The way people shop is changing faster than ever, and nowhere is this transformation more evident than in the rise of quick commerce in India.

Recently, I celebrated my younger son’s birthday. To my surprise, we received four smart TVs—of the same model! Turns out, each person had ordered from quick commerce platforms like Zepto and Blinkit because of their instant availability. This made me realize just how deeply quick commerce has changed shopping habits.

What started with groceries has now expanded to high-ticket items like electronics and mobile accessories. Brands like boAt are actively listing on these platforms, tapping into the growing demand for instant purchases. The real story of quick commerce isn’t just in the data—it’s in how products are now shaping consumer behavior.

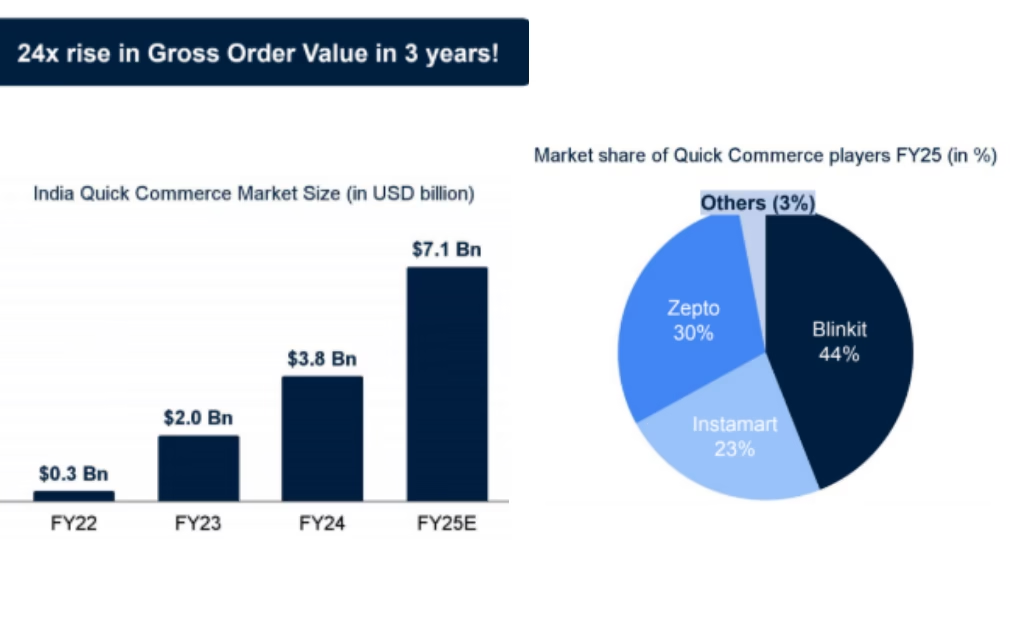

Quick commerce in India has seen a 24x growth in order value since FY22, with the user base doubling year over year. According to a report by Blume Ventures, this segment is India’s fastest-growing market, outpacing all other forms of retail.

Projections by strategy consultancy RedSeer estimate that the market will reach $5.5 billion (approximately INR 46,280 crore) by 2025, an increase from its early stages. In 2023 alone, the market surged by 77%, reaching $2.8 billion, while traditional retail grew at a much slower pace of just 5-10%.

Nearly 46% of online shoppers abandon their carts if deliveries take too long. The demand for speed is undeniable, and brands that fail to adapt risk losing customers to competitors who can fulfill orders faster

McKinsey

One clear example of this shift can be seen in the beauty industry. Previously, essential products like makeup remover, sunscreen, and lip balm would take days to arrive.

Now, thanks to quick commerce platforms like Blinkit and Zepto, these products are delivered within hours, encouraging consumers to try new brands that can fulfill their needs instantly.

This is also affecting traditional platforms such as Nykaa and Amazon, where sales of essential beauty items have declined in favor of faster alternatives.

Earth Rhythm, for example, saw its sales increase from Rs 5 lakh per month to over Rs 1.5 crore in just 18 months on Blinkit—growth that previously took three years to achieve on Amazon.

Table of Contents

- Why is Quick Commerce growing in India?

- Why is Quick Commerce Attractive to D2C Brands?

- Challenges for D2C Brands in Quick Commerce

- Examples of D2C Brands Succeeding in Quick Commerce

- Logistics Players Powering Quick Commerce in India

- Top 10 Quick Commerce Companies in India

- How Can D2C Companies Adapt to Quick Commerce?

- The Future of Quick Commerce

- Conclusion

1. Why is Quick Commerce growing in India?

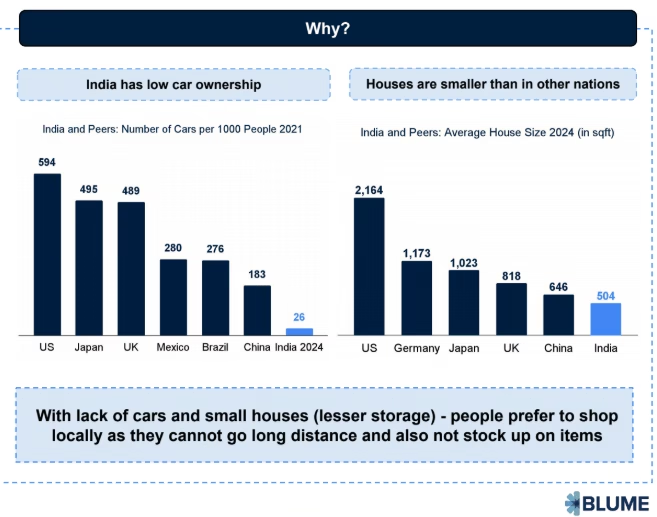

Quick commerce is growing fast in India because the country never fully moved to big supermarkets like in Western countries. Instead, people have always shopped at small neighborhood kirana stores.

There are a few reasons for this.

- Many people don’t own cars, so traveling far for shopping is not easy.

- Most homes are small, so families can’t store a lot of groceries at once. Because of this, Indians are used to buying things in small amounts as and when needed.

Now, quick commerce is making this habit even easier by delivering essentials to people’s homes in minutes.

Instead of moving from kirana stores to big supermarkets, India is skipping that step and going straight to quick commerce. This change is happening because of better technology, more smartphone users, and the rapid growth of fast delivery services.

Several factors contribute to the success of quick commerce in India:

- Low labor costs make hiring delivery personnel more affordable compared to Western markets.

- Low rider costs as a proportion of gross order value help maintain profitability.

- High population density allows for efficient delivery networks and quick fulfillment.

According to the Blume report. 2025, the minimum wage-to-cart size ratio in India is just 10-12%, compared to 35-40% in China and 40-50% in Western countries, making quick commerce more economically viable here.

2. Why is Quick Commerce Attractive to D2C Brands?

Quick commerce offers a lot of benefits that make it appealing for Direct-to-Consumer (D2C) brands. With more people using smartphones and shopping through mobile apps, instant delivery is becoming the norm.

Consumers no longer want to wait for days; they expect products to arrive within hours. This shift in shopping behavior is making quick commerce an essential sales channel for many brands. Here are some of the reasons behind its fast growth:

- Convenience: People value speed. Instead of waiting days for deliveries, they now expect essentials, groceries, and even non-food products to arrive in just a few hours.

- More product choices: Quick commerce platforms started with groceries but have now expanded into new categories like electronics, fashion, beauty products, personal care, toys, and gifts. This makes them attractive for both consumers and brands.

- Competitive pricing: Despite fast delivery, these platforms offer competitive prices, making them an appealing alternative to traditional retail and e-commerce.

As quick commerce spreads beyond big cities into Tier-2 and Tier-3 cities, D2C brands are seeing rapid growth. Today, over 30% of sales on these platforms come from new-age brands.

Interestingly, in smaller cities, these brands sell 2-3 times more than they do in metro areas. This is because traditional stores in smaller cities often have limited stock, making fast delivery platforms the preferred choice for consumers.

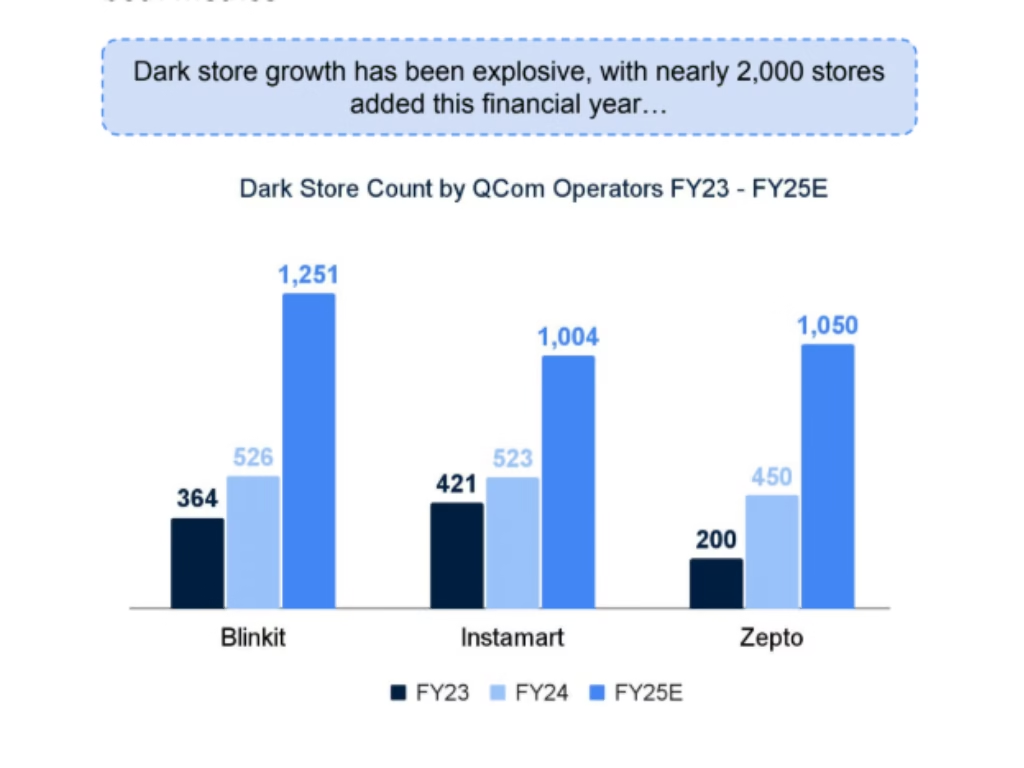

To keep up with rising demand, quick commerce companies are aggressively expanding their operations. In FY24 alone, nearly 2,000 new dark stores were set up across India to improve delivery speed and coverage. (Source: Blume Report, 2025).

Other than this, quick commerce also has high customer engagement. People who shop on these platforms often know exactly what they want, leading to fewer returns. You will understand this better through the 4700BC success story.

2.1 The Success Story of 4700BC

One example of a brand being successful through quick commerce is 4700BC, which is available on major platforms like Blinkit, Zepto, Swiggy Instamart, BigBasket, and Amazon Fresh.

Sales through these platforms are growing at an impressive 45% year-on-year and now account for a massive 87% of their total sales.

“Among online sales from traditional e-commerce platforms like Amazon and Flipkart, and direct website sales, it’s in quick commerce that we see the highest consumer engagement. It’s now integral to our overall digital strategy,” says Chirag Gupta, Founder & CEO of 4700BC.

3. Challenges for D2C Brands in Quick Commerce

Despite its benefits, quick commerce is not without its challenges. The rapid fulfillment model demands high operational efficiency and brings several challenges as well for D2C brands like:

4. Examples of D2C Brands Succeeding in Quick Commerce

Several D2C brands have successfully leveraged quick commerce to scale their business, taking a plunge into the demand for instant gratification among consumers.

- NEWME, a fast fashion brand, started offering 90-minute deliveries in September 2024 in parts of Gurugram. Within 30 minutes of launching, they received over 100 orders, some delivered in under 25 minutes. Now, NEWME covers more than 18 areas in Delhi-NCR.

- SNITCH, a men’s fast-fashion brand, has introduced a two-day delivery service across over 1,100 cities and 7,000+ pin codes in India. This enhancement ensures that 60% of orders are delivered within two days, aiming to boost customer satisfaction and drive growth.

- Decathlon, the sports equipment brand, has partnered with platforms like Zepto to offer deliveries in as little as 10 minutes in 16 cities. This partnership helps Decathlon deliver products quickly while expanding its reach.

- Nykaa, has launched a 10 min delivery pilot in Borivali, Mumbai

- Myntra is piloting a 3o mins delivery plan in 4 cities including Delhi and Bangalore.

Many other brands, such as DaMENSCH, Epigamia, Lenskart, and more, are also using quick commerce platforms like Blinkit, Zepto, and Swiggy Instamart to expand their market.

5. Logistics Players Powering Quick Commerce in India

Quick commerce relies on hyper-efficient logistics networks to fulfill orders within minutes. Companies like Blitz, Zippie, and LoadShare play a crucial role in enabling this rapid delivery ecosystem. Here’s how they contribute:

- Blitz (Founded in 2020 by Anuj Mehta & team): Specializes in AI-powered route optimization to reduce delivery times. It partners with major quick commerce platforms to ensure real-time tracking and seamless last-mile fulfillment.

- Zippie (Established in 2019 by ex-Flipkart executives Rajiv Sharma & Neha Kapoor): Focuses on dark store logistics, managing micro-warehouses strategically located within cities. This helps reduce dependency on traditional warehouses and speeds up deliveries.

- LoadShare (Started in 2017 by Rakib Ahmed, Tanmoy Karmakar & team) – Operates a hub-and-spoke model to enhance regional logistics efficiency, helping quick commerce brands expand to tier-2 and tier-3 cities.

These logistics players are the backbone of quick commerce, enabling ultra-fast deliveries and shaping the future of instant retail.

6. Top 10 Quick Commerce Companies in India

Here are the top 10 quick commerce companies in India, revolutionizing instant delivery across groceries, essentials, and fashion.

- Blinkit (2013, Gurgaon) – Formerly Grofers, Blinkit pioneered 10-minute grocery delivery and was acquired by Zomato in 2022. It holds a 40-46% market share.

- Zepto (2021) – Founded by Aadit Palicha and Kaivalya Vohra, Zepto scaled rapidly with 250+ dark stores, offering groceries, personal care, and electronics.

- Swiggy Instamart (2020) – A Swiggy subsidiary with 150 dark stores, it processes over a million orders weekly and plans aggressive expansion.

- BigBasket Now (2021) – Tata-owned BB Now operates 500+ dark stores in 35 cities, offering a vast range of grocery SKUs.

- Flipkart Minutes (2024) – Launched by Flipkart for 10-minute deliveries, starting in Bengaluru and expanding to Delhi NCR and Mumbai.

- Dunzo Daily (2015) – Founded by Kabeer Biswas and team, it offers grocery and essentials delivery, backed by Reliance Retail.

- Amazon Fresh (2019) – Amazon’s grocery service operates in 300+ Indian cities, ensuring fast delivery with a four-step quality check.

- M-Now (Myntra) (2024) – Myntra’s two-hour fashion delivery service launched in Bangalore, catering to Gen Z shoppers.

- Slikk (2024) – A fashion-focused quick commerce startup offering 60-minute delivery in Bangalore, with a Try Before Buy feature.

- FreshToHome (2015) – Founded by Shan Kadavil and Mathew Joseph, it specializes in fresh meat and seafood, with over 100 hubs in India and Dubai.

7. How Can D2C Companies Adapt to Quick Commerce?

To succeed in quick commerce, D2C brands must go beyond just listing on platforms. Here are three critical factors to focus on:

- Build Your Own Quick Commerce Supply Chain – Instead of relying solely on third-party platforms, brands can enable fast deliveries by shipping directly from stores or setting up local fulfillment centers. This gives better control over logistics and margins.

- Optimize Unit Economics & Inventory Management – Quick commerce can be expensive, so brands must ensure profitability by optimizing pricing, delivery costs, and product selection. Managing inventory efficiently is also key—stocking too much can lead to pile-ups, while too little can cause lost sales.

- Leverage Analytics to Measure Speed Impact – Fast delivery isn’t just about convenience; it can influence customer experience and brand perception. Using data analytics to track its impact on conversions, repeat purchases, and overall profitability is crucial.

8. The Future of Quick Commerce

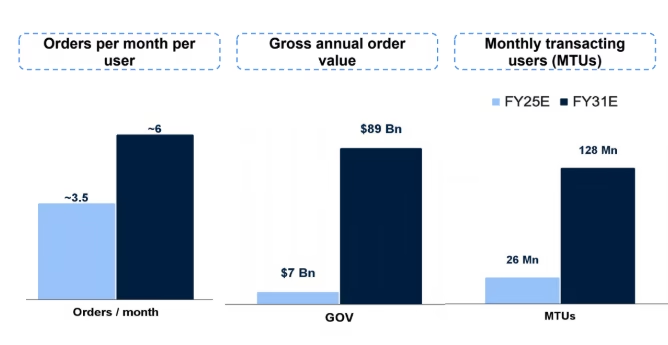

As per the prediction of analysts, quick commerce will reach $89 billion by FY31. But, we still do not know whether this is realistic or not.

It is because much of India’s consumption comes from just 8-10 million households, and this segment is growing slowly.

Instead of a broad expansion, consumption is deepening. This means attracting new users may be tough, and doubling order volumes could be a challenge.

9. Conclusion

Quick commerce is set to play a major role in the future of retail, especially for D2C brands. However, to stay competitive, brands must manage the key challenges like fast deliveries, changing customer demands, and efficient logistics.

Moreover, AI and data analytics can help brands plan better, reduce waste, and cut costs—making quick commerce more sustainable in the long run.

Read more – Marketing Analytics | The Next Big Frontier in Data-Driven Growth

The brands that succeed will be the ones that balance speed with efficiency, ensuring they meet customer needs while keeping operations cost-effective.

If you’d like to discuss how we can help enhance your quick commerce strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!