPS) have been used traditionally.

While valuable, NPS can be misused. If used solely as a sales target, it can lead to skewed data and inaccurate feedback. Additionally, the person collecting the feedback can influence the outcome, introducing bias.

If you build a great experience, customers tell each other about that. Word of mouth is very powerful.

Jeff Bezos Tweet

Channels to Gather CX Data

Brands typically gather CX data through two main channels: direct customer experience feedback and indirect customer behavior analysis. Both methods provide valuable insights into customer experiences and preferences.

- Public Platforms: Social media, review sites like Google, and online forums are valuable sources of customer sentiment analysis. In many instances, it has been observed that dissatisfied customers end up using public forums like social media to vent their frustration. Often this happens if there has been an unsatisfactory resolution of their issues or an absence of dedicated brand-owned spaces where they can voice their concerns.

- Direct Feedback: This involves customers actively providing responses to surveys or questionnaires directly offered by the brand through email, messages/embedding in websites/apps.

Methods of Capturing Customer Voices

Capturing customer voices involves a mix of traditional and digital approaches to gather comprehensive feedback.

These methods ensure that businesses can understand their customers’ experiences from multiple perspectives.

- Traditional-Paper-based Surveys: While for many people filling a paper-based survey is a familiar process, it may be prone to errors and misinterpretations. It can also have low response rates.

- Digital Channels: Digital surveys are convenient, and get higher response rates due to ease of completion. The biggest advantage of these surveys is that they allow for real-time data collection and reduce the risk of errors or tampering.

Top 3 Frameworks for Customer Experience Feedbacks

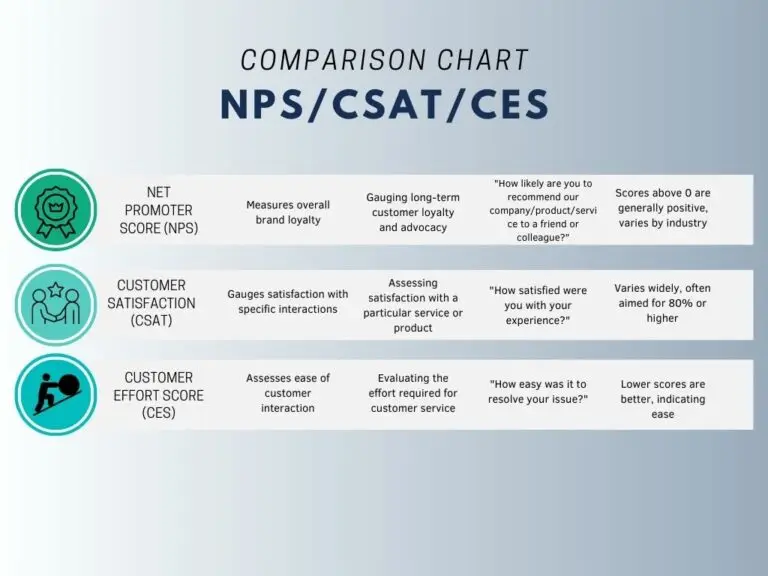

Understanding the strengths and applications of NPS, CSAT, and CES can help businesses effectively gauge and improve customer experience across different touchpoints.

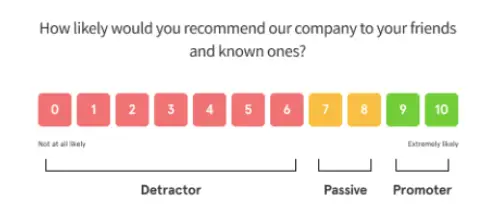

- Net Promoter Score (NPS): It is one of the oldest and most popular customer experience measurement metrics. This metric measures customer loyalty by asking a single question: “On a scale of 0-10, how likely are you to recommend our brand to others?” Customers are categorized as Promoters (9-10), Passives (7-8), or Detractors (0-6). NPS is a valuable indicator of overall customer sentiment.

- Customer Satisfaction Score (CSAT): This metric focuses on satisfaction with a specific interaction (e.g., purchase, service call). CSAT typically uses a Likert scale of 1 (very dissatisfied) to 5(very satisfied) to gauge satisfaction levels. While helpful for specific touchpoints, CSAT doesn’t necessarily reflect overall brand loyalty.

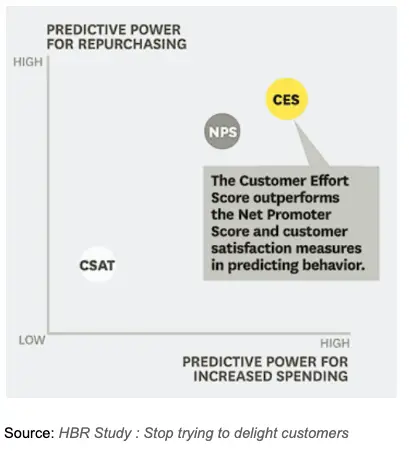

- Customer Effort Score(CES): CES surveys measure how easy (or difficult) it was for a customer to complete a specific task or interaction. It is usually used to help customer service improve resolution times and provide higher-quality experiences. CES typically uses a Likert scale of 0 (very difficult) to 5(very easy) to measure customer effort.

Comparison Among NPS/CSAT/CES

Key Takeaways

- NPS: Ideal for understanding overall customer loyalty and predicting long-term growth. Data can be segmented by channel, product, and overall company for detailed analysis.

- CSAT: Best for immediate feedback on specific transactions or experiences. Often used to gauge satisfaction right after an interaction.

- CES: Focuses on the ease of customer service interactions. Lower scores indicate a smoother, more efficient experience for the customer.

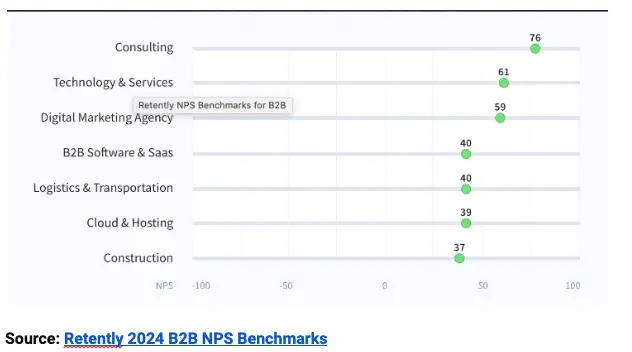

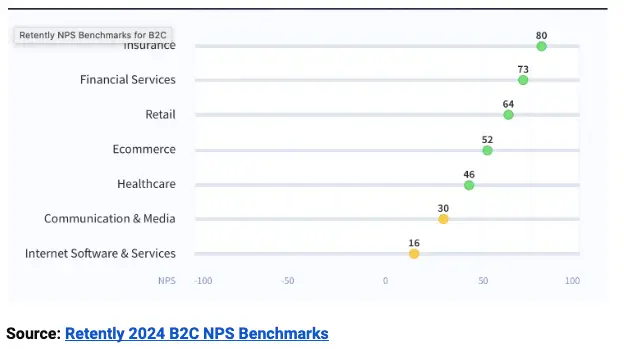

Industry Benchmarks for NPS

While there’s no single “good” score, scores above 0 are generally positive. This varies by industry and whether the context is B2B or B2C.

Segmenting NPS data by channel (e.g., email, social media, website), product, and overall company allows for monitoring and analysis, revealing trends in areas with consistently high or low scores.

Analyzing customer feedback associated with each score provides deeper insights for targeted improvements to enhance the customer experience across all channels and products.

Over time, NPS has become a self-reported metric to management and investors. The drive to achieve a 70+ NPS score has led to strict actions on low ratings and the adoption of various practices to drive higher scores.

However, self-reported scores and misinterpretations of the NPS framework have sown confusion and diminished its credibility. In industries and companies with no human intervention in collecting NPS, scores tend to be much lower and unbiased.

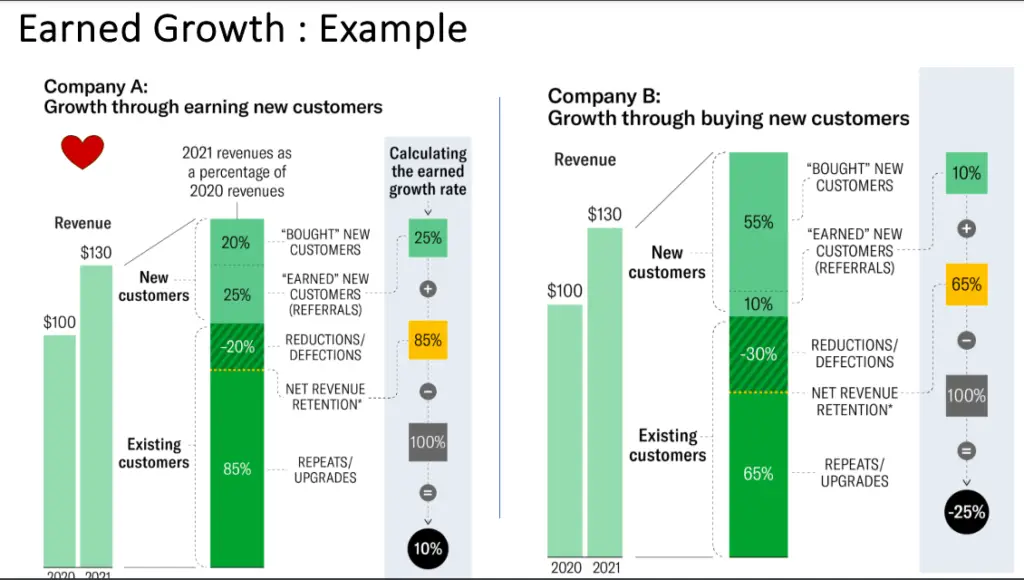

In a 2021 article in Harvard Business Review, Fred Reichheld introduced the NPS 3.0 concept, highlighting the impact of NPS with the “Earned Growth” framework.

This framework helps build long-term economic value through referrals, making it a complementary metric to NPS and helping measure true business impact.

Source: Earned Growth Framework, Fred Reichheld, Harvard Business Review, 2021

This framework helps build a long term economic value through referrals which makes it a complementary metric to NPS helping measure the true business impact.

- Net Promoter Score (NPS) is crucial for assessing business performance and customer experience, but deeper insights are essential.

- Monitoring response rates ensures a representative sample, reducing bias and enhancing survey quality.

- Analyzing NPS across customer segments provides targeted insights for strategic actions based on demographics, product usage, or geographic data.

Available Tools for Capturing Feedback

Several tools are available to cater to varying needs and budgets, providing comprehensive solutions for gathering and analyzing customer feedback effectively.

- Free Tools: Google Forms offers a basic but functional platform for creating surveys.

- Paid Tools: SurveyMonkey and Typeform provide more advanced features and customization options.

- Enterprise-Grade Tools: Qualtrics offer powerful solutions for large organizations with complex customer experience measurement needs.

- Feedback Collection Platforms: Medallia and Confirmit are specialized platforms offering robust capabilities for collecting and analyzing customer feedback across multiple channels.

Your most unhappy customers are your greatest source of learning.

Bill Gates Tweet

Best Practices for Gathering Customer Feedback

Here are some effective ways to gather valuable customer feedback:

- Use automation for surveys to minimize bias in collection and analysis.

- Aim for a good response rate by targeting the right audience, using multiple channels, and offering incentives.

- Balance anonymity for honesty with gathering basic customer data for targeted follow-ups and trend analysis.

- Design surveys carefully with clear questions aimed at actionable insights.

- Analyze feedback to pinpoint areas for improvement and make changes accordingly.

By following these best practices and utilizing the right tools, businesses can gain valuable insights into their customer experience and make data-driven decisions to create a loyal customer base and achieve sustainable growth.

Hope this blog has helped you get some insights about mapping out your customer experience measurement strategy.

For more such informative blogs and posts, stay tuned to DAIOM!!!

Subscribe to our Newsletter!