In India, shopping isn’t a straight line. A customer might see a product on Instagram, ask about deals on WhatsApp, and then walk into a store to buy it.

This mix of online discovery and offline buying is common now — but it creates new challenges for omnichannel brands. To scale smoothly, they need to pick a store model that suits their capital, gives enough control, and meets customer expectations across channels.

That’s why omnichannel brands like Tanishq, Zudio, and Lenskart are winning — by choosing the right offline model to support their omnichannel growth.

Scaling offline isn’t easy. But with strong tech, robust SOPs, and the right systems in place, omnichannel brands are scaling faster and more efficiently than ever.

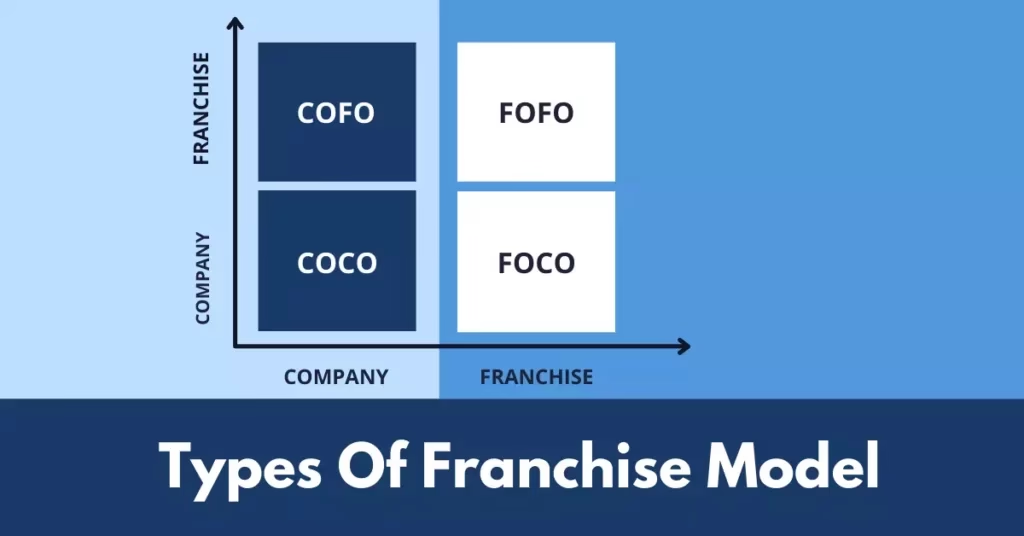

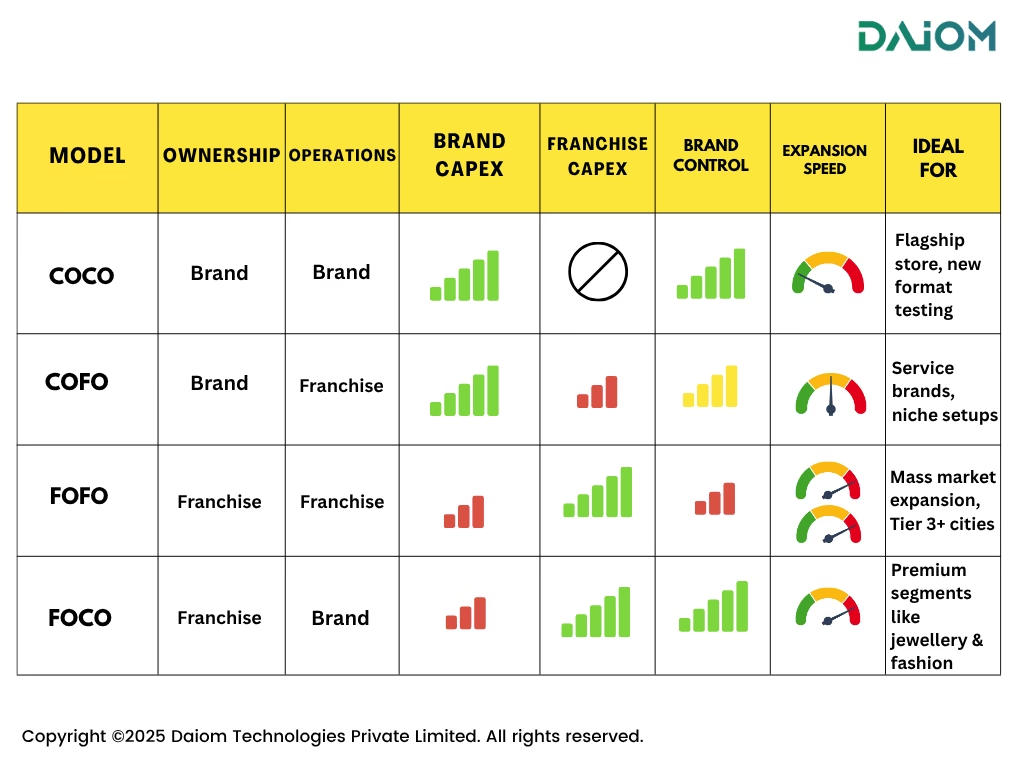

This blog breaks down four key retail expansion models—COCO (Company Owned, Company Operated), COFO (Company Owned, Franchise Operated), FOFO (Franchise Owned, Franchise Operated), and FOCO (Franchise Owned, Company Operated)—used by Indian omnichannel brands scaling their offline presence alongside online growth.

Learn how leaders like Lenskart (2,000+ COCO stores), Tanishq (1,000+ FOCO stores), DTDC (3,500+ FOFO points), and Zudio (500 FOCO stores) use these models to match customer expectations, city tiers, and investment strategies.

Your offline model isn’t just a real estate decision — it’s a growth strategy. The right format can unlock scale, reduce risk, and bring you closer to your customers.

Retail Strategy Lead, Omnichannel India Summit

Table of Contents

1. The Four Retail Store Models

When a brand decides to go offline, the first question isn’t where to open — it’s how. There’s no single right way to set up a retail store. The model you choose can define your growth speed, costs, control, and customer experience.

Let’s break down the four most common retail models — COCO, COFO, FOFO, and FOCO — and see how they work in the real world:

A. COCO – Company Owned, Company Operated

In the COCO model, the company owns everything — from the real estate to the staff. It’s the most control-heavy setup, where the brand directly manages store operations, inventory, pricing, and customer experience.

This model is perfect for omnichannel brands that care deeply about consistency. It allows full control over branding, store design, staff training, and tech adoption.

Advantages:

- Total control over operations and customer experience

- Easy to pilot new formats or tech

- Smooth sync with digital channels (omnichannel readiness)

Disadvantages:

- High investment and operating costs

- Expansion takes more time and planning

Examples in action:

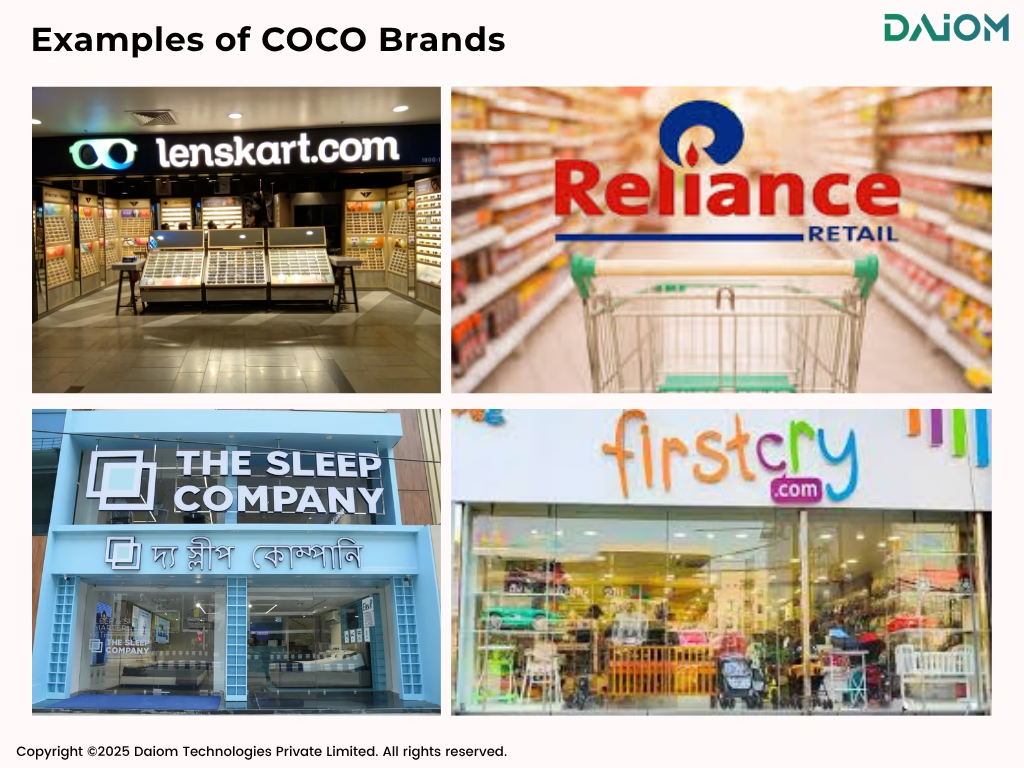

- Lenskart: ~80% of its 2,000+ stores are COCO

- Reliance Retail: Most verticals run on the COCO model

- FirstCry: Uses COCO in metro cities before franchising elsewhere

1.1 How Lenskart Scaled with the COCO Model?

Lenskart is one of the best examples of a brand that successfully leveraged the COCO (Company Owned, Company Operated) model to build a strong offline presence. Nearly 80% of Lenskart’s 2,000+ stores are COCO, showing how deeply committed the brand is to controlling the end-to-end customer experience.

By owning and operating its stores, Lenskart ensures consistency in everything—from store design and service quality to inventory and pricing. This control is critical for a product like eyewear, where accuracy, trust, and after-sales service play a big role in customer satisfaction.

The COCO format has also allowed Lenskart to:

- Seamlessly integrate online and offline channels, offering try-at-home, virtual try-on, and in-store pick-ups.

- Test new formats like smart stores and vision lounges without external interference.

- Invest in staff training, ensuring personalized consultations and tech-led fittings.

While the COCO model required high upfront investment, Lenskart used it to build a premium, uniform customer experience and create trust before entering smaller cities with other formats. This strategic use of COCO helped the brand scale smartly—without compromising on quality.

B. COFO – Company Owned, Franchise Operated

In the COFO model, the company owns the store infrastructure, but day-to-day operations are handled by a franchise partner. This setup strikes a balance between brand control and operational delegation.

It’s suited for businesses looking to stay asset-light on operations while retaining ownership of prime retail spaces. The franchisee brings local knowledge and handles the staffing, while the brand controls the environment.

Advantages:

- Brand retains control over infrastructure and store setup

- Franchisee contributes hands-on local expertise

Disadvantages:

- Still capital-intensive for the company

- Risk of uneven service or operational standards

Examples in action:

- Jawed Habib: Reportedly uses COFO in select semi-owned salon formats

- Training/service brands: Occasionally opt for COFO setups

- Rare Rabbit: Primarily runs on FOCO or COCO, with COFO being rare in practice

Difference Between COCO and COFO Model

COCO stands for Company Owned, Company Operated. In this model, the brand owns the store and manages everything—real estate, inventory, staff, and customer experience. It offers full control but also comes with high investment and operational costs.

COFO, on the other hand, stands for Company Owned, Franchise Operated. Here, the company still owns the store property and setup, but a franchise partner runs the day-to-day operations. This reduces the operational burden for the brand while still retaining asset ownership.

COCO = Brand owns + Brand runs the store

COFO = Brand owns + Franchise runs the store

This difference matters a lot when brands scale across cities. Some prefer full control (COCO), while others choose to grow faster with partners (COFO).

1.2 How Jawed Habib Uses the COFO Model?

Jawed Habib Hair & Beauty Ltd. is one of the few Indian brands that has experimented with the COFO (Company Owned, Franchise Operated) model—especially in select salon formats across metro and Tier 2 cities.

In the COFO setup, the company owns the salon infrastructure—including location, interiors, and equipment—while a franchise partner manages daily operations like staffing, customer service, and local marketing.

Jawed Habib chose this model in semi-owned setups where:

- The brand wanted to control the real estate or maintain uniform interiors, especially in high-footfall areas.

- Franchisees with local expertise could bring in strong operational value and customer relationships.

- Operational risks were shared, allowing the brand to maintain asset control while reducing manpower burden.

Though not widely adopted across its network, the COFO model allowed Jawed Habib to maintain brand consistency in key locations while remaining operationally light. However, due to the model’s complexity and cost structure, most of its expansion today leans more toward FOFO or hybrid approaches.

C. FOFO – Franchise Owned, Franchise Operated

In the FOFO model, the franchisee both invests in and manages the store, while following the brand’s guidelines and systems. The brand provides support, but day-to-day operations are fully in the franchisee’s hands.

It’s the fastest way to scale with minimal financial burden. Since franchisees put in their own capital and manage operations, they’re highly invested in the store’s success.

Advantages:

- Minimal financial risk for the brand

- Rapid expansion into new markets

- Franchisees are motivated by ownership and profits

Disadvantages:

- Limited control over daily operations

- Customer experience and branding can vary

Examples in action:

- DTDC: 3,500+ FOFO outlets nationwide

- Giani’s Ice Cream: Over 600 franchise stores

- Louis Philippe: 100+ Tier 2/3 stores

- Dolly Ki Tapri: 1,600+ franchise requests received.

1.3 How DTDC Scaled with the FOFO Model?

DTDC is a textbook example of how the FOFO (Franchise Owned, Franchise Operated) model can drive rapid, nationwide expansion. With over 3,500+ franchise outlets across India, DTDC has built one of the country’s largest last-mile delivery networks—without owning most of the stores itself.

In the FOFO model, each DTDC franchisee invests their own capital to set up and run the outlet, while operating under DTDC’s brand name and service standards. This allowed DTDC to:

- Expand quickly across Tier 2 and Tier 3 cities, even in remote areas, without heavy investments.

- Empower local entrepreneurs who know their markets and are highly motivated to deliver results.

- Keep operational costs low since the company didn’t have to invest in infrastructure or staffing.

This model worked well for DTDC’s business, where scale, reach, and speed matter more than complete operational control. By using FOFO, DTDC grew its footprint efficiently, built brand visibility, and improved delivery reach—especially important in a price-sensitive and logistically complex market like India.

D. FOCO – Franchise Owned, Company Operated

In the FOCO model, the franchisee invests in setting up the store, but the brand takes over the operations. It’s a hybrid approach that combines financial backing from franchisees with full control from the brand.

It’s ideal for sectors where customer experience is key, like premium retail. The brand ensures service standards while the franchisee helps reduce setup costs.

Advantages:

- Franchisee funds the store setup

- Brand controls daily operations and experience

Disadvantages:

- Requires the brand to efficiently manage store ops

- Revenue sharing models can be complex

Examples in action:

- Tanishq: 1,000+ stores, largely FOCO

- Kalyan Jewellers: 900+ stores

- Zudio: 500+ value fashion stores under FOCO

- Shoppers Stop, Lifestyle: Expanding via FOCO in Tier 2/3 cities

1.4 How Tanishq Scaled with the FOCO Model?

Tanishq, the jewellery brand from the Tata Group, has successfully used the FOCO (Franchise Owned, Company Operated) model to expand across India while maintaining tight control over its premium brand experience. With over 1,000+ stores, a large share of Tanishq outlets follow the FOCO format.

In this model, the franchisee funds the setup cost—including interiors, location, and infrastructure—while Tanishq manages the store’s daily operations, including staff, inventory, pricing, and customer service.

This approach helped Tanishq:

- Ensure consistent customer experience, which is crucial for high-value purchases like gold and diamond jewellery.

- Retain control over pricing, product assortment, and service standards—key to building trust in a category driven by credibility.

- Scale faster by reducing its capital burden while still running operations in a centralized, brand-led way.

By combining the franchisee’s investment with the brand’s operational excellence, Tanishq built a strong, uniform offline presence—especially in Tier 2 and Tier 3 cities—without compromising on quality or brand promise.

Difference Between FOFO and FOCO Models

FOFO (Franchise Owned, Franchise Operated)

In this model, the franchise partner does it all — they invest in the store, own the setup, and manage daily operations. The brand provides the name, training, and support, but the store is fully run by the franchise. It’s low cost for the brand and ideal for quick expansion.

FOCO (Franchise Owned, Company Operated)

This one flips the script. The franchise partner invests and owns the store, but the brand takes care of operations. That means the company runs the store, hires the staff, and manages the experience — all while the franchise earns a return on their investment.

To summarise:

FOFO = Franchise owns + Franchise runs the store

FOCO = Franchise owns + Brand runs the store

Brands pick between these based on how much control they want vs. how quickly they want to scale.

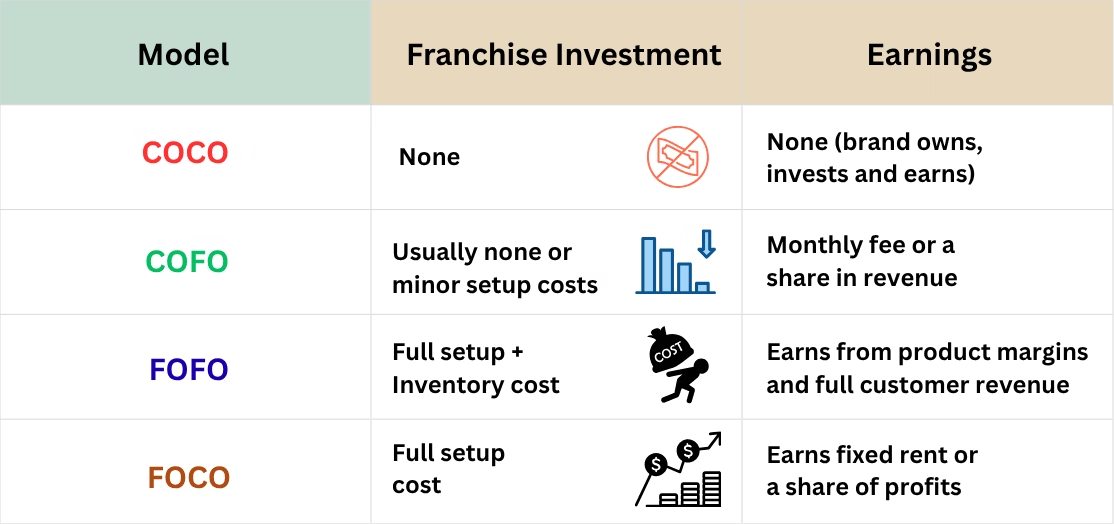

2. How Franchisees Make Money?

Franchise models don’t just define how stores operate — they also define how money flows. From who pays for setup to how profits are shared, each model offers a different earning opportunity for the franchisee.

Here’s a breakdown of how franchisees invest and earn under each model:

- COCO (Company Owned, Company Operated): The brand owns everything. Since the franchisee isn’t involved, there’s no investment or earning opportunity here for external parties.

- COFO (Company Owned, Franchise Operated): The brand invests in setup. The franchisee, usually an operator, earns a monthly management fee or a small revenue share. It’s low risk, low return.

- FOFO (Franchise Owned, Franchise Operated): The franchisee puts in full capital — store interiors, staff, inventory, etc. In return, they keep the full margin from product sales. It’s high risk, but offers full control and earning potential.

- FOCO (Franchise Owned, Company Operated): The franchisee funds the store setup, but the brand runs the show. The franchisee typically earns a fixed rent or a percentage of the store’s profits. This model suits those looking for passive income without operational involvement.

Each model has a different risk–return equation. If a franchisee wants full control and high rewards, FOFO is ideal. If they prefer low effort and steady income, FOCO is a better bet.

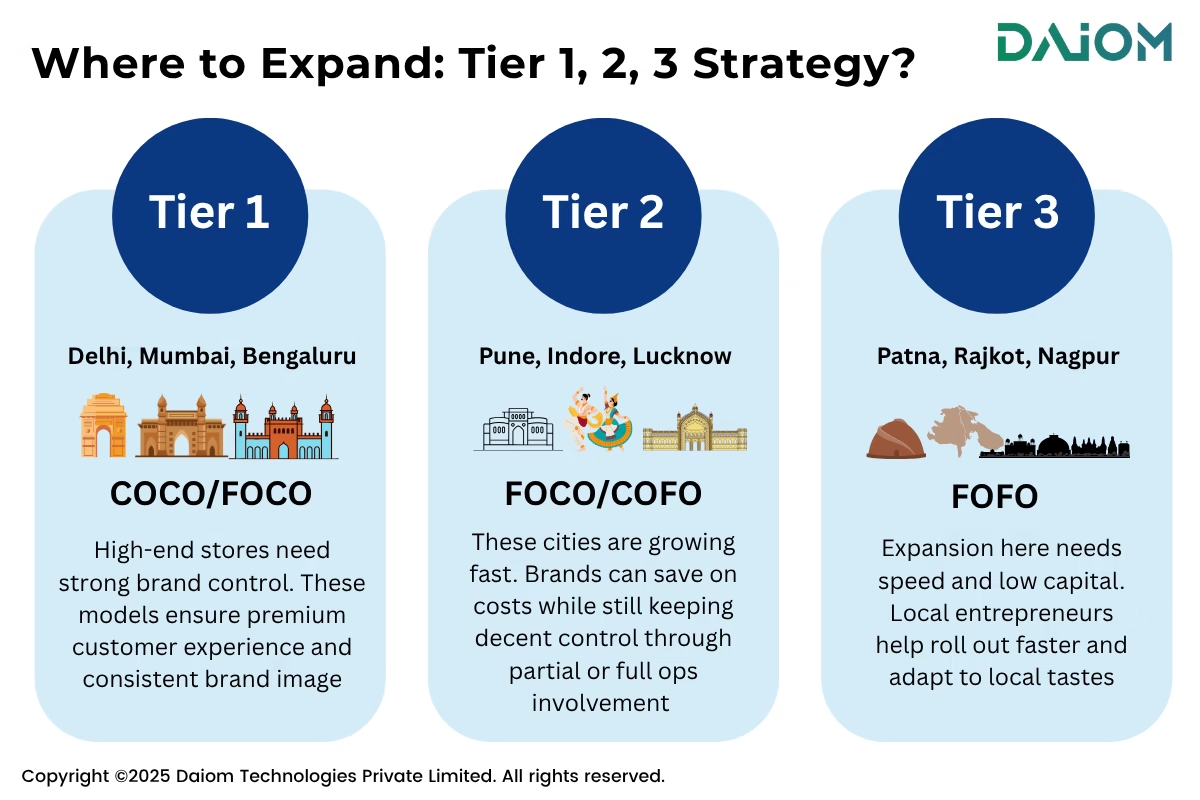

3. Where to Expand: Tier 1, 2, 3 Strategy?

Not all cities need the same store model. Choosing the right model by tier ensures you’re not just expanding — you’re expanding smart.

A metro like Delhi will demand a different setup compared to a Tier 3 town like Nagpur. Choosing the right retail model based on city tier can help balance brand control, cost, and speed of expansion.

Here’s a quick comparison of what works best where:

Let’s simplify this:

- Tier 1 Cities demand premium experiences. These are high-competition zones where omnichannel brands want full control. COCO or FOCO models work best to protect the brand’s image and ensure service consistency.

- Tier 2 Cities offer growth at lower costs. Here, omnichannel brands can experiment with FOCO (for control) or COFO (to reduce operational load), balancing investment with reach.

- Tier 3 Cities need speed and local connection. FOFO is ideal because local franchisees understand the audience better and help scale quickly with minimal brand investment.

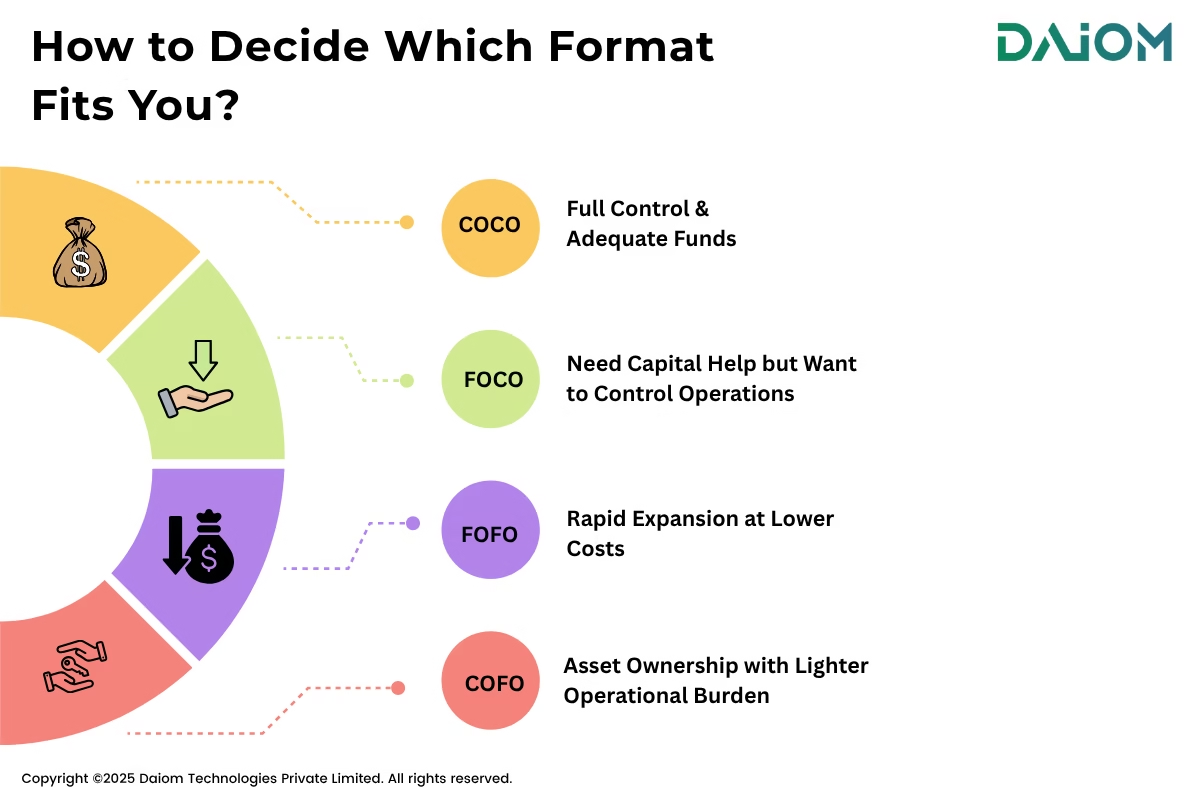

4. How to Decide Which Format Fits You?

Determining the right retail format for your brand is all about aligning your ambitions with your resources and comfort with risk. Start by clarifying what’s most important to you—whether it’s having absolute control over the customer experience, minimizing upfront costs, or speeding up your expansion.

For example, if you have the funds and want to carefully manage every aspect of operations, the COCO model is ideal. If you prefer to let franchise partners handle the day-to-day work while still keeping tight reins on the customer experience, FOCO might be the best fit.

Here are some quick points to help clarify your choice:

- Full Control & Adequate Funds: Opt for COCO, where you own and operate every element, perfect for flagship stores or pilot testing new formats.

- Need Capital Help but Want to Control Operations: Choose FOCO, where the franchisee funds the setup, and you control the operations—ideal for premium sectors like jewellery and fashion.

- Rapid Expansion at Lower Costs: Go with FOFO, a model that lets franchisees invest and run the stores, making it ideal for mass-market expansion and tapping into new geographies quickly.

- Asset Ownership with Lighter Operational Burden: Consider COFO if you want to keep asset control but prefer not to handle the daily operations, suitable for service-based or niche formats.

By answering these questions, you can align your strategic goals with the right retail model, making your expansion both efficient and sustainable.

5. Most and Least Popular Models in India

In the Indian retail landscape, some store models have become the go-to choice for expansion, while others remain niche or rarely used. The difference usually comes down to scalability, capital needs, and operational control.

Most Popular: FOFO (Franchise Owned, Franchise Operated)

FOFO is the most widely used model in India, especially for omnichannel brands looking to grow quickly across multiple cities. It’s cost-effective for the brand and offers local entrepreneurs a chance to run their own business under an established name.

Why it’s widely adopted:

- Minimal investment from the brand

- Fast expansion into Tier 2 and Tier 3 cities

- Franchisees take full ownership and responsibility

Brands using this model:

- DTDC: 3,500+ franchise counters

- Giani’s Ice Cream: 600+ outlets

- Louis Phillipe: 100+ stores in Tier 2/3 cities

Least Popular: COFO (Company Owned, Franchise Operated)

COFO sees very limited use in Indian retail. In this model, the brand invests in the store infrastructure but leaves operations to a franchisee — which often results in lower control with high upfront costs.

Why it’s rarely used:

- High capital burden on the brand

- Limited control over daily operations

- Operational inconsistencies across stores

Where it’s seen occasionally:

- Service-focused setups like training centers

- Select salons such as Jawed Habib (in semi-owned formats)

Overall, FOFO remains the preferred model for rapid and wide-scale growth, while COFO is used selectively, if at all.

"The future of retail isn’t just digital or physical—it’s strategic. Choosing the right store model is as important as choosing the right product."

— Kumar Rajagopalan, CEO, Retailers Association of India

6. Conclusion

Omnichannel may shape the future of Indian retail, but your store model determines how effectively and sustainably you scale. Whether you’re entering metros or smaller towns, there’s no one-size-fits-all format. The right model depends on your capital, your need for operational control, your customer experience goals, and where you’re planning to grow.

Align your format with your brand’s strengths—financial, operational, and strategic—and you’ll be better positioned to scale smartly, serve consistently, and reach India’s next billion customers.

If you’d like to discuss how we can help optimize your omnichannel and offline expansion strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at saurabh@daiom.in

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!