India is often praised for its digital growth. But when you look closer, there are still many challenges.

While over 800 million Indians are online — but not everyone has the same experience. Most use mobile phones, internet quality is uneven, and there’s still a big gap between how men and women access the internet.

The 2025 Digital Country Report shares clear data on what’s working — and what still needs to improve.

Here’s a quick breakdown of the top 10 India Digital stats that you need to know:

- Indians spend nearly 7 hours online daily, mostly on mobile.

- Over 800 million people in India use the internet.

- WhatsApp is used by 80.8% of internet users.

- Social media use is 2.5 hours a day across 7+ apps.

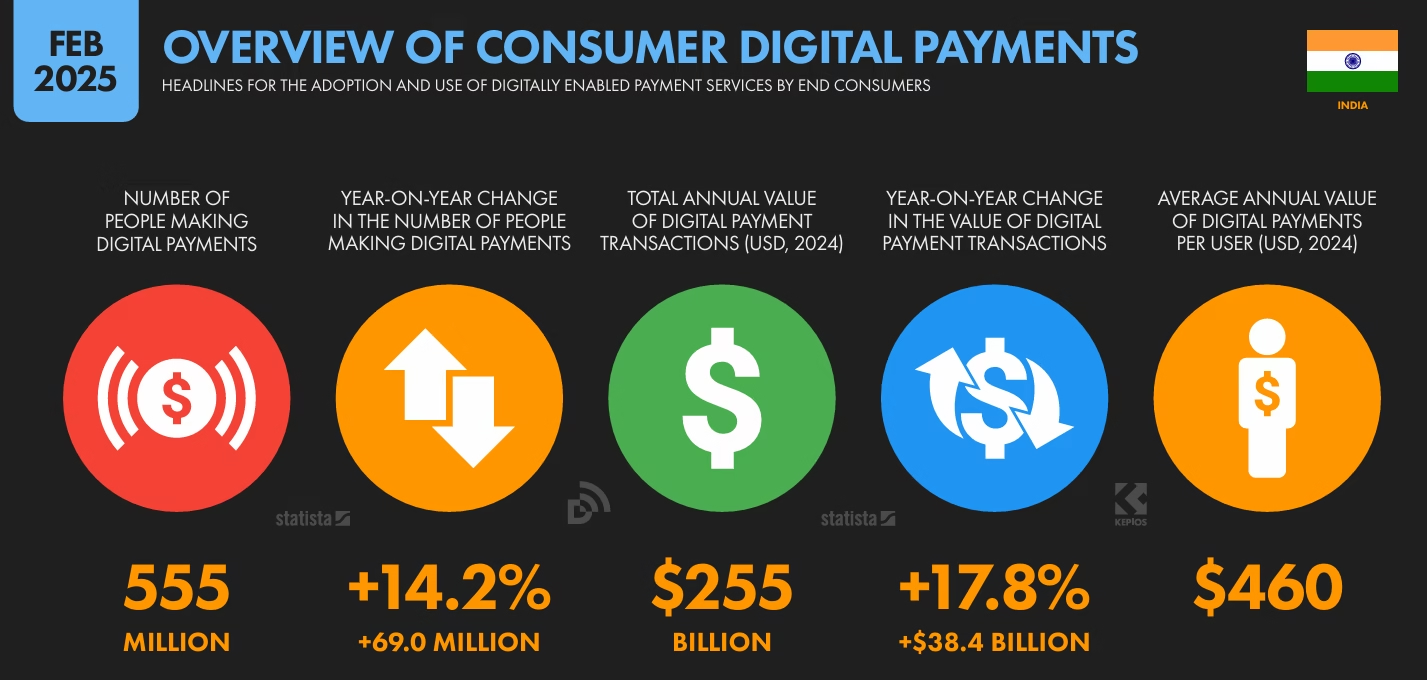

- 555 million Indians use digital payments regularly.

- 97.4% of internet users own a smartphone.

- 155 million people use digital health apps and services.

- 43.3% go online to learn or upskill.

- By 2030, 20% of India’s GDP will come from digital.

- Only 26.2% of WhatsApp users are women, showing a gender gap.

India has over 800 million internet users, but access, speed, and experience still vary widely across regions.

Table of Contents

1. What Drives India’s Internet Use?

In Feb 2025, Indians spent an average of 6 hours 49 minutes online each day — with 58% of that time on mobile phones. That’s nearly 4 hours daily just on mobile internet use, showing how central smartphones have become to our digital habits.

But what are people doing online for so many hours?

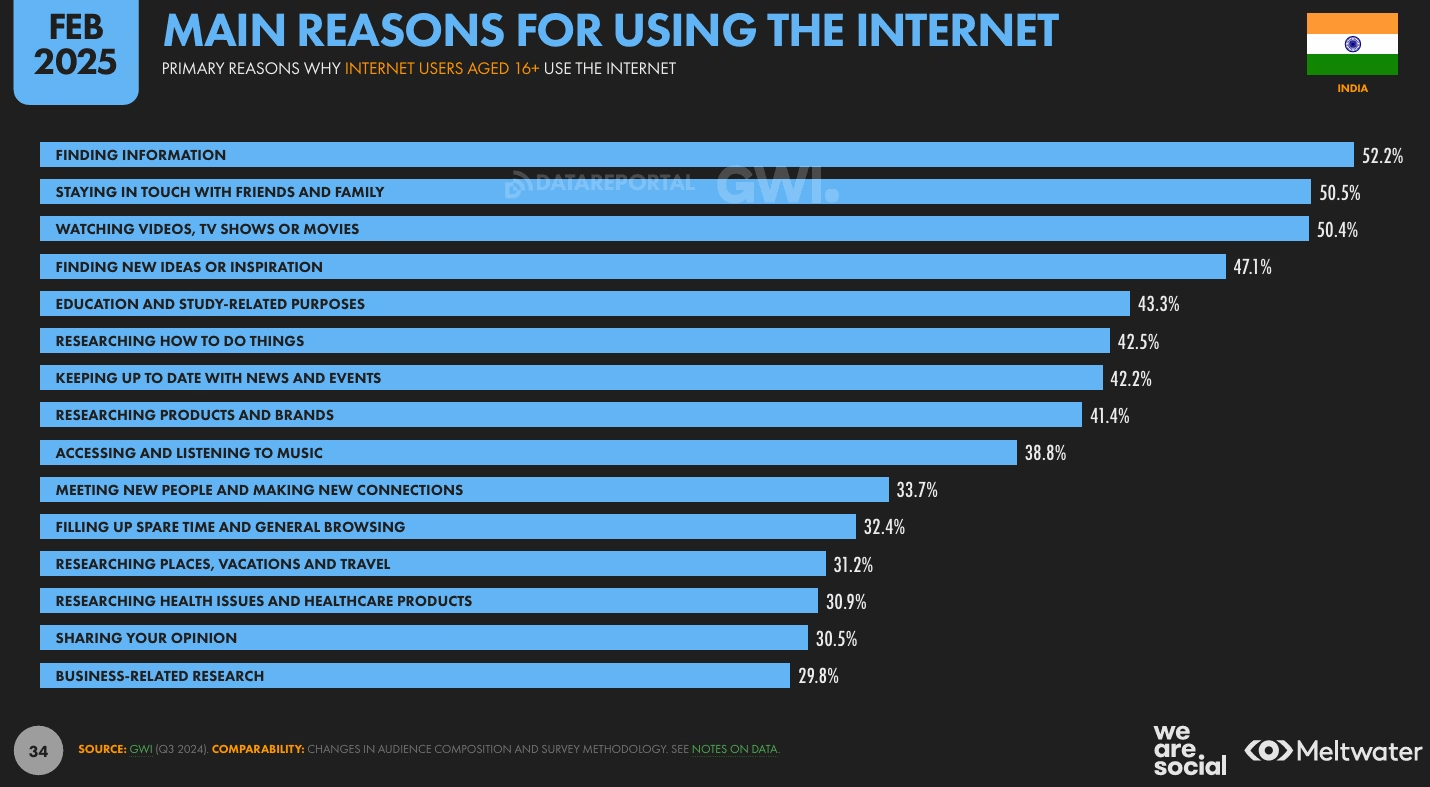

A recent report reveals the top five reasons why Indians go online — and it reflects a mix of everyday needs, habits, and entertainment:

- 52.2% go online to find information — from quick facts to in-depth research, users rely on Google, YouTube, and other platforms to answer everyday questions.

- 50.5% use the internet to stay in touch with family and friends — mostly through WhatsApp, Instagram, and Facebook.

- 50.4% go online to watch videos and entertainment — driven by platforms like YouTube, OTT apps, and Instagram Reels.

- 43.3% use the internet for education and learning — from school students to professionals upskilling via online courses.

- 42.2% log on to stay updated on news and current events, using digital news portals, Twitter/X, and even WhatsApp forwards.

These behaviors clearly show that social networking, research, and content discovery are central to how Indians spend their time online.

Indians now spend an average of 6 hours and 49 minutes online each day, with 58% of that time spent on mobile phones.

It highlights the need for:

- Content marketing that’s optimized for search and answers real user queries.

- Regional-language tools and platforms that make learning accessible to non-English speakers.

- Mobile-friendly, video-first content that works well even on lower-speed networks.

Public services, educators, and brands must build with these habits in mind to truly connect with the Indian digital audience.

2. Social Media Growth in India: How Big Is the Audience?

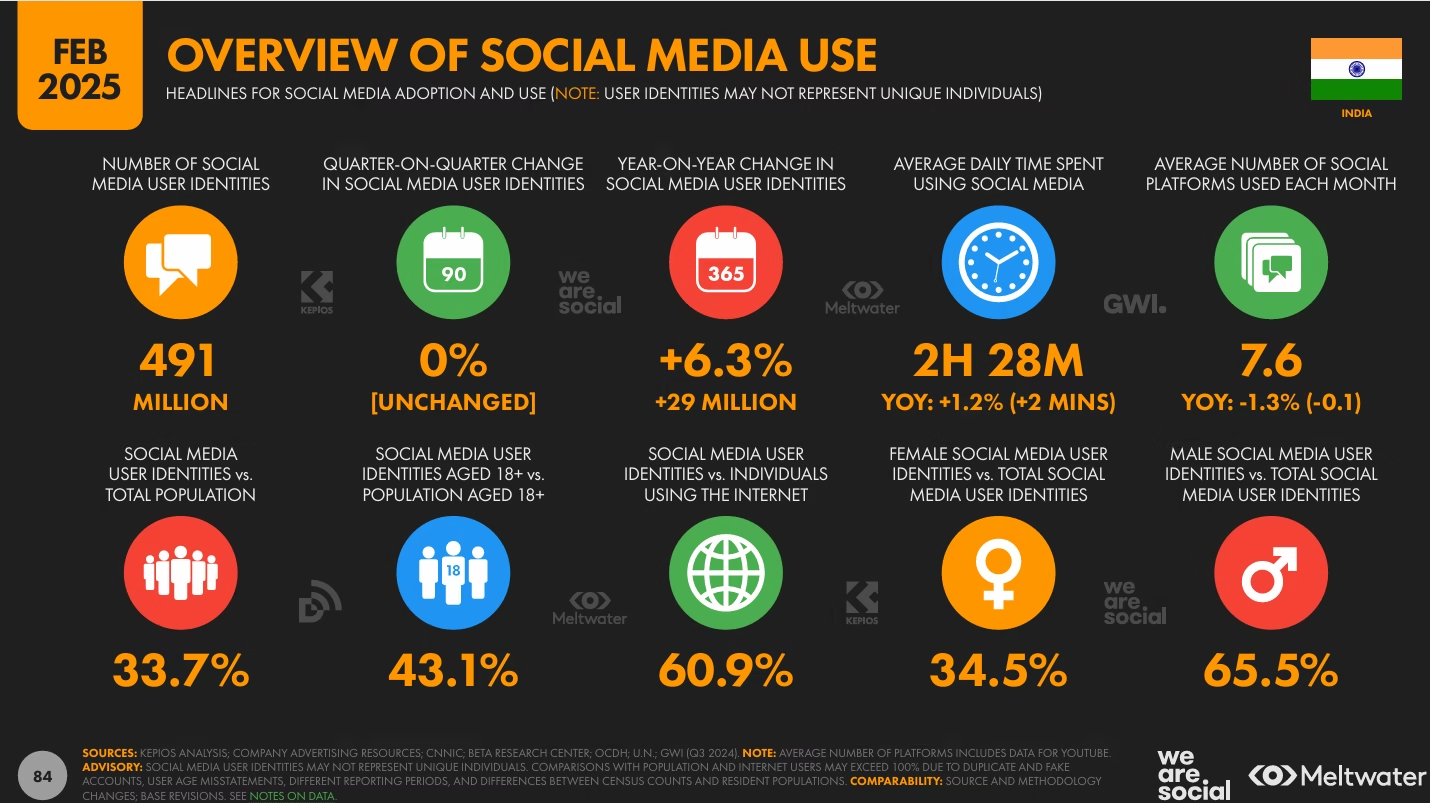

India’s social media audience is massive—and still growing. As of 2025, there are 491 million social media user identities, and users spend nearly 2.5 hours a day across platforms.

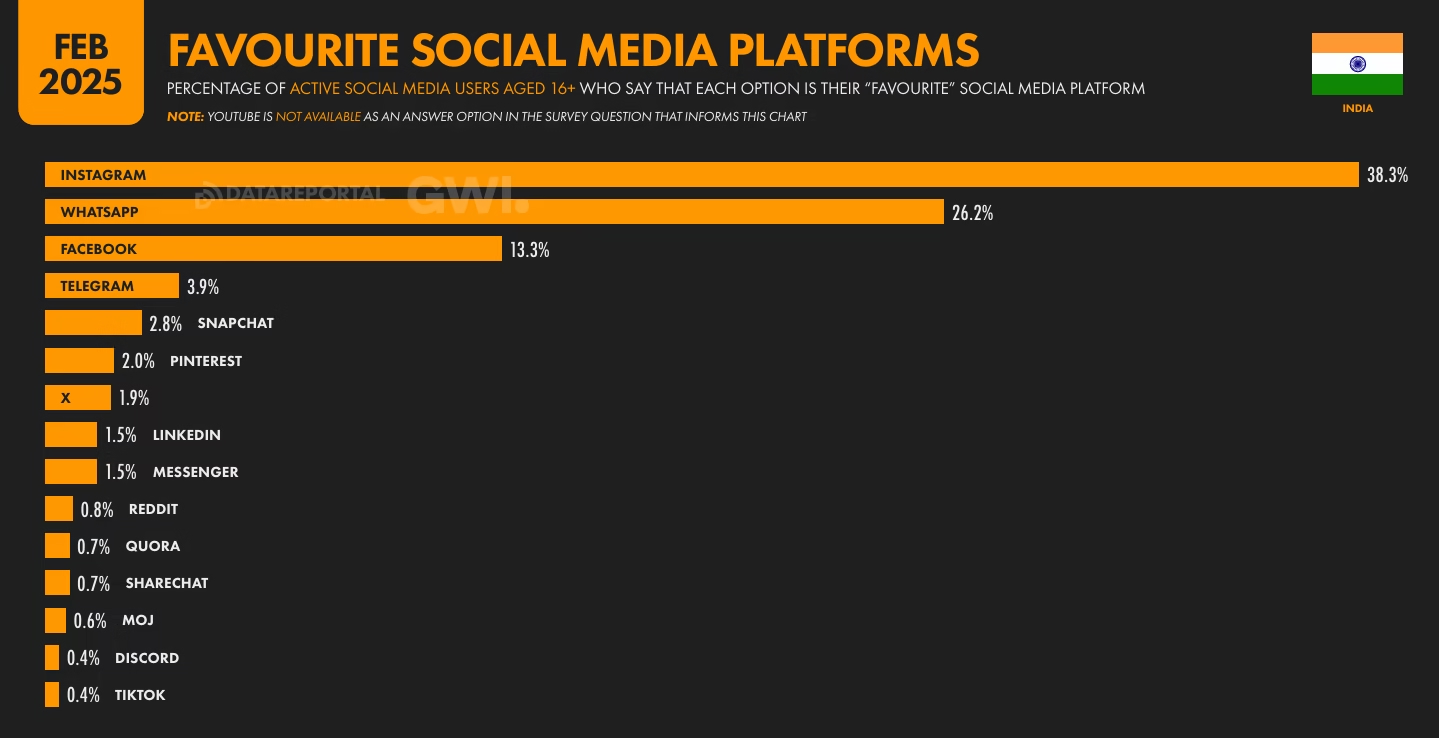

Instagram has now taken the lead in growth. In the previous report, Facebook was the top platform in terms of reach. But this year, Instagram has overtaken Facebook, driven by its younger audience, Reels, and creator ecosystem.

Facebook still continues to grow, especially in Tier 2 and 3 cities. But the real surprise has been Snapchat, which is growing very fast in India, especially among Gen Z. It’s becoming one of the go-to platforms for short, visual communication and content discovery.

Indian users spend about 2 hours and 28 minutes daily on social media, across an average of 7.6 platforms each month.

This shift shows how user behavior is changing—from text-based networking to visual-first, mobile-native platforms. For brands, it’s a reminder to constantly re-evaluate where their audience actually spends time and how they prefer to engage.

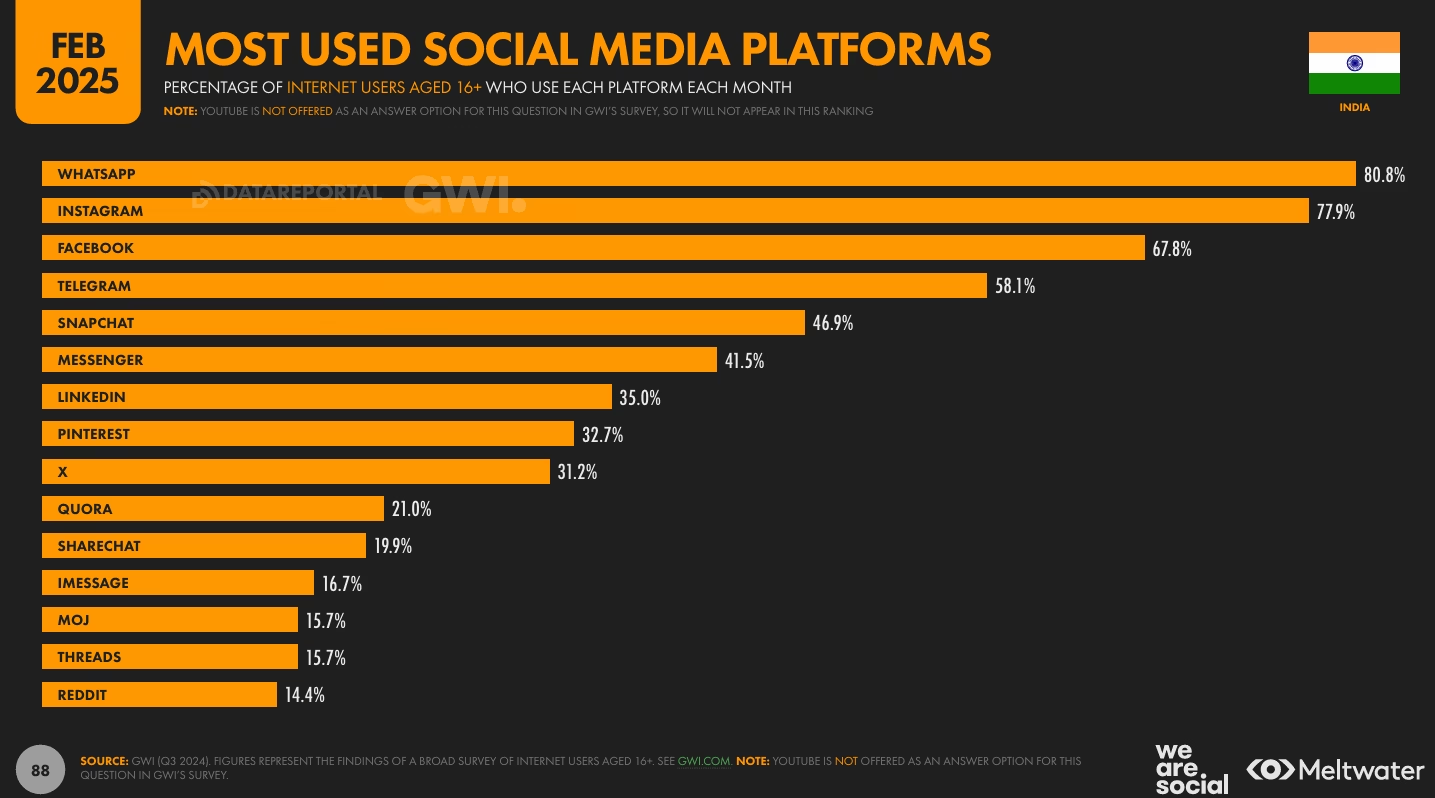

The most popular platforms:

- WhatsApp – used by 80.8% of internet users

- Instagram – used by 77.9%

- Facebook – used by 67.8%

- Telegram – used by 58.1%

- Snapchat – used by 46.9%

Read more – Driving Business Impact through Social Media Marketing

WhatsApp is the most used platform among Indian internet users, followed closely by Instagram and Facebook.

As of February 2025, Instagram is the most loved social media platform in India, with 38.3% of users calling it their favorite—well ahead of WhatsApp (26.2%) and Facebook (13.3%). While Facebook continues to have reach, platforms like Instagram and Snapchat (2.8%) are gaining popularity faster, especially among younger audiences looking for short-form, visual content.

2.1 LinkedIn’s Reach in India Is Growing Fast

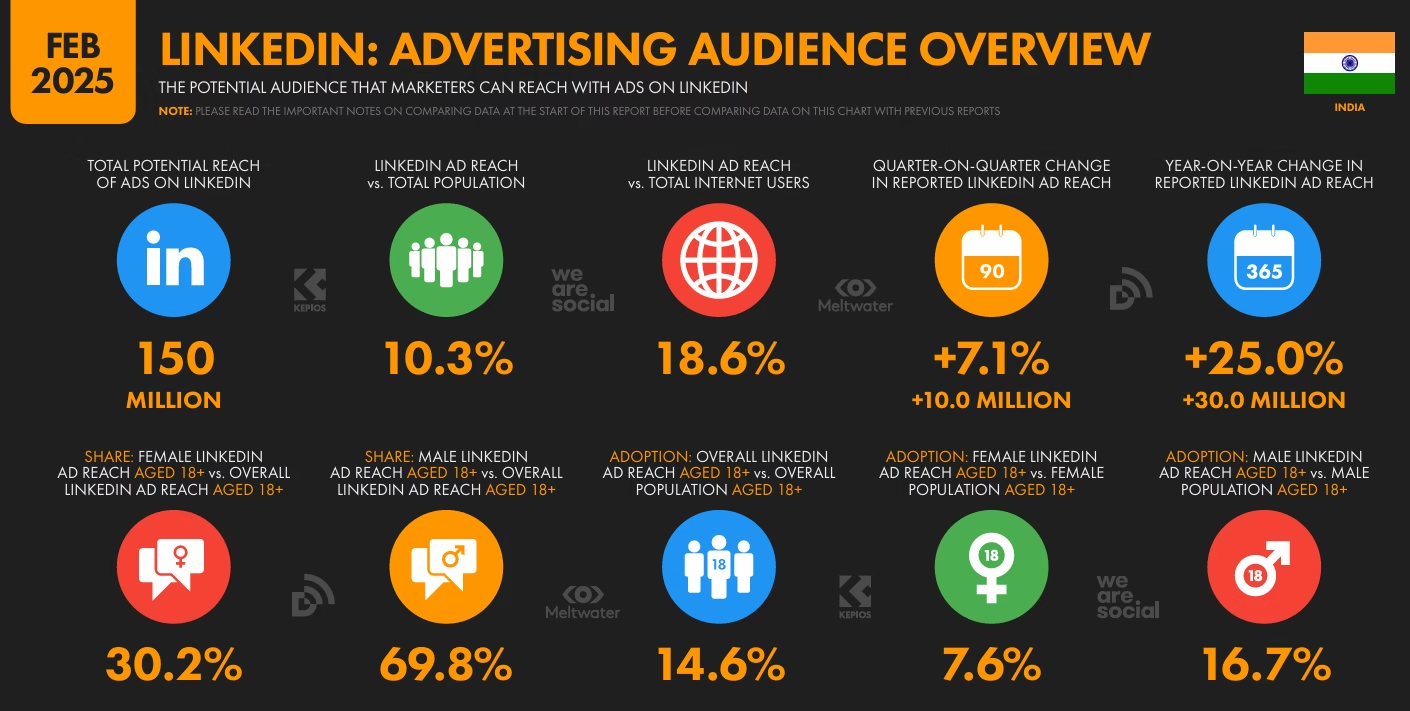

LinkedIn’s ad reach in India has climbed to 150 million users, covering 10.3% of the total population and 18.6% of total internet users. What’s more impressive is its 25% year-on-year growth, adding 30 million users in just one year.

Adoption is higher among men (69.8%) compared to women (30.2%), but both segments are growing. The platform also saw a 7.1% growth in the last quarter alone, showing that LinkedIn is becoming an increasingly important space for marketers, recruiters, and professionals to engage audiences in India.

For brands targeting working professionals or B2B buyers, this growth signals a big opportunity.

How to Reach Today’s Digital Consumer?

- Brands can use WhatsApp or Telegram to talk directly with customers — whether it’s to solve problems, share updates, or run offers.

- News and content creators can use these channels to send regional, hyper-local stories.

- And for marketers, platforms like Instagram and Snapchat are ideal for reaching young users who spend a lot of time on short videos.

3. Devices: Mobile-Only (For Most)

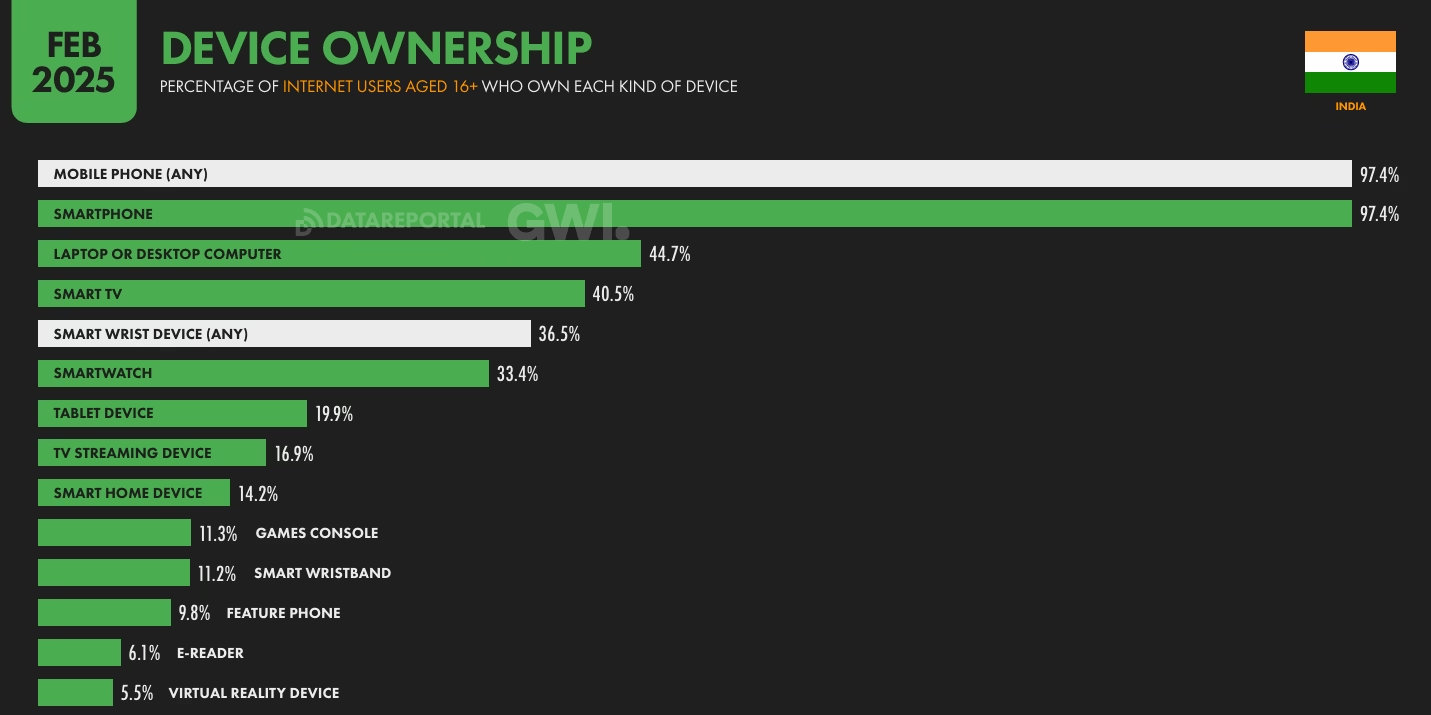

Today, mobile phones are nearly universal in India — with 97.4% of users owning a smartphone, not just any phone. This highlights that India’s mobile ecosystem is now overwhelmingly smartphone-led and app-driven.

97.4% of Indian internet users own smartphones, making mobile the primary device for digital access across the country.

Other popular devices include laptops/desktops (44.7%), smart TVs (40.5%), and smartwatches (33.4%), showing that digital experiences are expanding across screens and contexts. Meanwhile, feature phone ownership has dropped below 10%, confirming that even in rural and lower-income segments, smart devices are becoming the norm.

3.1 Why is this important?

With smartphones in nearly every hand, mobile is no longer a channel — it’s the foundation of the digital experience.

- Design for mobile first — always. With smartphones being the primary device, every product, service, and website must be optimized for small screens and quick access.

- Lightweight apps are essential. Not everyone has the latest phone or fast internet. Apps need to be low on data usage and high on performance.

- Offline-first and voice-enabled features aren’t optional. Many users still face patchy connectivity or prefer using voice commands. Building with these realities in mind improves accessibility and reach.

The digital India of today is smart-first, mobile-heavy, and experience-driven — and tech, product, and UX teams must build for this reality from the ground up.

4. How Did Digital Payments Become a Daily Habit?

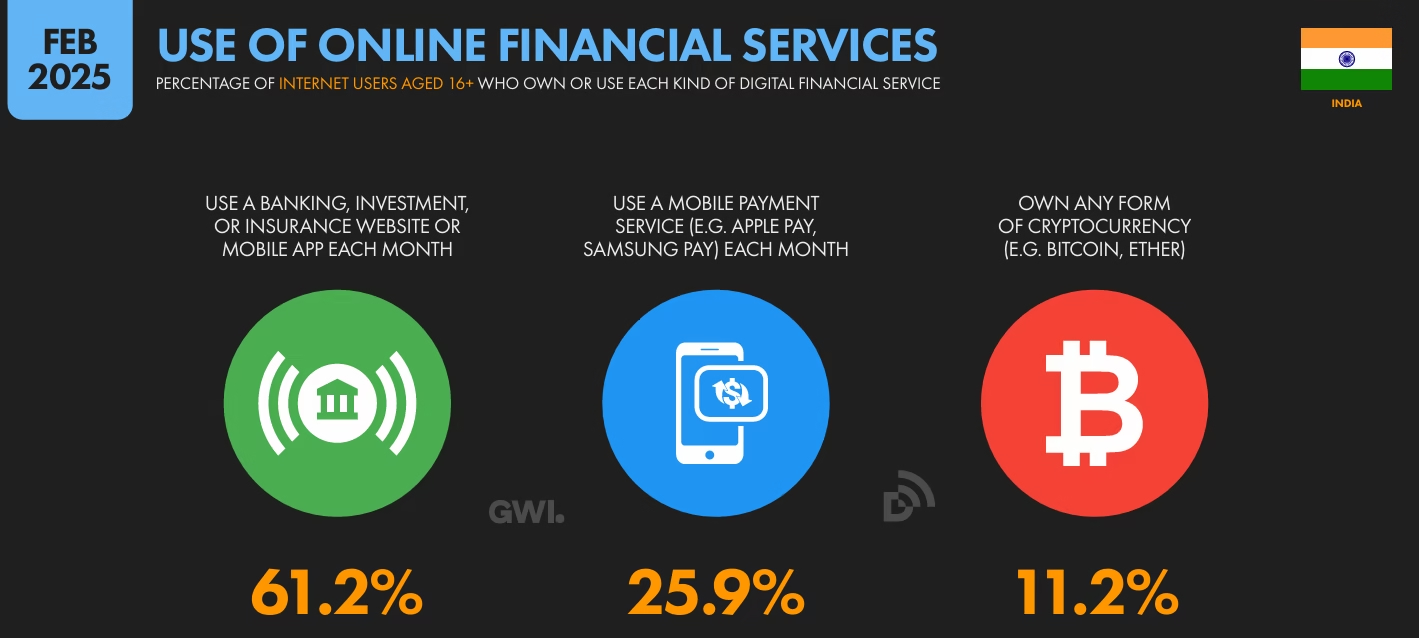

Digital payments in India are no longer just a tech trend — they are a habit, a preference, and for many, the default way to pay.

555 million Indians use digital payments regularly, with total transaction value reaching $255 billion annually.

As of Feb 2025 according to the Meltwater report, 555 million Indians used digital payment methods, making it a core part of daily life. The total value of these transactions reached a massive $255 billion, with the average user spending around $460 per year through digital platforms.

From mobile wallets and UPI apps to QR code scanners at local tea stalls, digital payments are now more convenient than cash for many. The ease of tapping a phone, scanning a QR code, or sending money instantly has reshaped how India transacts — across cities, small towns, and even rural areas.

Fintech products and payment solutions in India need to evolve based on how users actually behave:

- Security is critical. With millions transacting online, building trust through safe and transparent systems is key.

- Simplicity matters more than features. Users value fast, clear, and glitch-free payment experiences over fancy interfaces.

- Regional language support is a must. India’s next wave of users will come from non-English-speaking regions — apps must speak their language.

5. What’s Driving India’s Digital Health Craze?

Digital health is becoming mainstream — and it’s shaping how millions in India take charge of their well-being every day.

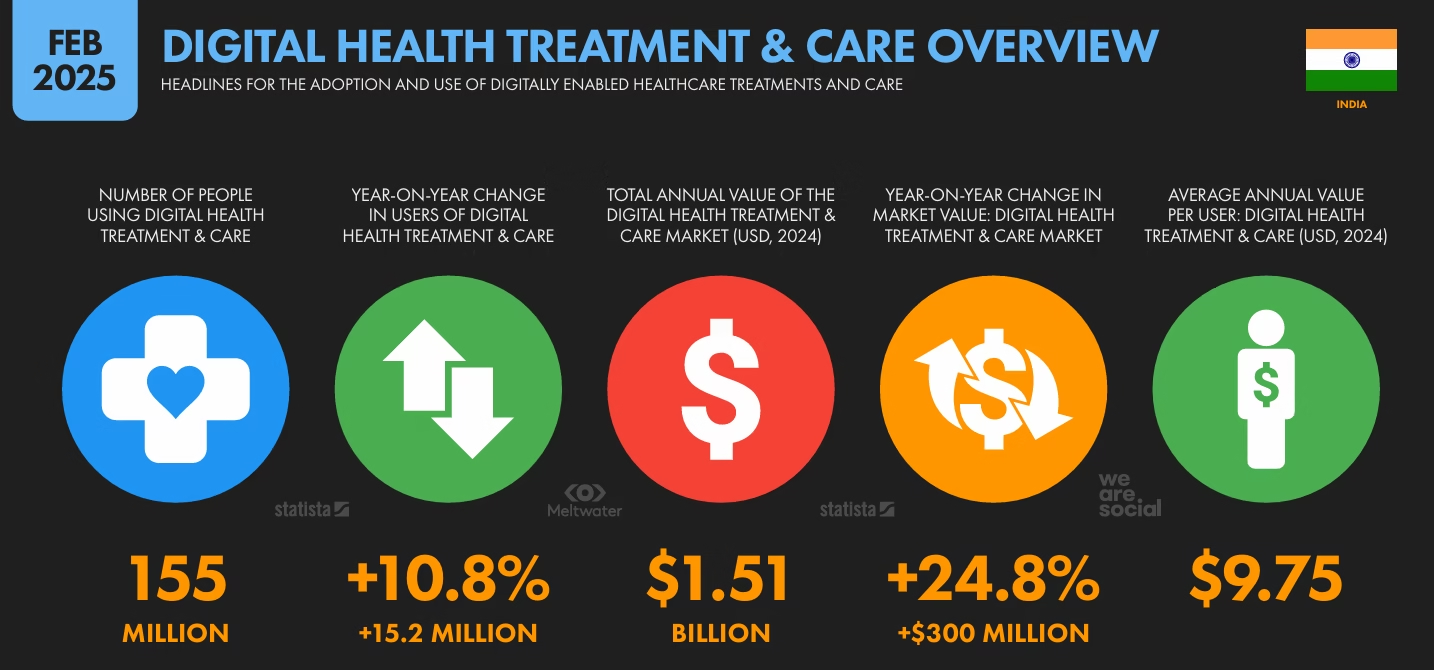

Around 155 million Indians actively used digital health and wellness services — through apps, websites, and wearables. The sector is now valued at $1.51 billion, growing at a strong pace of 24.8% year-on-year.

People are using these platforms for a wide range of purposes:

- Checking symptoms online before visiting a doctor

- Consulting doctors through telehealth platforms

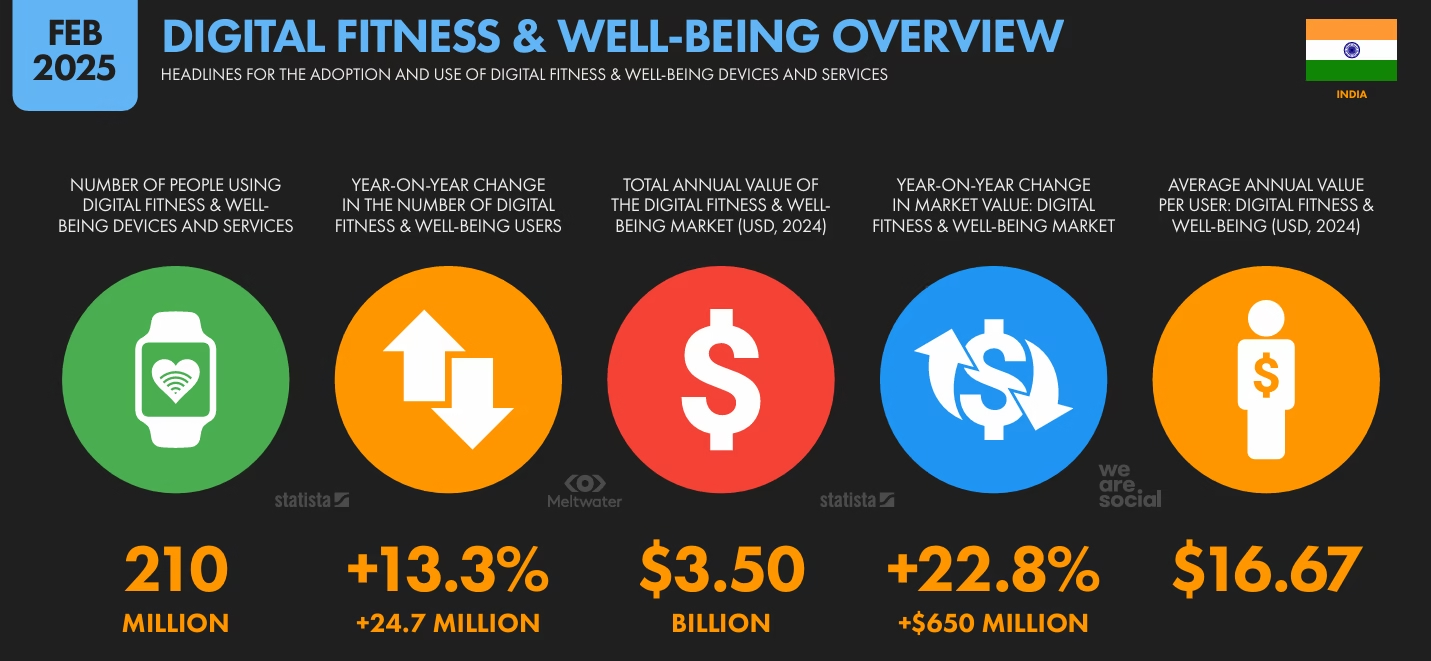

- Tracking daily wellness — like sleep, heart rate, or steps — via smartwatches and fitness bands

Read more – Why Doctors Should Scale Up Their Digital Presence?

What’s important is that this trend is no longer limited to metro cities. With more affordable wearables, easier internet access, and a growing awareness around preventive care, digital health is expanding into tier 2 and 3 cities as well.

- Healthcare brands and startups should focus on simplified, multilingual apps that serve both urban and semi-urban users.

- Preventive care tools, not just emergency services, are now in demand — offering opportunities for fitness, nutrition, and mental health products.

- Wearables and health tech integrations are becoming part of everyday life — not just for fitness buffs, but for people managing stress, sleep, and chronic conditions.

“AI‑powered diagnostics, MedTech innovations and digital health records are transforming patient care.” — Joydeep Ghosh, Deloitte India Life Sciences & Healthcare Industry Leader

6. How Are Indians Using the Internet to Learn?

A significant portion of India’s online population is using the internet as a learning tool.

As of 2025:

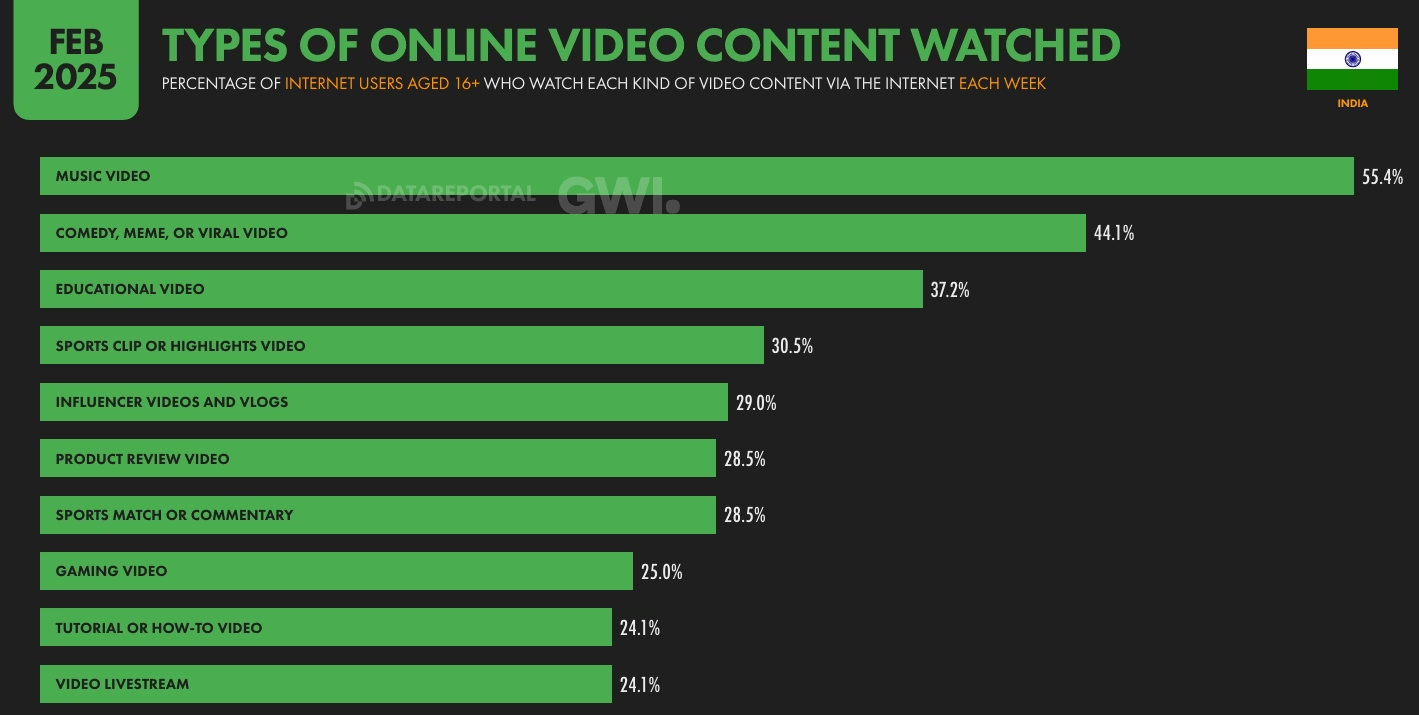

- 43.3% go online for educational content — including schoolwork, exam prep, and skill-building courses.

- 42.5% use it for how-to research, from tutorials and DIY projects to learning new tools.

- 41.4% explore product and brand research, relying on reviews, unboxings, and comparisons before making a purchase.

- 30.9% search for health-related information, often before visiting a doctor or buying wellness products.

This growing trend shows that the internet is not just for entertainment — it’s a powerful tool for self-service learning, digital upskilling, and informed decision-making. For edtech firms, coaches, creators, and even brands, there’s a rising opportunity to build credible, accessible content that helps users learn, solve problems, and feel confident in their choices.

7. The Gender Gap

While ownership of smartphones and internet use has risen for women, the report shows a consistent skew in usage patterns, online participation, and economic activity through digital means.

By 2029–30, nearly 20% of India’s GDP is expected to come from the digital economy, overtaking traditional sectors.

For instance, only 26.2% of WhatsApp users were female compared to 38.3% male users on Instagram.

Why this matters: Policy and product design must prioritize inclusivity. Digital literacy, safety, and affordability are barriers that need tailored, gender-aware solutions.

Digital participation among women is still low, with only 26.2% of WhatsApp users being female—highlighting the gender gap in access.

8. Conclusion

India’s digital growth story is impressive — but it’s not uniform. The data reveals a country that is connected but still climbing. It also tells us where the next wave of innovation and intervention must happen.

For more informative content and blog, follow and stay tuned to DAiOM.

Subscribe to our NEWSLETTER!