You ever wonder why someone spent five minutes on your site, filled a cart, maybe even chatted with your bot, then disappeared? Or picture the offline version: A person steps into your store, tests five mattresses, nods, asks for a brochure, then walks right out. No purchase. No explanation.

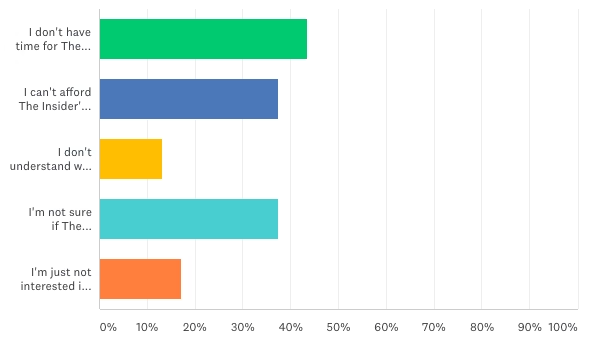

Most brands ignore and chase the next sale, and hope customer satisfaction will lift their NPS. But here’s the thing: If you only talk to existing customers through CSAT or NPS, you’re basically flying blind. The real goldmine is when you start talking to the people who almost bought, but didn’t.

Most companies spend too much time only listening to those who already buy. While this is helpful, it also gives a limited view of the market. If a brand wants to improve the conversion rate, it needs to understand what keeps non-buyers away. This makes non-buyers surveys very powerful.

In this blog, we will explore how to improve the conversion rate and why brands should prioritize non-buyers surveys, how they benefit growth, and ways to use their insights wisely.

Table of Contents:

1. Simplify & Speed Up the Checkout Experience

The moment of checkout is where most online shoppers disappear.

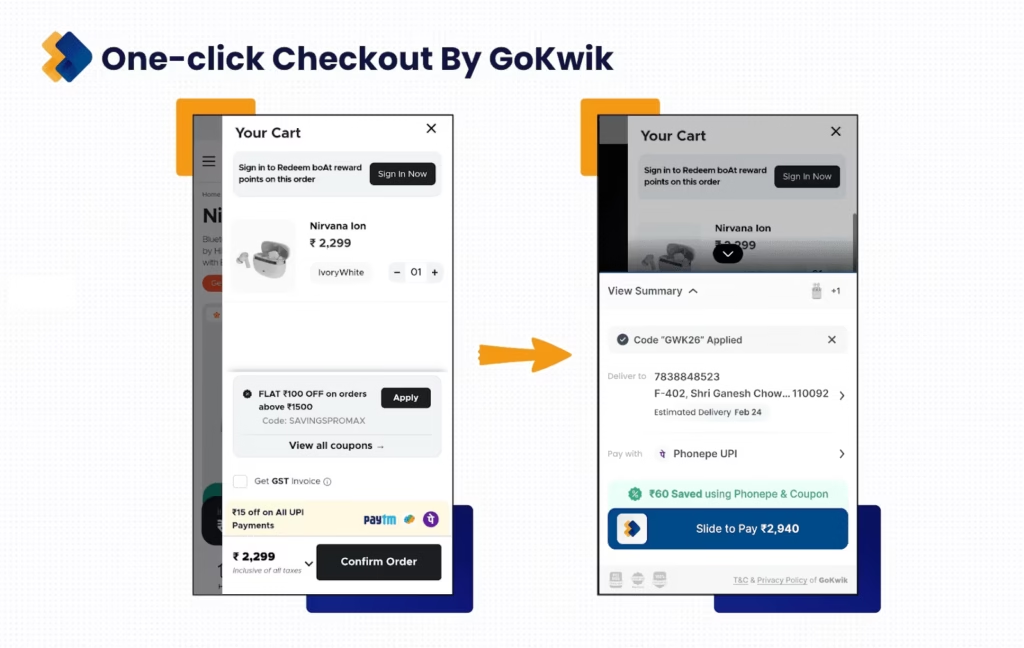

Today, tools like GoKwik, Razorpay, MagicCheckout, and Shopflo bring similar one-click checkout experiences to D2C brands.

Among our clients, using these faster checkout tools has led to a 15–20% increase in conversions by removing last-step friction.

Even tiny tweaks like autofill, showing progress bars, or upfront shipping costs can dramatically reduce drop-offs and boost your conversion rates.

2. Strong Cart Abandonment Journeys

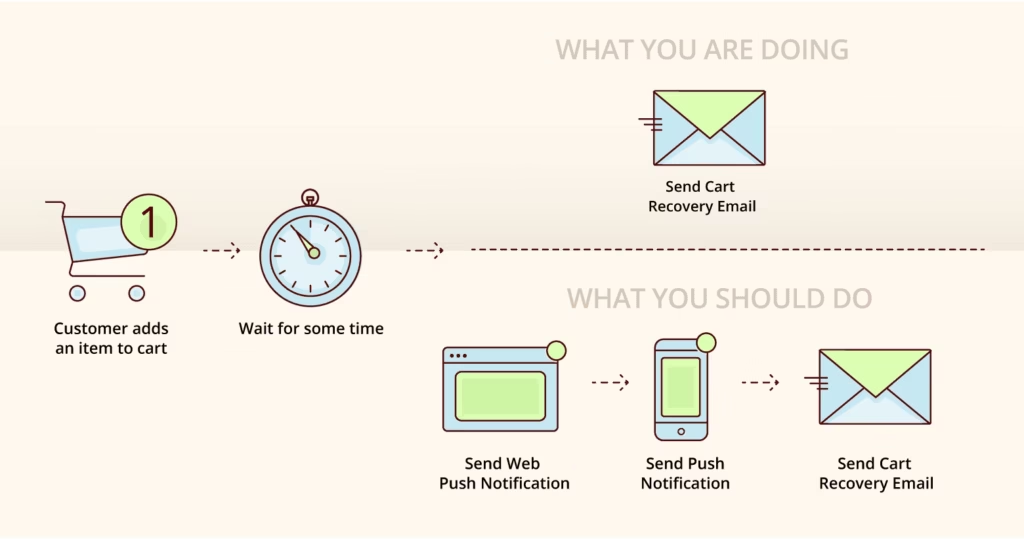

Cart abandonment represents the highest-intent drop-off in your conversion funnel.

According to research, approximately 70% of checkouts result in abandonment, but companies can enjoy a 35% increase in conversion rates by implementing effective recovery strategies.

A strong cart abandonment recovery journey is essential for recapturing these potential sales:

3. Why Should Non-Buyer Surveys Be a Priority?

Imagine when someone leaves your site without buying, it’s not always because your product wasn’t right for them.

Sometimes, it’s the small things that push them away:

- Confusing pricing.

- Zero trust in the brand yet.

- Slow website, bad reviews, no easy returns.

- Or maybe, just maybe, your competition did a better job nurturing that same lead.

That’s why running a non-buyer survey isn’t optional—it’s essential. Because guessing why people didn’t convert keeps you stuck. But asking them? That’s how you uncover the real reasons and start turning “almost customers” into loyal ones.

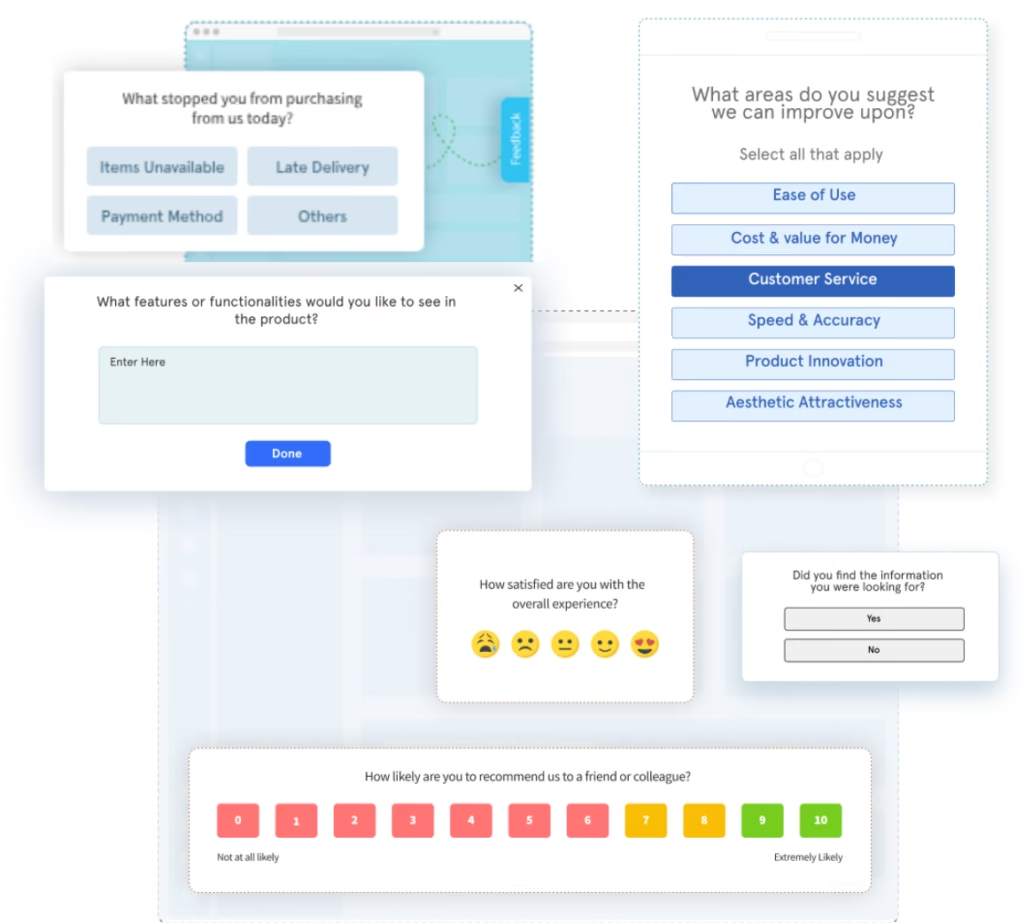

4. Questions to Ask in Non-Buyer Surveys

The success of a non-buyer survey depends on asking the right questions.

Examples include:

- We observed you exploring products on our website/Store, Were you able to make the purchase?

- If yes, which brand did you make the purchase from?

- What factors made you buy from the Other brand instead of our brand?

- From which channel did you make the purchase?

- What was the main reason you did not complete your purchase from our brand?

- Will you be interested in getting assistance to complete your purchase?

These simple questions reveal the blockers that stop a person from becoming a buyer. They also give us very crucial information about who our competitor brands are. They also reveal what can we improve in our service or product offerings to improve conversions.

Brands with both online and offline presence should tailor their non-buyer survey questions for each channel to accurately understand why customers choose not to make a purchase.

Working with one D2C brand, we learned that the primary reason for non-purchase at a physical store was the behavior of the store staff. In another scenario, the lack of parking space was a significant deterrent that led customers to choose not to buy.

These insights demonstrate the value of customizing survey questions based on touchpoints, enabling brands to identify and address unique barriers within each setting and improve the overall customer experience.

In another instance during our engagement with a comfort solutions brand, we found that asking customers if they required assistance allowed us to promptly connect them with our chat agents. This real-time support helped resolve customers’ doubts, resulting in successful conversions that may not have occurred otherwise.

5. The Framework for Non-Buyer Survey

A structured non-buyer survey framework helps dig deeper, giving you real insights straight from those who almost converted. It’s not just about finding faults; it’s about understanding the gaps in pricing, trust, experience, and communication so you can turn near-misses into loyal customers.

5.1 First-Party Data: The Foundation for Real Insights

First-party data is all the information you gather directly as people browse your website, use your app, visit your stores, or engage with your brand. This can include:

- Logins and account registrations: Know precisely who’s interacting, not just anonymous numbers.

- Cart activity: What did visitors add, and where did they drop off?

- In-store visits (with loyalty programs or QR scans): Who walked in but didn’t buy?

- Chat sessions: What questions did non-buyers ask and where did conversations stall?

- Browsing and behavior analytics: Which products/pages drew attention but not sales?

- Email and SMS interactions: Which leads are reading but not converting?

You own this data, which means it’s accurate, privacy-safe, and actionable. It lets you directly segment non-buyers, people who are engaged in some way, but not enough to click “buy.”

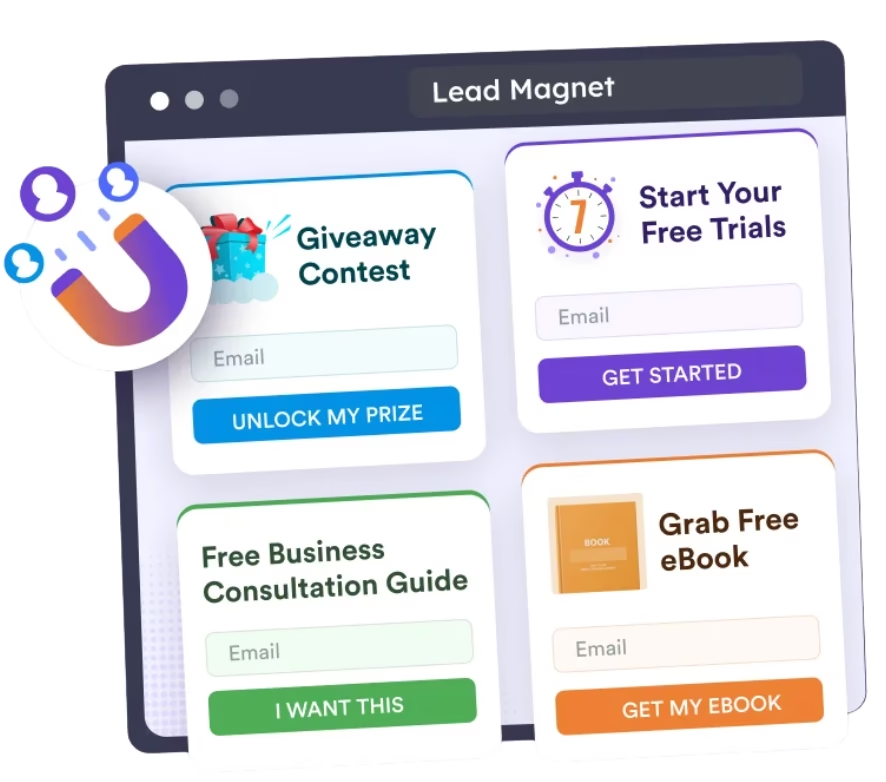

5.2 Lead Magnets: Opening the Door to Honest Feedback

But here most people won’t tell you why they didn’t buy unless you give them a compelling reason. That’s where lead magnets come in.

Lead magnets are incentives offered to prospects in exchange for a small action, like providing feedback or contact details. Think:

- Free downloads (like a sleep guide if you sell mattresses)

- Short quizzes (“find your perfect pillow!”) that end with a feedback question

- Limited-time discounts for sharing “what stopped you from buying?”

- Entry into a giveaway just for non-buyers who complete a 30-second survey

- Early access to launches for anyone who leaves insight on what could improve their experience

In both online and offline contexts:

- In-store: QR codes offering a freebie to anyone who gives a quick survey answer.

- Online: Exit pop-ups, chatbot nudges, or email follow-ups tied to a reward.

Why Does This Framework Work?

- Creates a feedback loop: Instead of guessing, you actually know why non-buyers hesitate, be it price, product fit, checkout friction, or bad reviews.

- Improves segmentation: You can compare feedback from frequent browsers, cart abandoners, in-store window shoppers, or email openers. Each group tells you something different.

- Drives future conversions: When you fix what real shoppers complain about, you remove barriers for the next visitor.

- Builds trust: Prospects feel heard (not hounded), and you get more accurate, honest data for continuous improvement.

You’d be surprised what honest non-buyers will tell you:

- “I didn’t trust the mattress quality” (if you sell mattresses).

- “Found a better offer elsewhere.”

- “Couldn’t find my size.”

- “Too many steps at checkout.”

- “No COD option.”

And when you loop this back into your product or website? That’s when conversions actually start to improve.

6. Which Brands are Already Doing This Right?

Let’s see some of the examples:

- Lenskart: They have mastered the art of follow-up.

If you’ve ever left a cart abandoned online or walked out of their store without buying, chances are you’ve soon received a friendly WhatsApp message asking, “How can we help?” Simple, proactive, and effective.

- Giva: Listens closely to customer feedback.

They’ve used insights from non-buyers to refine their product photos, adjust offers, and make online jewelry shopping feel safer and more transparent, especially for people who worry about authenticity or returns.

- Duroflex: Duroflex takes it a step further.

Whether online or in-store, they run quick follow-up surveys after every visit, asking what stopped a customer from buying, was it the price, the options, or delivery concerns? That data helps them continuously improve.

- Tanishq: They regularly survey offline visitors to understand their experience, pricing perception, and product preferences, using that feedback to train their staff and redesign store displays.

Each of these brands understands one thing: Non-buyers are a goldmine of insights, if you’re smart enough to ask.

It’s not enough to know your average customer. Brands that win are obsessed with understanding why they’re losing, too. Build into your process:

- Online: Exit surveys, retargeted messages, cart abandonment feedback.

- Offline: QR codes at the store entrance/exit, SMS surveys after a visit, feedback cards.

7. Conclusion

When you close the “why not” gap, everything improves, conversion, product design, user experience, and even marketing ROI. More importantly, you treat your almost-customers with respect, and they often come back when you fix what’s broken.

Stop flying blind. Non-buyer surveys aren’t just a “nice to have” anymore, they’re the edge brands need to win in today’s competitive market. Don’t just follow the buyers. Ask the ones who walked away. Then fix what matters most.

If you’d like to discuss how we can help optimize your Omnichannel Marketing strategies, we’d be happy to set up a consultation call. Feel free to reach out to us at alibha@daiom.in.

For more informative content and blog, follow and stay tuned to DAiOM!

Subscribe to our NEWSLETTER!